Time Deposit Plus

Deposit any day.

High interest your way.

Updated interest rates apply to Time Deposit Plus accounts opened from August 6, 2024 onwards

Open up to 5 Time Deposit Plus accounts that earn interest on deposits of up to ₱1 million each. Minimal cancellation fees apply. Deposits are insured by PDIC up to ₱500,000 per depositor. Maya Bank, Inc. is regulated by the Bangko Sentral ng Pilipinas. www.bsp.gov.ph

Elevate your savings and choose

from these flexible terms

5.5% p.a

3 months

6.0% p.a

6 months

5.75% p.a.

12 months

Interest rate applies to a maximum balance of ₱1 million.

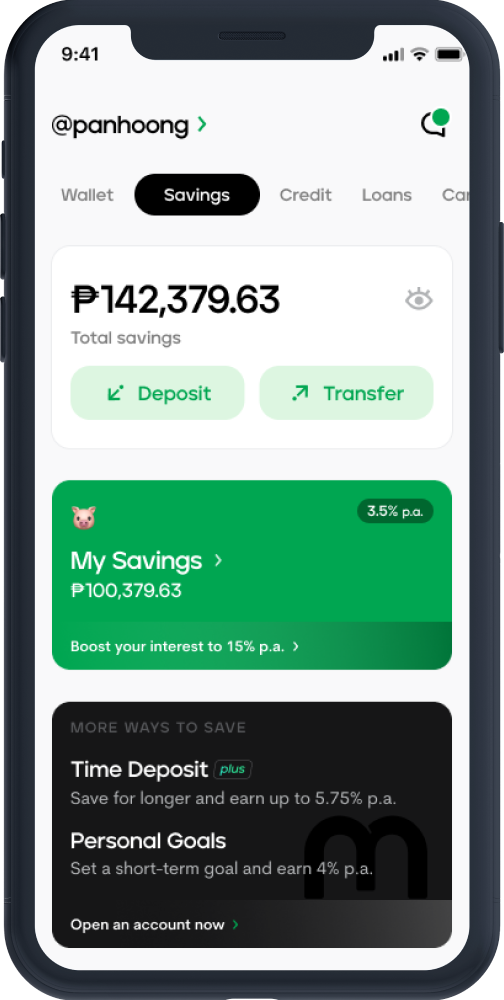

Open a new Time Deposit Plus account in 3 easy steps

Make sure to meet the following requirements to qualify:

💯 An upgraded Maya account

💪 Updated customer information

1Go to your Savings

dashboard and tap Create a new Time Deposit Plus

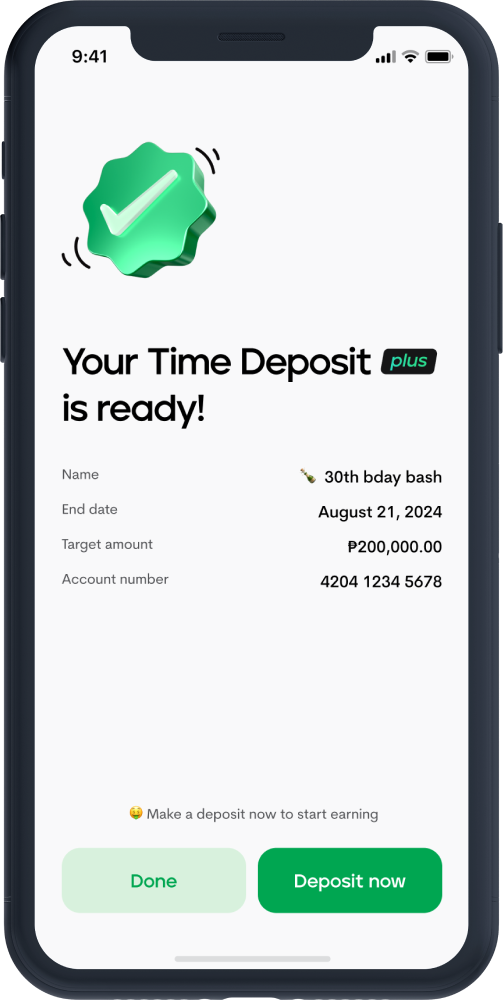

2Choose from 3, 6, or 12 months then set an account name and target amount.

Updated interest rates apply to Time Deposit Plus accounts opened from August 6, 2024 onwards

3Once created, fund your Time Deposit Plus account seamlessly from your Maya Savings, wallet, or other banks

Once you accept your loan, the full amount will be instantly transferred to your Maya Wallet.

Loan approval, amounts, and monthly add-on rate are subject to credit evaluation.

Get more out of Time Deposit Plus with this quick guide

Updated interest rates apply to Time Deposit Plus accounts opened from August 6, 2024 onwards

What makes Time Deposit

extra flexible with your money?

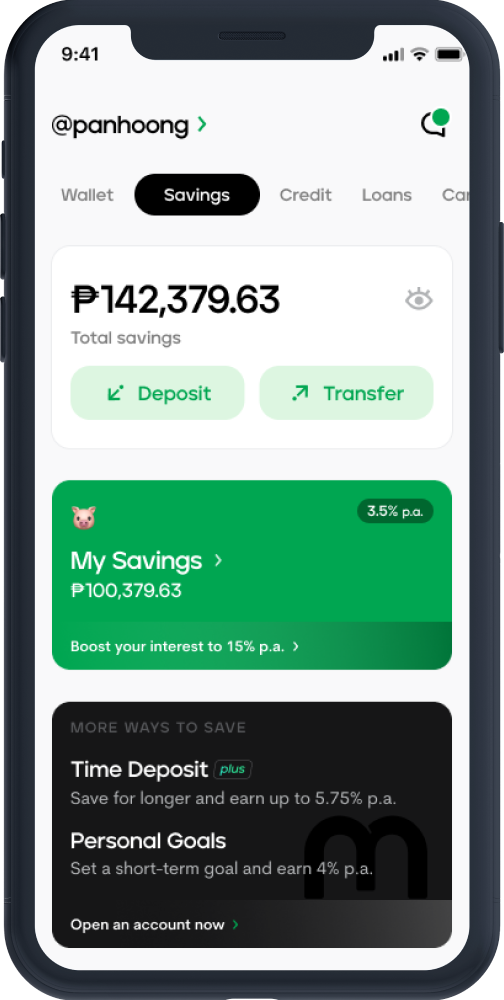

Earn up to 5.75% interest p.a. monthly

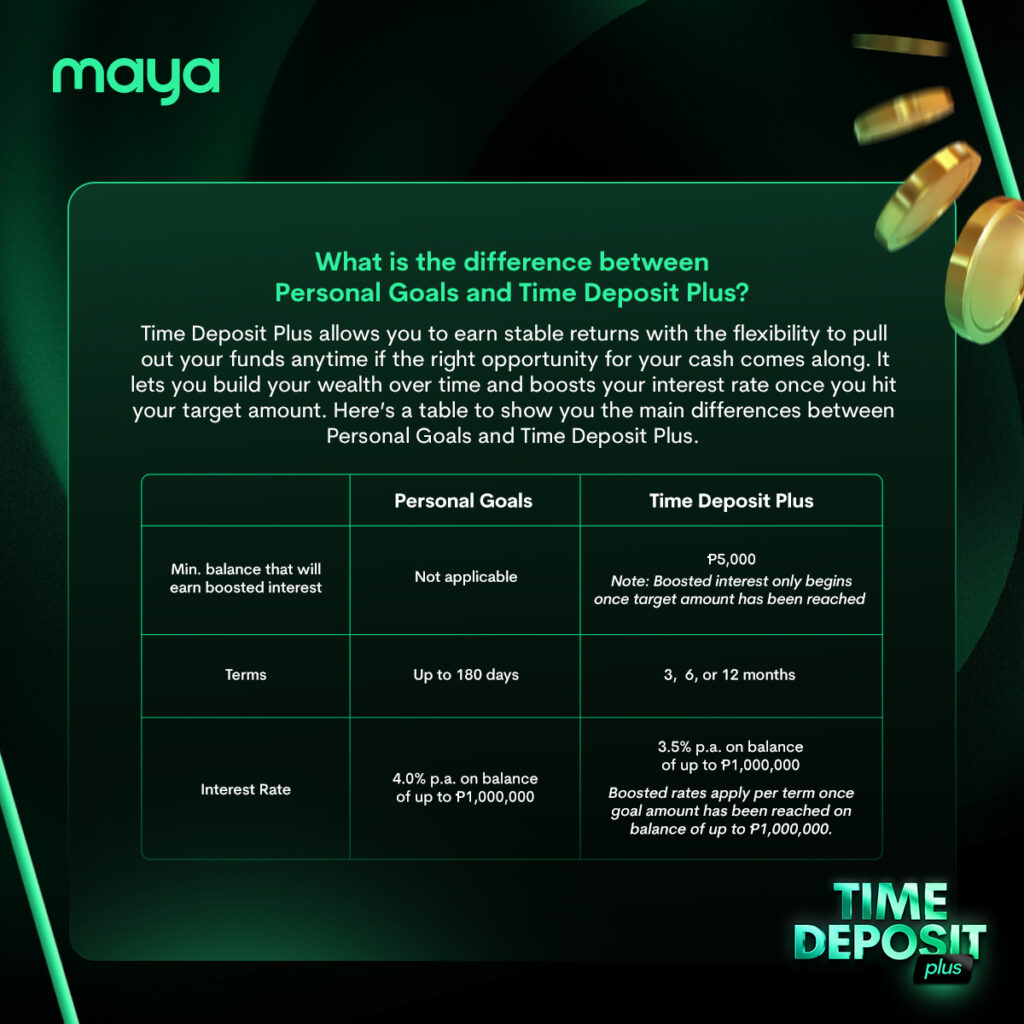

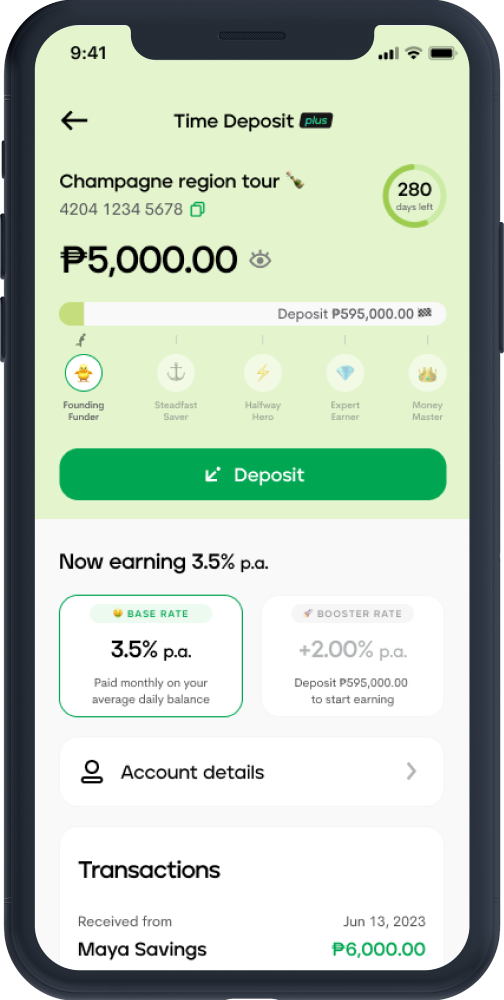

All Time Deposit Plus accounts start with a guaranteed 3.5% p.a. that you can boost up to 5.75% p.a. when you reach your target amount and date.

Interest rate applies to max Time Deposit plus balance of ₱1 million. Any amount higher will no longer earn interest.

Open multiple Time Deposit plus accounts

Create up to 5 active accounts at a time with ₱1 million balance each so you can earn up to 5.75% p.a. for up to ₱5 million in total.

Grow your savings at your own pace

Enjoy no minimum balance and a low total goal amount of at least P5,000 to start earning boosted interest rates then deposit any amount any time until you reach your target. You can easily check your progress on each one right from the Savings dashboard. Earn badges the closer you reach your target amount!

Easy and free top up anytime

Enjoy multiple ways to deposit to your Time Deposit Plus accounts. Deposit directly from your Maya Wallet, Maya Savings, BPI, BDO, UnionBank, GCash, ShopeePay, and more.

Deposits

✅ From your Maya Wallet1 instantly and for free

✅ From other banks and e-wallets via PESONet and InstaPay2

Transfer

✅ To your friends’ Maya Savings instantly and for free

✅ To other banks and e-wallets via PESONet3 and InstaPay4

- Cash in to your Maya Wallet using these methods:

- FREE using your linked bank account/s

- FREE up to ₱8,000/month from over-the-counter channels

- Fee depends on the source bank.

- PESONet transfers are free until further notice.

- ₱15 fee per transaction Terms and Conditions apply.

Keep your money safe and secure

Maya Bank, Inc. is regulated by the Bangko Sentral ng Pilipinas

Deposits are insured by PDIC up to ₱500,000 per depositor.

Beyond Time Deposit Plus, do more with the #1 all-in-one digital banking app - Maya

Pay your bills, buy load, get a loan, try crypto – that’s all you can do and more with an all-in-one digital bank like Maya!

Make sure you are using the latest version of the Maya app. Just go to App Store or Google Play, search for Maya, and tap ‘Update.’

Frequently Asked Questions

You’ve got questions, we’ve got answers

Need more answers?

Time Deposit plus, a product of Maya Bank, Inc., is a timebased savings account so you can easily make your excess money grow. You can keep your money for 3, 6 or 12 months and earn interest of up to PHP 1,000,000.00 per account, based on your average daily balance per annum.

Each Time Deposit Plus has its own account number and is different from your Maya Savings or Personal Goal accounts. You can have up to 5 active Time Deposit plus accounts.

Time Deposit Plus earns you a base interest rate of 3.5% per annum, credited to your account monthly. Once you reach your target amount, you'll earn an additional boosted interest rate based on your target date.

All earned interest rates are applied to deposits of up to PHP 1,000,000. Boosted interest rate will only start accrual once goal amount is reached.

Please note that interest rates may be subject to change. Customers will be notified of the change on Maya Bank Inc.’s official website at mayabank.ph and/or via in-app notification, SMS, email, or any of our other official channels.

Maya Bank Inc. is regulated by the Bangko Sentral ng Pilipinas. Deposits are insured by the PDIC up to PHP500,000.00 per depositor.

Time Deposit Plus accounts opened by August 6, 2024 can boost their interest rate up to 5.75% p.a.

All accounts opened prior to August 5 will maintain their boosted interest rate upon account opening.

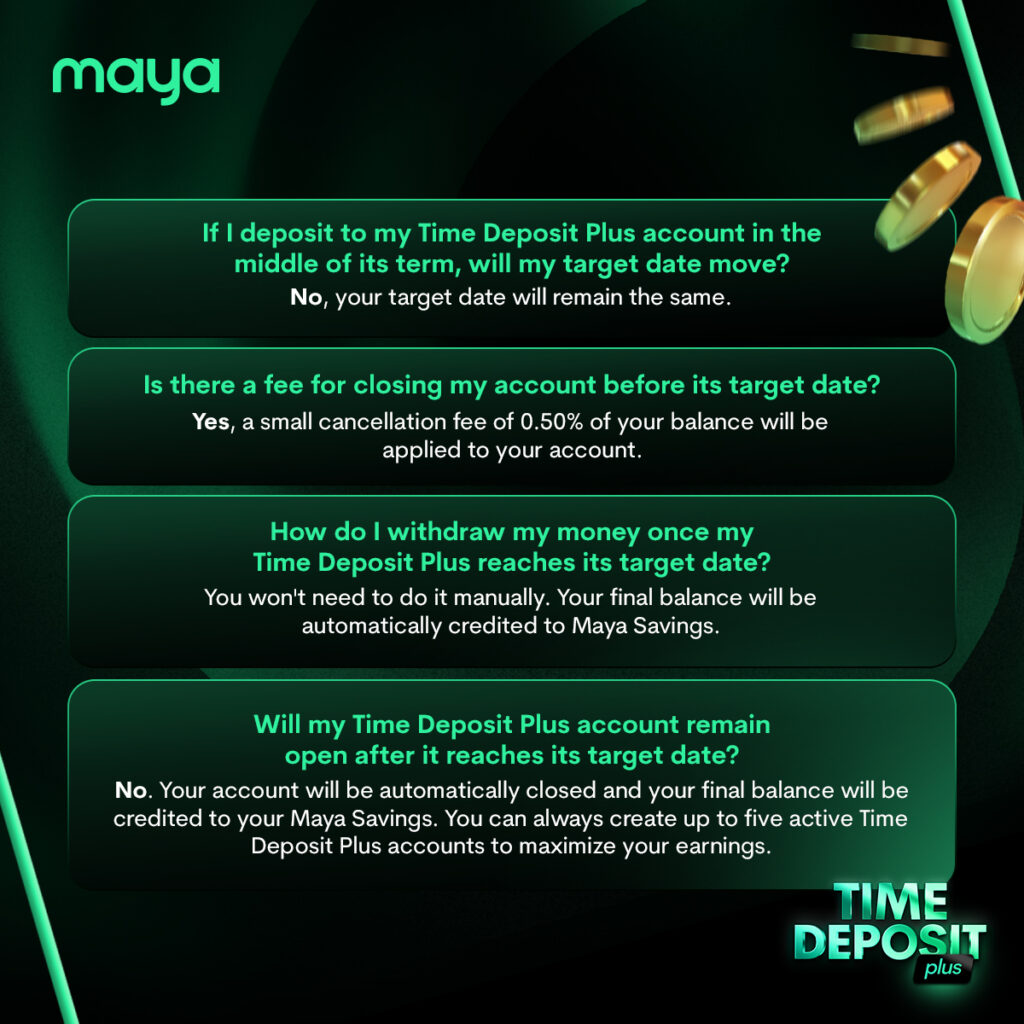

Yes, you can cancel your Time Deposit plus account anytime, subject to cancellation fees. Just go to your Time Deposit plus Account Details page and tap 'Cancel my account'

You must achieve your target amount and complete your term for you to earn the base and boosted interest rates for Time Deposit Plus.

No, you cannot withdraw money from your Time Deposit Plus account before its due date.

However, should you want to move out your money, you can cancel your account. This automatically closes the Time Deposit Plus account and adds the applicable interest rate minus applicable taxes and fees. The final balance will then be transferred to your Maya Savings account.

Yes, but please note that all interest rates only apply to a maximum balance of up to PHP 1,000,000.00 per Time Deposit Plus account.

No, your term will remain to be 3, 6, or 12 months from the time you opened your account.

If you cancel your account before the due date, your account will be charged a cancelation fee of 0.50% of your Time Deposit Plus balance.

Your accumulated amount, which includes your total deposit and earned interest minus taxes, will be automatically credited to your Maya Savings account once you reach your target date.

No, because once your Time Deposit Plus reaches it due date, the account will be automatically be closed and your final balance will be transferred to your Maya Savings account.

You can create a new Time Deposit Plus account once your goal has reached its due date. You can have up to five active Time Deposit Plus accounts at a time.

CONSUMER DEPOSIT TERMS AND CONDITIONS

1. General Terms and Conditions

1.1 These terms and conditions (“T&C” or “Terms”) govern the terms under which you may access and use the products of Maya Bank, Inc. By opening a consumer savings account and/or using our services, you agree to be bound by these Terms. The General Terms and Conditions (GT&Cs) of Maya Bank accessible through this link: https://mayabank.ph/terms-conditions/ are deemed incorporated into these T&C. In case of conflict or inconsistency between the GT&Cs and these T&C, the terms of these T&C shall prevail.

1.2 Under these T&C, the terms “Maya Bank,” “Bank,” “we,” “us,” and “our” refer to Maya Bank, Inc. together with its employees, directors, affiliates, successors, agents, and assigns. Maya Bank, Inc. is a Filipino digital bank, duly licensed by the Bangko Sentral ng Pilipinas (“BSP”).

1.3 The terms “you” and “your” refer to the depositor who uses the services of Maya Bank as depositary bank.

1.4 These T&C shall be effective, valid, and binding from the time that you signify your agreement to these Terms. These T&C will be in full force and effect up to the time that it is terminated by you or us, save for some provisions, which shall remain effective after termination, as stated in this T&C, or under any law, rule, or regulation.

2. Definition of Terms

2.1 Account Holder refers to an individual who maintains any deposit or savings account with Maya Bank.

2.2 Affiliates refers to any person or entity controlled by or under common control with another person. For purposes of the Terms, any of the entities under the MVP Group of Companies, including but not limited to Maya Philippines, Inc. (“Maya Ph”), PLDT, Inc., Metro Pacific Investments Corporation, Smart Communications, Inc., The Manila Electric Company, Maynilad Water Services, Inc., Metro Pacific Tollways Corporation, and MediaQuest Holdings, Inc., shall be considered as Affiliates of Maya Bank.

2.3 AMLA refers to the Anti-Money Laundering Act, otherwise known as Republic Act No. 9160, as amended, as implemented by the AntiMoney Laundering Council of the Philippines (AMLC).

2.4 Disputed transaction – refers to a transaction that was reported to us or transactions that we have reasonable ground/s to believe to appear to be unusual or without clear economic purpose, from an unknown or illegal source or unlawful activity, or facilitated through fraud, crime, and other social engineering schemes.

2.5 Dormant Account refers to any savings account that has had no client-initiated deposit or withdrawal for a period of two (2) years.

2.6 Maya Bank Account or Account refers to your savings account with Maya Bank.

2.7 Maya App refers to the mobile application that serves as the interface between the account holder and Maya Bank Account, whose terms of use shall be in accordance with the Terms and Conditions (refer to https://www.maya.ph/terms-and-conditions) and User’s Guide (refer to https://www.maya.ph/user-guide) found in the said Maya App.

2.8 Maya Savings refers to a deposit product offered by Maya Bank, Inc. in the Maya app where customers are able to make deposits and withdrawals at any time and without penalty through the available channels. Interest earned is computed based on the average daily balance (ADB) of the account.

2.9 Personal Goal/s refers to a goal-based deposit account where customers can keep their money for up to one hundred eighty (180) days while earning interest based on their average daily balance.

2.10 Time Deposit Plus refers to a goal and time-based deposit account where customers can keep their money for a fixed tenor of three (3), six (6), and twelve (12) months while earning interest based on the goal amount and tenor set by the customer on the account.

2.11 Maya Wallet Account or Maya Wallet refers to a reloadable electronic wallet account that stores Philippine Peso (Php) value in the Maya Ph system, which is linked to the Account Holder’s mobile phone number and which may or may not be evidenced by a physical and/or virtual card.

2.12 Maya Consumer Lending Products – refer to consumer loan products provided for by Maya such as but not limited to Maya Credit Card, Maya Easy Credit, Maya Personal Loan, and other related consumer lending products of Maya.

3. Opening of an Account

3.1 You may open and maintain Accounts subject to our sole discretion, upon your compliance and our verification of the requirements, in accordance with the our policies, Bangko Sentral ng Pilipinas (BSP) onboarding and due diligence requirements, AMLA and other applicable laws and regulations. These requirements may include, but are not limited to, the following:

3.1.1 Name of customer (Full Name including Middle Name) and/or PhilSys Number (if available);

3.1.2 Date and Place of Birth;

3.1.3 Address;

3.1.4 Contact Number or Information / email address;

3.1.5 Citizenship or Nationality;

3.1.6 Source of funds;

3.1.7 Nature of work;

3.1.8 Specimen Signature or Biometrics; and

3.1.9 One valid Primary ID or Two valid Secondary IDs (refer to https://www.maya.ph/quick-guide/upgrade for accepted government IDs).

4. Maintenance of Account

4.1 You agree that withdrawals must be made through the modes that may be provided by Maya Bank. These may be subject to the procedures of Maya Bank’s partner entities and your providing of the required information in the Maya Ap

4.2 You must maintain a minimum monthly average daily balance (“ADB”), the amount being reasonably determined by Maya Bank and may be subject to change upon prior notice. Failure to maintain a balance equal to or greater than the minimum monthly ADB for at least two (2) consecutive months will entail the imposition of a maintenance fee.

4.3 Maya Bank shall notify you on the imposition of fees, should it decide to impose or revise any service charges, fees and penalties that will be applicable to your Accounts and as may be necessary for the maintenance, processing for claiming balance, and closure of your Accounts. These fees may include charges for closed accounts, mishandled accounts, and/or dormant accounts, subject to compliance with the notice requirements under applicable laws and regulations. For this purpose, Maya Bank is authorized to debit from any of your Accounts the applicable service charges, fees, and/or penalties. In addition to or in lieu of personal notice, the amount of fees and charges are posted on the Maya Bank website, or such other communication channels, and as the same may be amended, revised, updated and/or supplemented from time to time.

4.4 In all instances, any aggregate and unpaid charges or fees shall immediately become due without need for demand and may be debited without prior notice from any remaining funds, money, or assets in any of Your or the Account Holder’s accounts with Maya Bank or Maya Philippines. This includes unpaid charges or fees in case of erroneous, fraudulent or instances of unlawful crediting of transactions in your accounts with Maya Bank or Maya Philippines. We shall notify you of such deduction within a reasonable period.

4.5 Interest-bearing accounts shall earn interest per annum at a rate to be agreed upon by you and Maya Bank, subject to pertinent laws, rules, and regulations. The rates may be changed based on your activity, certain promotions, and other criteria, as may be applicable, provided that such a change shall only take effect after notice to you or as indicated in your Accounts. The interest rates and formula are posted on the Maya Bank website, or other such communication channels, and as the same may be amended, revised, updated and/or supplemented from time to time. No interest shall accrue on accounts that are considered dormant.

4.6 Your Maya Savings account earns interest daily, which shall be credited to your account on the next day minus the applicable taxes. Your Personal Goal and Time Deposit Plus accounts earn interest monthly, which shall be credited to your account on the first calendar day of the succeeding month, minus the applicable taxes.

4.7 If you are considered as a holder of a Foreign Account Tax Compliance Act (“FATCA”) reportable Account, you shall:

- Identify yourself as such holder;

- Provide Maya Bank with your U.S. Tax Identification Number; and

- Provide other documents or information as may be required by all the applicable laws, rules, or regulations, such as the Intergovernmental Agreement between the Philippines and the United States of America.

You also hereby declare, under penalty of perjury, that:

- all of the information that you have provided are true and correct; and

- you waive your rights pertaining to bank secrecy, privacy, or data protection rights on your Account if and when required by FATCA.

Failure to do the above may constrain Maya Bank to withhold the legally mandated amounts or to initiate the closure of your Account.

4.8 You agree that Article 1250 of the Civil Code of the Philippines shall not apply in case of extraordinary inflation or deflation of the currency stipulated herein.

4.9 If your Maya Savings Account has no client-initiated deposit or withdrawal for two (2) years and after providing you the required notifications under applicable laws and regulations, your account shall be considered dormant. Dormancy fees may be imposed after a period of five (5) years from the time of your last deposit or withdrawal. If your Maya Savings account has no remaining balance at the time it became dormant, Maya Bank shall have the right to automatically close your account with notice to you.

In addition to dormancy fees, Maya Bank may likewise impose other service fees on the dormant account as may be notified to you in accordance with applicable laws and regulations.

Dormant accounts shall not be entitled to earn any interest, bonus, or benefit. No inward or outward transfers may also be done on dormant accounts. However, dormant accounts may be reactivated and you are required to initiate a deposit or withdrawal transaction within a period after a successful reactivation. Reactivation of the dormant account may require resubmission of due diligence documents such as, but not limited to, updated identification cards, if applicable.

Failure to reactivate your Maya Savings account and initiate a transaction thereafter will retain its dormancy status.

Any account with remaining balance that has been dormant for ten (10) years shall be included in the list of unclaimed balances to be submitted to the Treasurer of the Republic of the Philippines and will be subject to escheat in favor of the Government of the Republic of the Philippines in accordance with the Unclaimed Balances Act, and other relevant rules and regulations.

5. General Terms of Service

5.1 Maya Bank agrees to act as a depositary bank for your deposit account which may be an interest- or non-interest-bearing account.

5.2 The applicable laws and rules of the Philippine Deposit Insurance Corporation (“PDIC”) relating to deposits shall govern. Applicable deposit accounts are insured by the PDIC up to a maximum of Five Hundred Thousand Pesos (P500,000.00) per depositor. PDIC shall presume that the name/s appearing on the certificate of deposit is/are the actual/beneficial owners of the deposit, except as provided therein.

5.3 Maya Bank’s office hours shall be from 9 AM to 6 PM, Mondays to Fridays. Maya Bank’s online platforms are available 24/7 subject to the cut-off time of its partners applicable to certain transactions. You shall be notified in advance or at the soonest possible time of maintenance activities and the like.

5.4 Maya Bank reserves the right to modify, suspend, stop, or terminate any of its services immediately upon notice, at any time and from time to time, within applicable laws and regulations of the Philippines.

5.5 You will not use any device, software, or routine to interfere or attempt to interfere with the intended working behavior of the Maya App.

5.6 Maya Bank reserves the right to verify any activity that is done through its facilities, especially if it involves compliance with AMLA or other laws, rules, or regulations.

Pursuant to the Implementing Rules and Regulations (“IRR”) of the AMLA, you grant Maya Bank the power and authority to report, at the Bank’s sole discretion, covered and suspicious transactions involving your account to the AMLC, subject to applicable laws and regulations

Pursuant to the IRR of the AMLA, you shall also authorize Maya Bank to maintain and safely store all records of all transactions involving your Account for five (5) years from the dates of these transactions. With respect to closed accounts, we shall also preserve and safely store the records on customer identification, account files, and business correspondence for at least five (5) years from the dates when the accounts were closed. Maya Bank also reserves the right to maintain and safely store any or all records of transactions involving your Account beyond the aforementioned period if required by law or any other applicable rules or regulations. However, in the event of any dispute or litigation in any forum or jurisdiction involving your Account or your records with us, Maya Bank reserves the right to retain your records until after the full and final settlement of such dispute or litigation. In all instances, Maya Bank shall retain or destroy your records in accordance with the bank’s retention policy or with the Data Privacy Act of the Philippines and other applicable laws and regulations.

5.7 We will attempt to process transactions promptly, but any transaction may be delayed or cancelled for a number of reasons including but not limited to: our efforts to verify your identity; to validate your transaction instructions; to contact you; due to variations in business hours and currency availability; availability of the system which may be affected by service disruptions or system maintenance; or otherwise to comply with applicable laws, rules, or regulations.

5.8 We may, in our absolute discretion, refuse or cancel transactions or services if: (a) Maya Bank is unable to verify your identity; (b) Maya Bank is unable to verify the identity of the recipient; (c) you do not comply with information requests pursuant to Clause 5.6, Clause 6.11, or Clause 7.1 of the T&C; or (d) Maya Bank reasonably believes you are using its facilities, or allowing it to be used, in breach of these T&C or any applicable laws, rules, or regulations or (e) Maya Bank determines that your account is being used by a person other than the Account Holder to commit fraud, launch a cyberattack against Maya Bank, Maya Philippines and its partners and customers, and commit activities that constitute Money Laundering.

5.9 If we have executed the transaction in accordance with the instructions you have provided to us, and that the instructions prove to have been incorrect, we are not liable for the incorrect execution of the transaction. We will, however, make reasonable efforts to recover the funds. We may charge you a reasonable fee, reflective of our efforts, to do so. Unless there are exceptional circumstances, no adjustment will be made for any currency fluctuations which may have occurred between the time you pay us the transaction amount and the time of credit.

5.10 Unless restrained or directed otherwise through a written order by the BSP or a court of competent jurisdiction, Maya Bank shall have the right to automatically suspend or block the transaction of any Account in the event that Maya Bank has reason to believe that the transaction or the account may be illegal or used for fraudulent or suspicious businesses or by an unauthorized person or if any of the other accounts maintained with Maya Bank or Maya Philippines, Inc., such as the Maya Wallet Account, is also suspended or blocked. Maya Bank may, but shall not have the obligation to, inform you prior to suspending or blocking the transaction pursuant to this clause if such suspension or blocking is due to actual or suspected violation of relevant laws or regulations, which may include, but is not limited to, the AMLA. You acknowledge the authority of Maya Bank to suspend or block the transaction and the closure of the Account and accordingly, you shall hold Maya Bank free and harmless against any and all consequences of such suspension or blocking, or any loss or damage which you may suffer as a result thereof.

5.11 Fees and other charges shall be in accordance with the Table of Fees and Charges posted in the Maya Bank website (refer to https://support.mayabank.ph/s/article/What-are-the-fees-charged-to-my-account ) which may be subject to changes upon discretion of Maya Bank and in accordance with laws, rules, and regulations. However, in the situation where there are insufficient funds in your Account to cover such fees and other charges, we reserve the right, without incurring any liability, to refuse to carry out the transaction.

5.12 Any changes in the fees and charges shall take effect in accordance with the notice from Maya Bank subject to compliance with the notice requirements under applicable laws and regulations.

5.13 In order to comply with our obligations under relevant laws, we reserve the right to require further information or evidence relating to your personal information and to the purpose of any transaction using our facilities.

5.14 In the event of a purchase or transaction where your Maya Wallet has insufficient balance but your Maya Savings has sufficient funds to cover the said purchase or transaction, You authorize Maya Bank to automatically transfer the necessary amount from your Maya Savings to your Maya Wallet to cover the difference.

6.Your Obligations

6.1 You agree to abide by the obligations stated under this section. You understand that failure to abide by these obligations is subject to Maya Bank applying reasonable penalties to you and your Account, including but not limited to charges, suspension, and/or termination of your Maya Bank Account, and proper reporting to the applicable authority of the laws, rules, and regulations that govern Maya Bank.

6.2 You agree not to use any “deep-link,” “page-scrape,” “robot,” “spider,” or other automatic device, program, algorithm or methodology, or any similar or equivalent manual process, to access, acquire, copy, or monitor any part of the Maya App, or in any way reproduce or circumvent its navigational structure or presentation, as well as to obtain or attempt to obtain any material, document, or information through any means not purposely made available through our facilities.

6.3 You agree not to gain or attempt to gain unauthorized access to any part or feature of the Maya App or to any other system or network connected to the Maya App. You also agree not to gather, harvest, or otherwise collect information about others using the Maya App without our explicit informed consent; nor restrict, prevent, or prohibit any other party from using our facilities, including but not limited to such actions which may tend to discourage others from using the services, such as stalking, flaming, or the lashing out at other parties, spamming or the sending of unsolicited information, advertisement or content, flooding or the sending of repetitive messages, trolling or the use of insulting or deliberately divisive information, material or content, other forms of annoyances, and the like.

6.4 You agree not to circumvent, disable, or otherwise interfere with security-related features of the Maya App, including those that prevent or restrict use or copying of any content, material, or information available on or through the Maya App, as well as those that enforce limitations on the use of our facilities.

6.5 You agree not to probe, scan, or test the vulnerability of the Maya App or any network connected to it, and not to breach the security or authentication measures on the same. You agree not to reverse lookup, trace, or seek to trace any information on any user of or visitor to the Maya App, or any other client of Maya Bank including any account maintained with our facilities not owned by you, to its source, or exploit these or any information made available or offered by or through the Maya App, in any way where the purpose is to reveal any information, including but not limited to personal identification, other than your own information.

6.6 You agree to use or access the Maya App for your information and personal use solely as intended through the provided functionality of the Maya App. You agree not to copy or download any material or content from or through them unless such copying or downloading is explicitly allowed by a visible manifestation thereof such as a “download” button or a similar link ostensibly displayed. You further agree not to engage or attempt to engage in the use, copying, transmission, broadcast, display, distribution, or sale of any of the contents, material, or information available on or through the Maya App, including user comments and the like, other than as expressly permitted herein, or as explicitly indicated.

6.7 You agree that you will not take any action that imposes an unreasonable or disproportionately large load on the infrastructure of the Maya App or its systems or networks, or any systems or networks connected to it.

6.8 You agree not to incorporate any word in your name, message identification, or custom user title that is defamatory, obscene or profane, or which violates any trademark, service mark, or other intellectual property rights of any third party, including that of Maya Bank. You likewise agree not to use any trademark, trade name, service mark, or logo in a way that is likely or intended to cause confusion about the owner or authorized user of such marks, names, or logos.

6.9 You agree not to use any device or routine to interfere or attempt to interfere with the proper working of the Maya App or any transaction being conducted using our facilities, or with any other person’s use of these facilities. You agree that you will not engage in any activity that interferes with or disrupts our services or the servers and networks which are connected to our facilities.

6.10 You undertake to provide us with: (a) true, accurate, current and complete evidence of your identity, and promptly update your personal information if and when it changes; (b) provide us with any identity documentations as may be requested by us; and (d) any other information that must be provided for our services to be properly executed. You agree not to conceal your true name or use a fictitious name; otherwise, Maya Bank may file a criminal case against you for violation of penal laws of the Philippines, including the Anti-Alias Law (Commonwealth Act No. 142, as amended by Republic Act No. 6085), among others.

6.11 You agree to update your personal information should there be material changes or as may be required by Maya Bank from time to time.

6.12 Once you confirm the transaction or ask Maya Bank to proceed with the Transaction, you agree that you may neither cancel nor reverse such transaction. Maya Bank shall proceed with crediting the account of the recipient and once the money or fund is in the account of the beneficiary or recipient, Maya Bank cannot reverse nor deduct such account without the proper court order or authorization. In the event of an unauthorized or erroneous transaction, You must report to us immediately by providing the following details: a.) Name, contact number, and other credentials of the payor; b.) account from which the payment was made; c.) payee account details; d. transaction amount; and transaction date and time. To the extent possible, we will address and reverse the transaction should we find the same valid; otherwise, the transaction is final and irreversible.

6.13 You agree not to use the facilities of Maya Bank for any purpose that is illegal, unlawful, or prohibited by these Terms, or to solicit the performance of any illegal activity or other activity which infringes on the rights of Maya Bank or others, which includes but is not limited to selling, leasing, or giving your Account to a third party.

6.14 You agree that you are responsible to check for update/s and will download such update/s to the Maya App before use. You also agree that the device used to access the Maya App is compatible or meets the minimum system requirements of the Maya App. You understand that certain Maya App functions may not be available or may be disabled by Maya Bank if you do not perform the needed update or meet the compatibility / minimum system requirements.

You agree that it is your responsibility to take all reasonable precautions to ensure that the device used to access the Maya App is free or is reasonably protected from any computer viruses or similar devices or software including, but not limited to, Trojan horses and worms.

6.15 You agree that it is your responsibility to securely keep your PIN, Password, one-time PIN (OTP) and biometrics. The use of your User ID and your PIN and/or Password and/or your biometrics will serve as your irrevocable authorization for us to carry out transactions that you initiated. Any fraudulent activity, such as but not limited to access to phishing, smishing, and or vishing links or similar fraudulent transactions, or entering incorrect recipient details or biller information, or suspicious activities by your device, agents, employees, officers, and authorized representatives using your User ID and your PIN and/or Password or your biometrics, or unauthorized withdrawals or transfers, that may bring about financial losses to you is your sole responsibility. Similarly, biometrics authentication has been made available to you as a feature for your convenience the activation of which is subject solely to your sound discretion and consent. If you choose to enable biometrics authentication, any transactions authorized by you through the use of your biometrics shall be solely to your account. You agree to hold Maya Bank free and harmless in case of unauthorized access to your account or breach of your account or personal data or any financial losses you may have suffered as a result of but not limited to the misuse of the biometrics feature.

6.16 In case of loss or theft of any Maya Bank account due to a lost/stolen device or SIM, or theft due to fraud and/or scam, you agree to immediately inform Maya Bank of such loss or theft via our customer support hotline channel. Blocking of the account shall be made after Maya has conducted security verification and the submission of documentation, as applicable. All transactions made through your Maya Bank account prior to the report of loss or theft shall continue to be your liability. After you report the incident of lost or stolen device or fraud, a request for reactivation of the account shall require the presentation of documents, as may be requested by Maya Bank.

6.17 You agree that by supplying your personal information for the purpose of using the Service, you expressly consent to the processing of your supplied personal information for the purpose of creating and maintaining your Account. Such consent includes authorization for Maya Bank to disclose, exchange, and release the said information to its associates, Affiliates, subsidiaries, officers, employees, agents, lawyers, and other consultants, pre-paid/debit/credit bureaus such as TransUnion, Credit Information Coporation, Credit Information Bureau Inc., CRIF Corporation or other credit reference agencies or any such persons as Maya Bank deems necessary, or as required by laws, rules, or regulations. In the event that the disclosure or processing of your information does not fall among the above-mentioned situations, we will obtain the necessary consent, subject to existing laws, rules, and regulations on bank secrecy, data privacy, and other relevant laws, rules, and regulations.

6.18 In opening and maintaining a savings account and/or availing any of the bank products and services covered under these Terms, you agree to waive, without need of notice, in favor of Maya Bank, including any of its Affiliates, service providers, shareholders, associates, subsidiaries, officers, employees, agents, lawyers, partners, and other consultants, your rights under Section 55.1 (b) of Republic Act No. 8791 (The General Banking Law of 2000), under Republic Act No. 1405, or any other right pertaining to secrecy of bank deposits for any of the following purposes:

- Updating your Maya Bank account upon your request;

- Validating your identity before providing our services, or responding to any of your queries, applications, feedback, and complaints;

- Managing our day-to-day business operations;

- Keeping your information updated through our official data touchpoints;

- Providing customer service and support;

- Performing credit checks or due diligence checks to minimize risks or frauds;

- Safeguarding your account and protect you against fraud and other criminal activity;

- Settling claims or disputes involving any of our products and services;

- Complying with all applicable laws and regulations as well as performing our obligations from any legal authorities;

- Marketing and Credit scoring;

- Updating you on changes to our products or services; and

- For any other lawful purpose that Maya Bank may deem fit or necessary.

7. User Representation and Warranties

7.1 You warrant that all information you provided Maya Bank are true, correct, and accurate. You further warrant that in case of any change in the circumstances which affect the information you have provided to Maya Bank, you shall inform Maya Bank of such changes within fifteen (15) days from the occurrence of the said change. Maya Bank, its officers, and/or employees shall be held free from any liability for any damages, claims, or demands from your failure to do so or to inform Maya Bank in a timely manner.

7.2 By visiting and/or using the Maya App, you declare, undertake, and affirm that you take sole responsibility for whatever consequences that may arise out of your visit and/or use of our facilities. You understand that Maya Bank shall not be liable for, and you hereby hold Maya Bank free from, any direct, incidental, special, consequential, indirect, or punitive damages whatsoever resulting from your use of, or your inability to use, our facilities. On the other hand, you declare, undertake, and affirm that you shall indemnify Maya Bank for any direct, incidental, special, consequential, indirect, or punitive damages whatsoever resulting from your use of the Maya App contrary to these Terms. You further agree, undertake, and commit to indemnify Maya Bank for any breach of its proprietary and other rights, including breach of these Terms, which you may commit in the course of or arising out of your use of our facilities.

7.3 You acknowledge that in compliance with AFASA (RA 12010), we may temporarily hold your funds subject of a disputed transaction within the period as prescribed by law and implementing rules and regulations issued by the BSP.

In compliance with the authority to hold the funds subject of a disputed transaction, you acknowledge that we cannot be held administratively, criminally, and civilly liable in our exercise to hold the disputed fund in your Account.

You further acknowledge that upon the conclusion of relevant investigation of Maya Bank or other requesting bank or financial institutions or upon instructions by the Bangko Sentral ng Pilipinas or upon court order, Maya may permanently hold, suspend, freeze or block any of your access to the disputed fund or your Account.

8. Reserved Rights

8.1 You understand and agree that Maya Bank reserves the right to deny access to and/or discontinue its services or any component thereof in accordance with applicable laws, rules and regulations of the Philippines. Maya Bank further reserves the right to reject, suspend, or freeze your application or transaction should we find that you have provided false, inaccurate, or incomplete information, or if you are in violation of any applicable law, rules, or regulations, this Maya Bank Terms and Conditions, and/or the Maya App Terms and Conditions.

8.2 You understand and agree that Maya Bank reserves the right, at its sole discretion but without obligation, to collect, screen, review, flag, filter, modify, block, refuse, or remove any and/or all information provided by any user, explicitly or implicitly to and through its facilities, including but not limited to hardware information, IP address, browser-type related information, cookies, and the like. You hereby irrevocably agree, affirm, and warrant to hold Maya Bank free from any liability, both under equity and the law, arising or that may arise out of any such collection, screening, review, flagging, filtering, modification, blocking, refusal, or removal of any and/or all information provided by any user to and through its facilities.

8.3 You understand and agree that Maya Bank reserves the right, at its sole discretion but without obligation, to enhance, improve, develop, and introduce new features and functionalities to its facilities at any time and without prior notice. You hereby understand, agree, and affirm that any such enhancement, improvement, development, new feature, and/or new functionality to the Maya App shall form part of its services as defined herein and thus shall likewise be covered by these Terms and its subsequent revisions or amendments, as applicable.

8.4 You understand and agree that Maya Bank reserves the right, at its sole discretion, to verify, check, cross-refer, validate, and ascertain the veracity and truthfulness of all information supplied by you by acquiring, accessing, retrieving, or otherwise acquiring similar or additional information supplied by you to other third-party service providers, including, but not limited to telecommunications providers, etc. You hereby expressly, unequivocally, and voluntarily allow Maya Bank to request for and secure such information, and expressly, unequivocally, and voluntarily instruct such third-party providers to: (a) receive and process Maya Bank’s request; (b) favorably act at all times on any such request by producing the information requested; and (c) when requested by Maya Bank, provide the latter with certified digital or printed copies of the said information.

8.5 You understand and agree that Maya Bank reserves the right, at its sole discretion but without obligation, to send you or cause to send you service updates and/or messages, including SMS, notifications, email and/or any data message transmission, informing you of enhancements, improvements, developments, features, functionalities, products, promotions, offers, advertisement and/or any other information relative to its services and Maya Bank. Maya Bank makes no warranty of any kind, express or implied, for such service updates and/or messages, but you hereby agree to receive such service updates and/or messages and hold Maya Bank free from any liability and/or claims for indemnification or damages that may arise there from.

8.6 You understand and agree that Maya Bank reserves the right, at its sole discretion, to set limitations to and charge fees and applicable taxes for the use of its facilities, at any time and upon prior notice. You further understand and agree that Maya Bank reserves the right, at its sole discretion and under no obligation, upon notice, to change the applicable fees, taxes, and charges levied for the use of the services, at any time, subject to the conditions set out in Section 15.1 of the Terms and Conditions.

8.7 You understand and agree that Maya Bank reserves the right, at its sole discretion but without obligation, to enforce the provisions of these Terms, including but not limited to performing investigation and legal actions with law enforcement agencies regarding the Account Holder. Non-enforcement of any of the rights of Maya Bank under these Terms, under the law or under principles of equity shall not be construed as a waiver thereof. Likewise, no subsequent course of action by Maya Bank, by you, and/or by any third party, individually or collectively, shall not operate and shall not be construed to operate as abandonment, amendment, or modification of these Terms. You likewise hereby declare, affirm, and undertake the sole obligation to indemnify Maya Bank or any third party for any damage Maya Bank or said third party may sustain as a result of your use of our facilities.

8.8 You understand and agree that Maya Bank reserves the right, at its sole discretion but without obligation, to limit the provision, availability, quantity, and quality of any feature, product, or service to any person or to anyone within the same geographic area, demographic profile, or any other market, commercial, and/or trading segments. You likewise understand and agree that Maya Bank reserves the right, at its sole discretion but without obligation, to administer and operate any and/or all of its services from any or various locations outside the Republic of the Philippines. You further understand, agree, and hold Maya Bank free from any liability arising therefrom, that not all features, products, or services discussed, referenced, provided, or offered through or in the Maya App are available to all persons or in all geographic locations, or are appropriate or available for use outside the Republic of the Philippines. Any part or the whole of these Terms are void where prohibited. You hereby understand, agree, and undertake sole responsibility for your continued access to or use of our facilities, as well as the results or consequences of such access and use, including the responsibility for compliance with applicable local laws and the sole liability for non-compliance or breach thereof.

8.9 You understand and agree that Maya Bank reserves the right, in case of any amount mistakenly or fraudulently credited to your Account, to debit the erroneously or fraudulently credited amount either from your Maya Bank Accounts and/or your Wallet account or any of your funds with Maya Bank or Maya Philippines.

8.10 You understand and agree that Maya Bank reserves the right to comply with a notice or order from a court or other competent authority for the garnishment, attachment, freezing, or sequestration of any or all of your Accounts. The amount subject of the notice or order shall automatically be on hold and no withdrawals will be allowed until the order has been lifted.

8.11 You understand and agree that in the event that:

- a claim or dispute arises in relation to the Account, its ownership, or operation;

- conflicting instructions are given in relation to the Account;

- it receives a request or instruction to freeze the Account; or

- other similar or analogous circumstances occur,

Maya Bank reserves the right, in its sole discretion, to take any necessary actions, such as freezing of the account or filing interpleader suits. You understand that such actions are authorized, approved, and ratified by you and you hold Maya Bank free from any liability arising therefrom.

8.13 If you are a director, officer, or employee, vendor or service provider of Maya Ph or Maya Bank, or any of its Affiliates, you agree to offset, without need of prior notice and demand, any amount due and payable in your Maya Consumer Lending Products or any receivables or claims which we may have against you from your Maya Savings or Maya Wallet or any other funds, cash or asset you may have with Maya Ph or Maya Bank, and their affiliates. In all instances, we shall notify you of any offsetting that has been made.

9. Closing of Account

9.1 You are free to close your Account with Maya Bank, subject to the submission of necessary documents and the surrender of items or documents evidencing ownership. A reasonable nominal charge will be imposed if the Account is closed within thirty (30) days from its opening.

9.2 Maya Bank may also immediately close your Account with notice to you if:

- the balance of the Account becomes zero (0) and the account is or becomes dormant;

- if Maya Bank finds that the Account has been or is being used for or in connection with fraudulent or illegal activities;

- if the Bank finds it reasonable in order to protect its interest;

- for reasons provided under these Terms;

- for security and other reasonable purposes;

- for violations of any applicable laws, rules and regulations.

9.3 Maya Bank may also initiate closure of your Account when it finds that you have not handled the Account in a manner that exceeds fair, reasonable, or standard use. In the event that there are remaining funds after closure of your account due to findings of fraud or violation of law, you will be notified by Maya Bank to transfer the remaining funds from your account to your designated local bank account. Should Maya Bank fails to hear from you after notice, the remaining funds from your Maya Bank accounts and Maya Wallet account will be consolidated which can be transferred to your designated local bank after notice from you. Maya Bank is authorized to keep records and inform the Bankers Association of the Philippines of the closure of such accounts.

9.4 In the event of death of an Account Holder, the executor, administrator and/or legal heirs, of the Account Holder must immediately notify Maya Bank of the fact of such death. In accordance with the applicable laws and regulations, the withdrawal of the funds corresponding to the ownership interest of the deceased may be allowed, subject to the presentation of the documents as required by Maya Bank and submission of appropriate documents as may be warranted under relevant laws and regulations pertinent to succession.

10. Data Privacy Statement

10.1 You authorize Maya Bank and its official partners to process the personal information that you have provided directly or indirectly in our data collection touchpoints relevant to the respective purposes furnished to you in our privacy notices.

With your active use of our products and services, you agree to the Data Privacy Statement of Maya Bank found at http://www.mayabank.ph/privacy.

11. Liabilities

11.1 You agree to indemnify, defend and hold harmless Maya Bank, its subsidiaries and affiliates, and their directors, officers, employees and agents, from and against any loss, damage, liability, costs and expenses, including reasonable attorney’s fees (collectively, “Losses’), arising out of or based on:

- breach of, or failure to perform, any of your obligations contained in this Agreement;

- your gross negligence or willful misconduct; or

- errors incurred by or judgments/decisions made by you.

11.2 You may be penalized by Maya Bank equivalent to the amount of damage or cost incurred or penalty paid arising from your action as listed in the preceding section or from failure to comply with any provision of this Agreement as well as other agreements with Maya Bank.

11.3 Maya Bank agrees to indemnify, defend and hold harmless you, your subsidiaries and affiliates, and your directors, officers, employees and agents, from and against any losses arising out of or based on (a) breach of, or failure to perform, any obligation of Maya Bank contained in this Agreement, or (b) the gross negligence or willful misconduct of Maya Bank.

11.4 In no event shall Maya Bank and you be liable, in the absence of gross negligence and willful misconduct, for any indirect, special, incidental or consequential damages under this Agreement, including, without limitation, loss of profits, revenue, data or use, even if Maya Bank and/or you have been advised of the possibility of such damages.

12. Governing Law and Venue of Litigation

12.1 These Terms shall be construed and governed in accordance with the laws of the Philippines.

12.2 You understand and agree that these Terms including all disputes relative to your use of the services of Maya Bank and relating to your Account shall be governed by the laws of the Republic of the Philippines without regard to conflict of laws. In case of any dispute arising out of these Terms or your use of the Services, you hereby agree, undertake, and commit to resolve or attempt to resolve such dispute promptly and in good faith. In case of failure to resolve any such dispute, you agree to the jurisdiction by and venue in the appropriate courts of Mandaluyong City, Philippines, to the exclusion of all other courts, and waive as you hereby waive, any objection to such jurisdiction or venue.

13. Non-Waiver of Rights by Maya Bank

13.1 Failure, omission, or delay on the part of Maya Bank to exercise its right or remedies under these Terms and Conditions shall not operate as a waiver. Any such waiver shall be valid only when reduced in writing and delivered to the Account Holder.

14. Separability Clause

14.1 Should any term or condition in this Agreement be rendered void, illegal, or unenforceable in any respect under any law, the validity, legality, and enforceability of the remaining terms and conditions shall not be affected or impaired thereby.

15. Amendments

15.1 Maya Bank may at any time and for whatever reason it may deem proper, amend, revise, or modify these Terms, which shall only be implemented sixty (60) days after notice to the Account Holders. You agree that for purposes of these Terms, publication of the revised Terms in Maya Bank’s website shall be considered as sufficient notice. It is the Account Holder’s responsibility to regularly check any changes to these Terms at www.mayabank.ph. Your continued use of Maya Bank’s services and continued maintenance of your Account after any such changes constitute acceptance of the new Terms. Failure to notify Maya Bank of your intention to terminate your Account shall be construed as acceptance of the amendments to these Terms. You may notify Maya Bank of your rejection of the amendments to these Terms within thirty (30) days from receipt of individual notice or thirty (30) days from issuance of public notice. Proper notice of your rejection would entitle you to exit the contract without penalty.

16. Notices

16.1 All notice requirements shall be as stated in these Terms. If Maya Bank is required to send notice to you, it shall do so through available channels including but not limited to, in-app notifications, SMS, email, or registered mail which shall be sent to your registered address. Publication in Maya Bank’s website shall also be sufficient notice, as may be required by this Agreement.

17. Customer Service

17.1 At Maya Bank, we consider our customer’s financial questions, needs and feedback as very important. If you have any concerns about a procedure or have encountered a problem with our service, we will do our best to address it within fifteen (15) calendar days. Should your concern require more time to be resolved, we will update you every step of the way. You may contact our Customer Service through the different channels available at https://www.mayabank.ph/contact-us/

You have our assurance that we will handle your concerns, feedback and information with utmost confidentiality and will strive to resolve them as soon as possible. Maya Bank will handle the information we receive as construed in Section 10 Data Privacy Statement. Maya Bank is regulated by the Bangko Sentral ng Pilipinas: www.bsp.gov.ph

18. Corporate Governance

18.1 Maya Bank’s business activities are regulated by its own internal business rules and Corporate Governance policies which are compliant with applicable anti-corruption laws. Maya Bank’s policies and internal controls are designed to prevent bribery from occurring, avoid appearance of wrongdoing and enable Maya Bank personnel to respond promptly and effectively to any inquiries about its conduct. In case of any violation of the Corporate Governance policies by Maya Bank, its Stockholders, Directors, officers, employees, or agents, any party may report the same to Maya Bank’s Corporate Governance Office, by sending an email to [email protected], from 9AM to 6PM, Philippine Time, Mondays through Fridays, except holidays.

Annex A: Special Provisions on Personal Goals

1. Personal Goals Definition

1.1 Personal Goal/s refers to a goal-based deposit account where customers can keep their money for up to one hundred eighty (180) days while earning interest based on their average daily balance.

2. Personal Goals Creation

2.1 A maximum of five (5) active Personal Goal accounts are allowed per customer.

2.2 A maximum of one hundred eighty (180) days from the goal creation date is allowed for its due date.

2.3. An active Maya Savings account is required before a Personal Goal account can be created.

2.4 There is no minimum balance needed to open a Personal Goal Account. However, interest will only be accrued for balances up to PHP 1,000,000 per account.

3. Personal Goals Cancellation

3.1 Should you decide to move the funds from your Personal Goal account to your Maya Savings account prior to its due date, you may cancel your goal through the Maya App.

4. Crediting of Proceeds to Maya Savings Account

4.1 Proceeds from your Personal Goal (total deposit plus accrued interest less applicable withholding taxes), regardless if it is cancelled or completed, will be credited to your own Maya Savings account.

4.2 After which, your Personal Goal account may now be closed by tapping the “Done” button from the bottom sheet appearing on your Savings dashboard.

4.3 If your Maya Savings account is inactive for two (2) years and becomes dormant, funds from your cancelled or matured Personal Goal account will not transfer automatically to your Maya Savings. Balance retained in the Personal Goal account after cancellation or maturity shall not be entitled to any interest accrual. To ensure a seamless transfer, you must reactivate your dormant Maya Savings account by completing the reactivation process and initiating a transaction thereafter.

Annex B: Special Provisions on Time Deposit Plus

1. Time Deposit Plus Definitions

1.1 Time Deposit Plus refers to a goal and time-based deposit account where customers can keep their money for a fixed tenor of three (3), six (6) and twelve (12) months while earning interest based on the goal amount and tenor set by the customer on the account.

1.2 Tenor refers to the duration of time the amount is required to be placed in the account without being moved or withdrawn in order to continue earning the applicable interest.

1.3 Boosted Interest refers to an enhanced rate of interest applied to account balances, added on top of the base interest rate. This boost may be contingent upon meeting specific criteria or maintaining the account for a predetermined duration. The boosted interest is subject to change based on the terms outlined in the Maintenance of Account and special provisions.

2. Time Deposit Plus Account Creation

2.1 A maximum of five (5) active Time Deposit Plus accounts are allowed per customer.

2.2 The maturity date of a Time Deposit Plus account shall be dependent on the selected tenor of either three (3), six (6) or twelve (12) months. This shall be the basis of the Time Deposit Plus account’s maturity date. The maturity date shall be non-modifiable once the tenor is selected and the Time Deposit Plus account is created.

2.3 There is no minimum balance needed to open a Time Deposit Plus Account. However, interest will only be accrued for balances up to PHP 1,000,000 per account. Base interest shall start accrual upon first deposit, and boosted interest shall start accrual once goal amount has been reached, with minimum of PHP 5,000 for target goal amount.

2.4 An active Maya Savings account is required before a Time Deposit Plus account can be created.

3 Time Deposit Plus Account Cancellation

3.1 Should you decide to move the funds from your Time Deposit Plus account to your Maya Savings account prior to its maturity date, you may cancel your goal through the Maya App.

3.2 Time Deposit Plus account cancelled before the maturity date shall be subject to Maya Bank’s cancellation policy. A documentary stamp tax (DST), cancellation fee, and other fees as applicable shall be automatically deducted by Maya Bank from the proceeds upon cancellation of the Time Deposit Plus account. Refer to https://support.mayabank.ph/s/article/Are-there-penalties-if-I-cancel-my-account-before-its-due-date for Table of Fees and Charges for the corresponding fees and penalties applied for the cancellation of Time Deposit Plus accounts.

3.3 Accounts that are prematurely cancelled or withdrawn shall be credited their remaining accrued base interest but will no longer receive the remaining accrued boosted interest applicable to the Time Deposit Plus account for the period after the last interest crediting date prior the premature withdrawal or cancellation.

4. Crediting of Proceeds to Maya Savings Account

4.1 Proceeds from your Time Deposit Plus account (total deposit plus accrued interest less applicable fees and withholding taxes), regardless whether the Time Deposit Plus account is cancelled or matured, will be automatically credited to your own Maya Savings Account.

4.2 After crediting to your Maya Savings account, your Time Deposit Plus account may now be closed by tapping the “Done” button from the bottom sheet appearing on your Time Deposit Plus account page.

4.3 If your Maya Savings account is inactive for two (2) years and becomes dormant, funds from your cancelled or matured Time Deposit Plus account will not transfer automatically to your Maya Savings. Balance retained in the Time Deposit Plus account after cancellation or maturity shall not be entitled to any interest accrual. To ensure a seamless transfer, you must reactivate your dormant Maya Savings account by completing the reactivation process and initiating a transaction thereafter.

Interest rate chart

| Interest rate | New & existing depositors |

|---|---|

| Base rate | 3.5% p.a. |

| Boosted interest rate unlocked at P250 accumulate spend via QR, Pay via Maya Card, Pay via Mobile Number, Checkout with Maya | 5% p.a. |

| Boosted interest rate unlocked at P1,000 accumulate spend via QR, Pay via Maya Card, Pay via Mobile Number, Checkout with Maya | 6% p.a. |

| Boosted interest rate unlocked at P25,000 accumulate spend via QR, Pay via Maya Card, Pay via Mobile Number, Checkout with Maya | 8% p.a. |

| Boosted interest rate unlocked at P35,000 accumulate spend via QR, Pay via Maya Card, Pay via Mobile Number, Checkout with Maya | 10% p.a. |

| For Smart Postpaid users: Boosted Interest rate unlocked with exclusive voucher code and spend of P999 |

11% p.a. |

| Boosted Rate unlocked when you refer a friend with your @username | 12% p.a. |

Interest rate chart

| Interest rate | New & existing depositors |

|---|---|

| Base rate | 3.5% p.a. |

| Boosted interest rate unlocked at P250 accumulate spend via QR, Pay via Maya Card, Pay via Mobile Number, Checkout with Maya | 5% p.a. |

| Boosted interest rate unlocked at P1,000 accumulate spend via QR, Pay via Maya Card, Pay via Mobile Number, Checkout with Maya | 6% p.a. |

| Boosted interest rate unlocked at P25,000 accumulate spend via QR, Pay via Maya Card, Pay via Mobile Number, Checkout with Maya | 8% p.a. |

| Boosted interest rate unlocked at P35,000 accumulate spend via QR, Pay via Maya Card, Pay via Mobile Number, Checkout with Maya | 10% p.a. |

| For Smart Postpaid users: Boosted Interest rate unlocked with exclusive voucher code and spend of P999 |

11% p.a. |

| Boosted Rate unlocked when you refer a friend with your @username | 12% p.a. |