Personal Loan

Get your loan

in Maya Wallet instantly

As low as 0.77% monthly add-on rate*

Add-on rate applies to a 24-month installment

period. Terms and conditions apply.

Pay up to 24

monthly installments

How can Maya Personal Loan

help you?

Upgrade your home

Fund your home renovation or make a down payment on a new condo

Pay for school fees

Cover tuition and use the rest for

books and school supplies

Expand your business

Renovate your store, buy new equipment, or expand your inventory

Buy a new gadget

Get the new iPhone, upgrade your

TV, or own the camera you’ve always wanted

Apply in 3 easy steps

You’re qualified if you:

👌 are 21 to 65 years old

🇵🇭 are a Filipino citizen living in the Philippines

💯 have an upgraded Maya account

💸 use Maya actively for your transactions

*Open to select users during Early Access

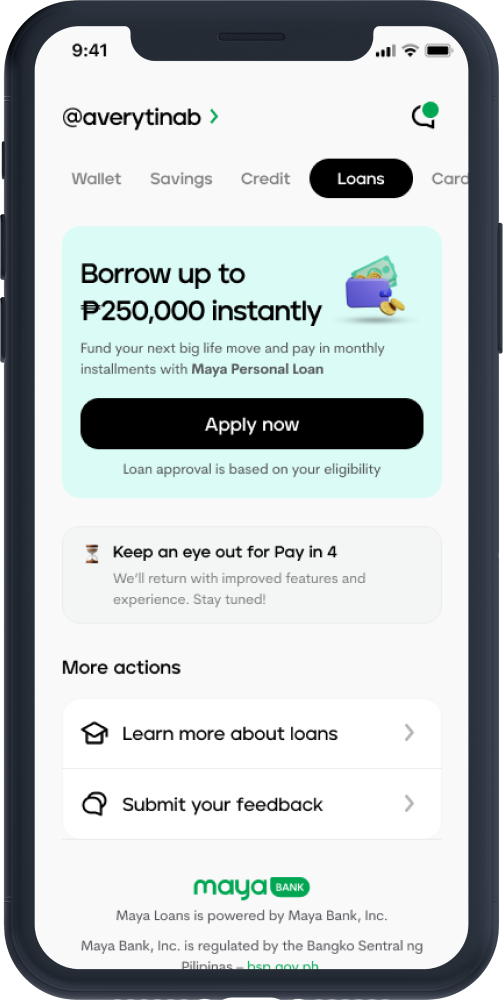

1Go to the Loans dashboard, tap Apply now

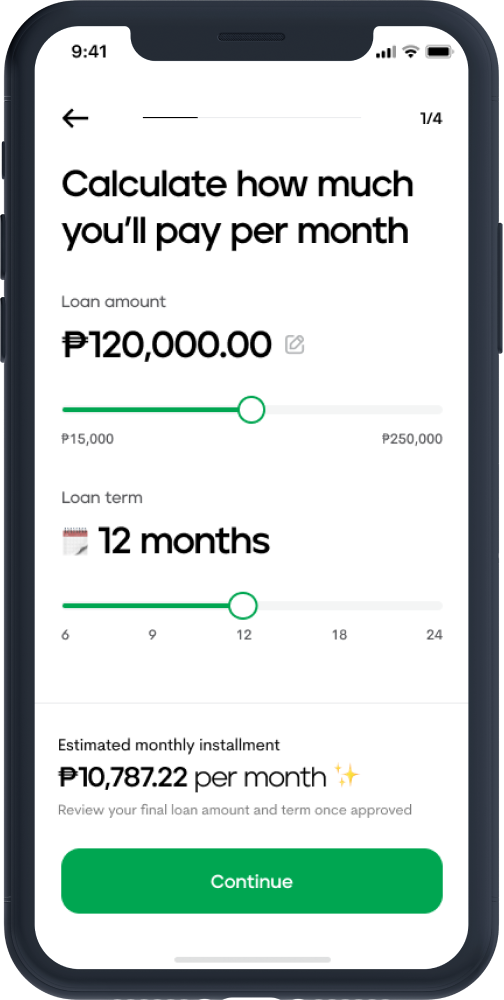

2Enter your desired loan amount and complete the application process

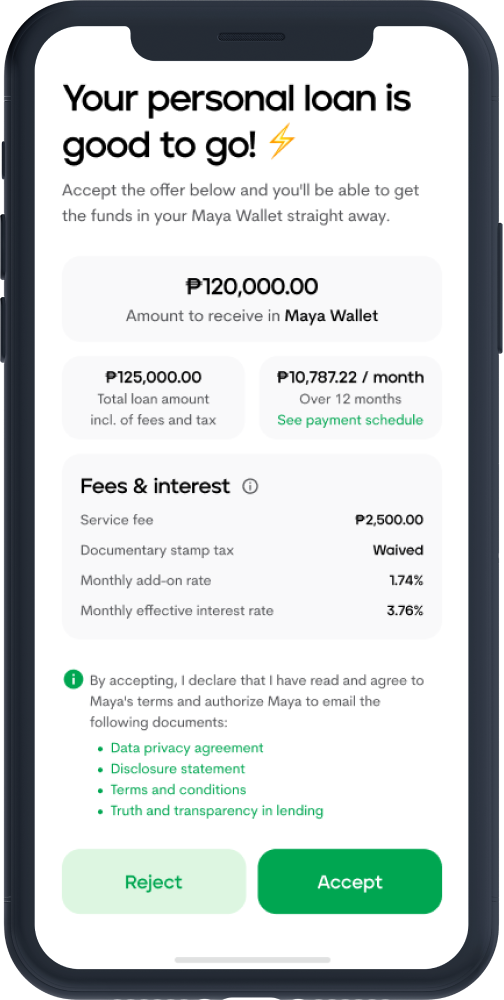

3Review your loan offer and tap Accept if you're happy with the terms

Once you accept your loan, the full amount will be instantly transferred to your Maya Wallet.

Loan approval, amounts, and monthly add-on rate are subject to credit evaluation.

Why choose Maya Personal Loan?

Low interest rates

Enjoy an add-on rate as low as 0.83%*

payable for up to 6 months

*Effective interest rate of 1.40% per month. Stay tuned for updates on these terms.

Instant* approval and disbursement

Get approved in seconds

and have your loan instantly

transferred to your Maya Wallet!

*For select upgraded Maya users only

Ease of use

Easy loan application, approval,payment, and tracking via the Maya app

Say yes to easy

loan computation

How much do you need?

How long do you need to pay?

Monthly installment amount

₱7,871.76/ month

for 6 months

Monthly add-on rate 0.83%

(monthly EIR 1.40%)

Your Maya Personal Loan offer is subject to credit evaluation.

Monthly installment amount is based on the lowest monthly add-on rate per installment period.

Your exact loan offer will be provided on the Maya App upon approval.

Stay tuned for more installment plans coming soon.

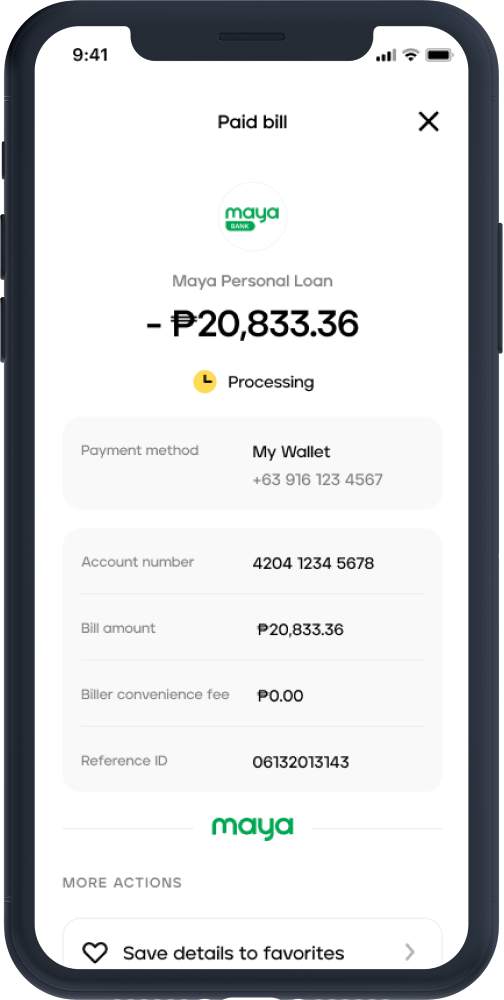

Pay easily

within the app

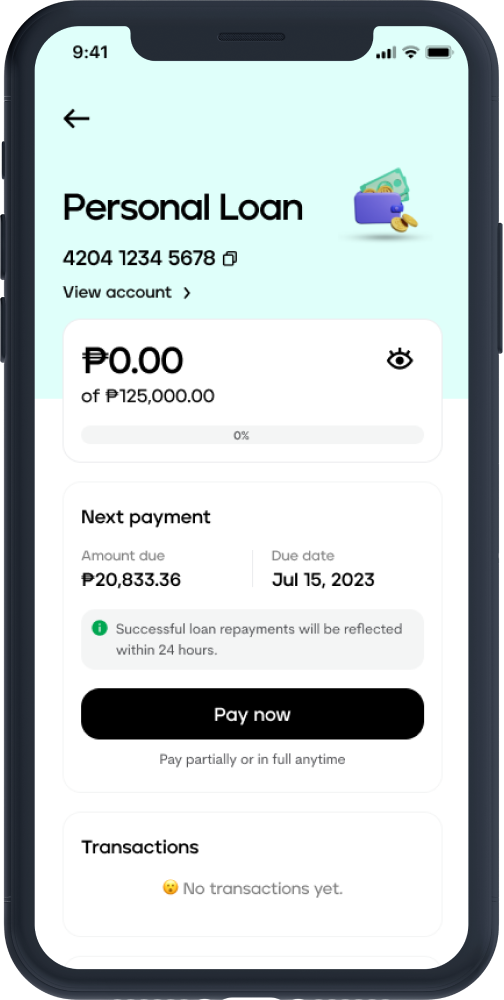

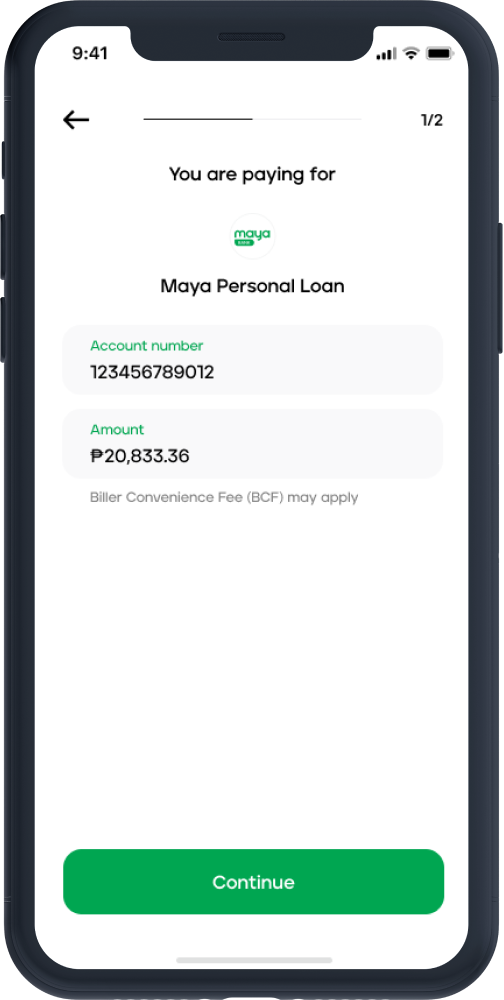

1Tap Pay now under Loans > Personal Loan

2Enter the amount you want to pay then tap Continue

*Please make sure you have enough balance in your wallet before your next due date

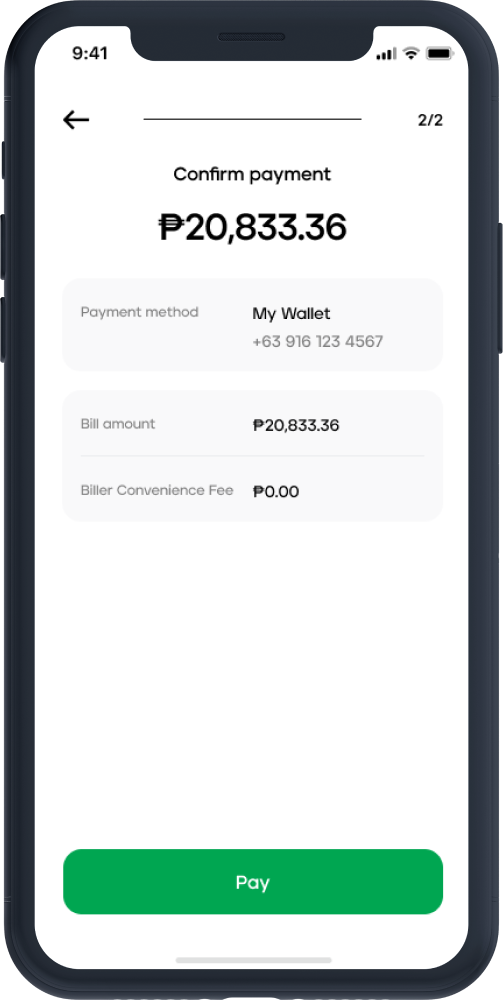

3Review the payment details then tap Pay

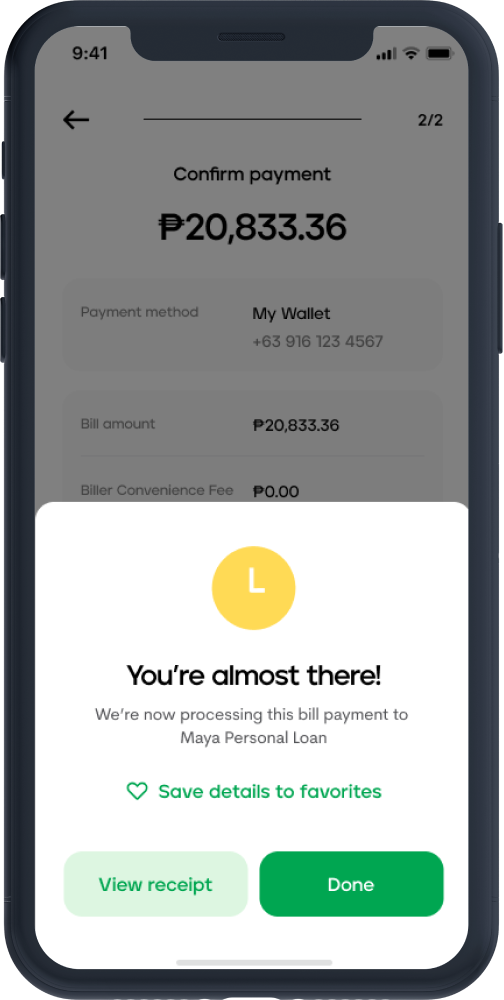

4 View your payment receipt or tap Done to go back home

5 Tapping View receipt on the previous screen will open the transaction summary

1Tap Apply now under Loans > Personal Loan

2Review the details then tap Continue

3 Set your desired loan amount and repayment terms then tap Continue

4 Review the loan offer then tap Accept

5 Enter the OTP you received then tap Verify to complete your application

Frequently Asked Questions

You’ve got questions, we’ve got answers

Need more answers?

Maya Personal Loan is still on early access at the moment. You may be eligible for Maya Personal Loan if you’ve met the following qualifications:

• You are at least 21 to 65 years old.

• You are a Filipino resident.

• You have an upgraded Maya account.

• You’ve been actively using your Maya account for transactions and purchases.

All applications are subject to credit evaluation. If you qualify for early access, we will notify you regarding your eligibility to apply for a Maya Personal Loan.

Step 1: Visit the Loans tab in the Maya app

Step 2: Tap Apply for a Loan in the Maya Personal Loan banner

Step 3: View the introduction screen and tap Continue

Step 4: Provide desired loan details in the loan calculator screen

Step 5: Input and validate your personal information then tap Submit

Step 6: Review and confirm your loan amount, interest rate, and repayment terms

Step 7: Enter a One-Time Pin (OTP) to authorize the loan disbursement

Step 8: Receive your loan through your Maya Wallet instantly

You may apply for a loan from P15,000 to P250,000.

Your Maya Personal Loan amount is subject to credit evaluation, based on your monthly salary and your credit history. Continue to use Maya for your transactions and always pay your bills on time to help increase your potential loan amount.

Your exact Maya Personal Loan offer, including your approved loan amount and interest rate, will be reflected in your Maya App upon application.

You can get a Maya Personal Loan with as low as 0.77% add-on rate per month (effective interest rate of 1.39% per month). All applications are subject to credit evaluation. Exact interest rate will be reflected in the Maya App upon application.