WHO WE ARE

The Fintech Game Changer

At Maya, we are redefining how banking is done in the Philippines.

The Philippines is one of the fastest-growing economies in Southeast Asia, with a young and digital-savvy population. While total financial account ownership grew to 56% in 2021—thanks to e-wallets—there is a vastly untapped market ripe for disruption.

Launched in April 2022, Maya has revolutionized the financial services landscape in the Philippines through its innovative all-in-one digital banking approach. It is the sole fintech brand that offers the most advanced digital banking and payments solutions across consumers and enterprise segments via a top-rated finance app, and leading merchant acquirer and payments processing business.

Maya is powered by Maya Philippines, Inc., which facilitates digital payments, and Maya Bank, Inc., which delivers digital banking services. Together, we are building the most comprehensive financial services ecosystem in the Philippines, empowering consumers and enterprises to thrive in the digital economy.

Mission

For Consumers

We are empowering all Filipinos, especially the unbanked and unhappily banked, by providing them with financial technologies and an enabling ecosystem that makes earning, growing, moving, managing, and protecting their money a breakthrough experience.

For Businesses

We are a leading technology partner to all kinds of enterprises, however big or small, equipping them with the best-in-class fintech solutions that give them a powerful platform to thrive and win in the market and in the hearts of their customers

Vision

To be the best provider of game-changing and life-enhancing financial services for all Filipinos

Our Evolution to Maya

- Voyager Innovations* is formed, a spin-off from Smart Communications, Inc.

- BSP grants Smart Money, Inc. (SMI) its own Electronic Money Issuer (EMI) license.

- SMI becomes PayMaya Philippines, Inc. (PayMaya).

- PayMaya launches:

- consumer e-wallet app linked to a debit card.

- PayMaya Business, an end-to-end, omnichannel payments business, including acquiring and processing.

- Voyager raises US$210 million, bringing the company’s valuation to unicorn+ status at US$1.4 billion.

- Maya publicly launches its offering integrating digital banking services.

* Voyager Innovations is the parent company of Maya Philippines, Inc. and Maya Bank, Inc.

Revolutionizing Banking for the Unbanked and Unhappily Banked

We started our journey recognizing that a significant number of Filipinos are still unbanked, and, if banked, are not happy with the services they get.

Fintech champions like our predecessor, PayMaya, led the charge, resulting in a doubling of the number of adult Filipinos with financial accounts from 29% in 2019 to 56% in 2021, according to the BSP.

Even with this incredible progress, there remains a big opportunity to grow banking services beyond financial access. In 2021, only 37% of adult Filipinos had savings, and from this base, only 31% saved with banks. Meanwhile, out of the 45% of Filipino adults with loans, a mere 4% borrowed from banks.

We also know, based on studies, that Filipinos trust banks with their data more than other institutions.

However, many Filipinos are intimidated by traditional banking because of cumbersome processes, extensive paperwork, deposit requirements for account opening and maintaining balances, low deposit interest rates, and clunky mobile app experiences.

With the digital boom, numerous fintech apps have flooded the market—from e-wallets, crypto, credit, money management, and mobile banking. However, none offer a seamless all-in-one experience. Those with financial accounts resort to juggling multiple apps to meet their digital transaction needs.

With its all-in-one digital banking proposition, Maya offers simplicity in a world of increasing complexity. Our promise: the convenience of an e-wallet matched with the safety and financial benefits of a digital bank.

Digital Banking Embedded Across a Comprehensive Ecosystem

We have integrated payments and banking seamlessly and embedded our offerings across Maya’s established consumer and enterprise ecosystems, a unique proposition unmatched by any e-wallet, digital bank, or other players.

For consumers, we have seamlessly wrapped up payments, savings, credits, and investments in one app—

a first in the Philippines. Businesses also benefit from our platform, enjoying a unified experience for payment acceptance, digital disbursement, business deposits, and credit.

This fusion creates a strong synergy across our ecosystem, enabling us to offer integrated services with broader offerings, promoting everyday transactions and boosting customer loyalty. We use our deep transactional data to develop better credit risk models for more personalized offers.

Our unique foothold in consumer and enterprise sectors, backed by a robust shareholder ecosystem with deep Philippine industry ties, strengthens our network.

Redefining How Banking is Done with AI and Data

Through our all-in-one digital banking, we are empowering Filipinos to regain control of their financial lives.

Maya is a data-driven bank leveraging on a mobile-first and cloud-first technology infrastructure, as well as Artificial Intelligence (AI). The combination of technology, insights from AI, and “human touch” has led us to build an innovative onboarding process and user experience that lets customers upgrade their accounts to access savings and credit in just a few minutes while maintaining a high level of security.

Our high-engagement model has made banking delightful, turning everyday transactions into opportunities for our customers to earn higher savings interest rates credited daily. According to our 2022 survey, this gamified approach resulted in unmatched customer satisfaction, with Maya Savings boasting a solid NPS score of 77.

As we promote everyday payments using the Maya wallet to help boost Maya Savings interest rates, our customers increase their digital financial footprint.

In turn, we use the data from payment transactions to boost our AI-enabled credit scoring, enabling us to offer instant credit. Based on our data, customers utilize this credit for everything from buying telco load, paying bills, and making necessary purchases.

As we enhance user experiences, we are also making transactions safer. Our mix of anomaly detection techniques, supervised learning models, and transactional analysis allows Maya to defend itself effectively against fraud attempts.

Leading the Charge in Next-gen Banking

In less than a year after launch, Maya is becoming an integral part of our users’ daily lives. Today, our bank customers who save or borrow engage in two to three times more transactions compared to e-wallet-only users.

Our early success in the consumer market also positions us to revolutionize businesses. As the leading enterprise payments acquirer, Maya is already seen as the “payments backbone of the Philippines.”

We are embedding our digital banking products across this unparalleled merchant network, starting with a business deposit and installment loans for their customers. Thanks to our robust financial foothold built via grassroots QR Ph adoption, we are positioned to extend credit to MSMEs.

We are strengthening our ecosystem as more users and enterprises embrace Maya, amplifying the benefits and opportunities for everyone involved.

We are Maya, and we are creating the future right now.

Driving Excellence

-

World Digital Bank Awards 2023

- Best Digital Bank (Pure Play) - Southeast Asia

- Best Digital Bank (Pure Ptlay) - Philippines

- Ranked 8th among digital banks worldwide

-

NPC's Privacy Awareness Week Awards 2022

- Privacy Initiative of the Year

- Finalist, Privacy Management of the Year

- Finalist, Data Protection Officer of the Year Award

-

LinkedIn

- Top Companies in the Philippines (2023)

- Diversity Champion – LinkedIn Talent Awards (2022)

- Learning Champion – LinkedIn Talent Awards (2022)

- Finalist, Best Talent Acquisition Team - LinkedIn Talent Awards (2022)

- Finalist, Talent Insights Pioneer - LinkedIn Talent Awards (2022)

-

PR Awards Asia-Pacific 2023

- Gold - Brand Development (Product)

- Bronze - PR Event

- World’s Best Banks List (2023)

- Best Digital Bank (Pure Play) – Southeast Asia

- Best Digital Bank (Pure Play) – Philippines

- Ranked 8th among digital banks worldwide

- Platinum Winner, Digital Bank of the Year

- Fintech 250 List (2022)

- Best in Future of Intelligence

- 2023 Global Mobile Awards – Maya app for Best Mobile

- Innovation for Digital Life

- Privacy Initiative of the Year Finalist

- Privacy Management of the Year Finalist

- Data Protection Officer of the Year Award

- Winner, SHIELD Trust Award

- Top Companies in the Philippines (2023)

- Diversity Champion – LinkedIn Talent Awards (2022)

- Learning Champion – LinkedIn Talent Awards (2022)

- Finalist, Best Talent Acquisition Team – LinkedIn Talent Awards (2022)

- Finalist, Talent Insights Pioneer – LinkedIn Talent Awards (2022)

- Excellence Award – Safety Communications

- (SAFEWork Internal Communications Campaign)

- Excellence Award – Publication (SAFEWork Playbook)

- Silver – PR Tools Publication (SAFEWork Playbook)

- Silver – Strategy & Effectiveness – Challenger Brand Strategy

- Gold – Art Direction

- Gold – Best Cinematography

- Gold – Best Editing

- Silver – Film Animation

- Silver – Film Direction

- Silver – Film Production Design

- Silver – Film Visual Effects

- Silver – Audio Visual Branded Content

- Silver – Talent

- Silver – Touchpoints & Technology

- Gold – Brand Development (Product)

- Bronze – PR Event

- Gold – Specialized Public Relations Program (PayMaya is Now Maya)

- Silver – Specialized Public Relations Program (Unleash Maya Internal Communications Campaign)

- Silver – PR Tools AVP (Maya by Shanti Dope)

- Silver – PR Tools AVP (Maya Center Rebrand Video)

- Silver – PR Tools Event (Maya Launch)

- Silver – PR Tools Event (Maya Business Launch)

- Silver – PR Tools Website (Maya Website Refresh)

- WARC Awards for Asian Strategy 2022

- Global WARC Awards for Effectiveness (Cultural Impact)

- 2023 One Show – Branded Entertainment: Music Videos

- 2023 Cannes – Customer & Acquisition Retention

- 2023 Cannes – Entertainment Commerce

Empowering Customers

Sto. Tomas, Batangas

Maya Center agent for 8 years

Innovating

Customer-Centric

Solutions

In less than a year after launch, Maya is becoming an integral part of our users’ daily lives. Today, our bank customers who save or borrow engage in two to three times more transactions compared to e-wallet-only users.

Building on a Solid Tech Foundation

At Maya, we’re building for scale, and we have laid down a solid foundation anchored on technology to make our business future-proof.

We have built our infrastructure to take full advantage of the benefits of a cloud-based infrastructure:

🕺🏻 Flexibility and scalability. We can easily reconfigure and add all the computing resources we need on-demand, giving us the agility needed to respond to changes in the market.

🪙 Cost-effectiveness. We use computing resources we need rather than buying servers upfront. We also utilize cost-monitoring tools and dashboards heavily for proactive alerting and identifying scale-down opportunities.

🔒 Reliability and security. We maintain high system reliability and foster strong security through cloud architecture best practices. Strict SLAs are enforced for all systems and are consistently being achieved to date.

These benefits work together to give our customers a game-changing financial experience with market-leading features, high availability, and security.

Data-driven approach

As a digital bank, our in-house machine learning and AI capabilities allow us to harness advanced analytics, taking advantage of our cloud-based infrastructure to gain a complete picture of our business.

We use insights and data from our transactions to create the next level of relevant products for our customers. We tease out insights and patterns analyzing financial & non-financial data.

We harness the power of artificial intelligence and data science so we can continuously evolve our products and offer new financial experiences:

- Stronger fraud prevention controls

- Personalized credit scoring and access to credit

- Better predicted outcomes

- Better understanding of customer behavior &

- uantitative tools for tailor made offers to customers

- Better Know-Your-Customer (KYC) verification.

Qualitative Research

We do not stop at just the data. To get the full story, we reach out to current and potential customers about their needs, why they have these needs, and how they prefer to be served.

Embracing User-Centered Design

Customer experience is at the heart of our mission to make Maya the all-in-one digital banking app for every Filipino. We have developed modular, integrated, and personalized financial experiences that are changing the game for financial services.

Our design approach takes advantage of best practices in user-centered design, the latest trends in user experience (UX), and continuous improvements based on customer feedback and data.

We have designed our user interface to be clean, scalable, and user-friendly.

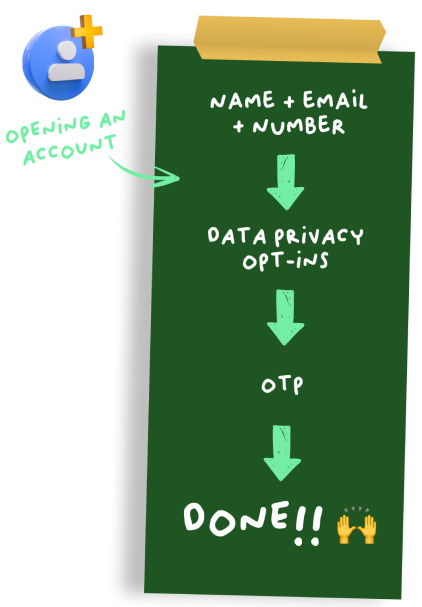

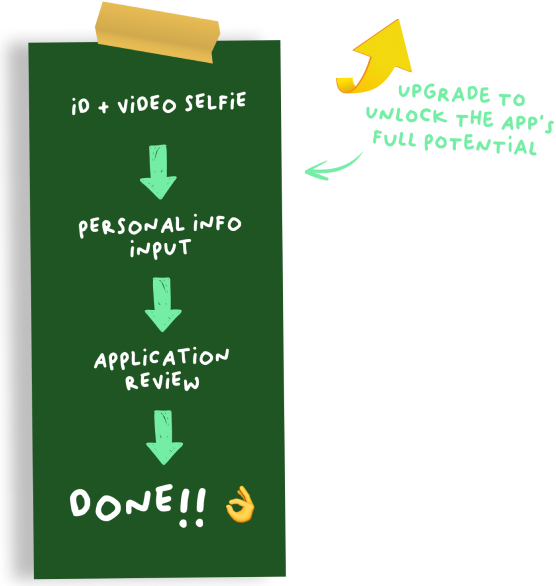

We are accelerating financial inclusion through an innovative onboarding process that allows users to open and fully verify their accounts to access full services, offering convenience while complying with local and international financial regulations.

Maya users can set up their account within a few minutes—no joining fee, no annual fee, all through the app.

Because Maya is an all-in-one financial platform, customers only need to go through one KYC process for e-wallet, savings, and credit.

Prioritizing Privacy and Security

Protecting customer data and assets is our top priority.

Our privacy and security strategies are rooted in:

- Resilient cybersecurity controls

- Strong culture of privacy and security

- Close collaboration with government agencies

AI to combat fraud. We employ AI and machine learning for customer verification processes including face matching, ID image classification, fake ID detection, ID OCR, and biometrics.

Multi-factor authentication. In addition to password, we require additional means of authentication such as a one-time pin when logging in and transferring money.

24×7 monitoring and response. Our Security Operations Center (SOC) is always on, ready to fend off cyberattacks.

We recognize the critical role of our employees in upholding security and protecting the privacy of our customers.

Our unique approach to building a culture of privacy combines consumer protection advocacy, gamified missions, social media challenges, and awareness testing for our employees.

We received the Privacy Initiative of the Year award in the Privacy Awareness Week in 2022 organized by the National Privacy Commission (NPC). We won for our #FraudPatrol campaign.

We collaborate with the Anti-Money Laundering Council (AMLC), the Philippine National Police (PNP) Anti-Cybercrime Group, the National Privacy Commission (NPC), and the Bangko Sentral ng Pilipinas (BSP) for a united stand against financial crime.

Products and Services

Our product offerings reflect our innovation-driven approach to promoting digital adoption and financial inclusion.

|

|

|

||

|---|---|---|---|---|

| Consumer | Business | |||

|

Maya Credit | A revolving credit line of up to ₱18,000 that customers can use to transfer cash to wallet or use it to directly pay partner merchants online or in store |

|

|

| BNPL Pay-in-4 | Short-term loan product that allows customers to buy goods with credit, and pay in four installments every two weeks |

|

||

| Negosyo Advance | Term loan (up to 90 days) offered to Maya Center agents for working capital and expansion (offered in the Maya Business App) |

|

||

| Negosyo InstaCash | 7-day financing offered to Maya Center agents for short-term funding needs (offered in the Maya Business App) |

|

||

|

Maya Savings | High interest rate consumer digital savings account with daily interest income payouts |

|

|

| Personal Goals | Customizable goal-based consumer digital savings account with monthly interest income payouts |

|

||

| Business Deposit | Commercial digital savings account with monthly interest income payout |

|

||

CULTIVATING CORPORATE GOVERNANCE

Our Promise

Our Promise

Maya Bank is dedicated to the principles of strong governance, following the guidelines laid out by the Bangko Sentral ng Pilipinas (BSP) and the Securities and Exchange Commission (SEC).

Our shareholders, Board of Directors, and Senior Management recognize the crucial role that good governance plays in our strategic business decisions.

We are committed to cultivating an awareness of its importance across our organization, helping us meet our economic, ethical, legal, environmental, and social obligations to our stakeholders and our country.

To help our team and stakeholders adhere to our corporate governance principles, we have issued a Corporate Governance Manual (CGM). The manual helps us comply with other internal policies and relevant laws, outlines our business principles and values, and guides all business relationships within the Bank.

We review and update the CGM annually to ensure that it is aligned with the latest regulatory changes and the best practices in corporate governance.

The CGM serves as the guide to reaching our key objectives, including:

- Enhancing financial literacy

- Fostering competitiveness

- Delivering top-notch customer support

- Adhering to the applicable laws and regulations.

Governance Culture

We are committed to conducting our business to the highest ethical standards.

Everyone in our team—from our directors and officers to our employees—strives to cultivate

a culture of strong governance.

Whether among ourselves or dealings with our customers, suppliers, competitors, business partners, regulators, and the public, we make sure all actions of our team align with our core principles:

Accountability

Integrity

FAIRNESS

Transparency

Compliance

Maya Bank’s compliance culture starts at the top. The board of directors, president, and senior management all lead by example and expect everyone on the team—with guidance from the Compliance Office—to familiarize themselves with all the laws and regulations that apply to the work they do.

Anti-Money Laundering, Terrorist Financing, and Proliferation Financing

At Maya Bank, we are fully committed to conducting business responsibly and ethically. This is why we have the following measures in place:

- Anti-Money Laundering Program

- Counter-Terrorist Financing Program

- Counter-Proliferation Financing Program

Designed to help prevent illegal activities such as money laundering, terrorism financing, and dangerous weapons distribution, all three programs follow all the rules and best practices set by the law.

Aside from these, we are also:

- Regularly update our policies to keep up with regulatory changes

- Ensure we are using the latest technology to detect and stop suspicious behavior

- Constantly check and upgrade our systems to make sure they are always working effectively.

Internal Audit

At Maya Bank, we have an independent internal audit team in place dedicated to keeping our operations running as smoothly and effectively as possible. It provides valuable insights and advice based on a risk-focused approach to evaluate and improve the way we work, helping us achieve our goals without exposing ourselves, our shareholders, and our customers to unnecessary risk.

Managing Risk

Managing Risk

At Maya, we believe that stability is the cornerstone of success and understand the potential obstacles in the banking industry. This is why we’ve developed a robust strategy to remain steadfast in the face of challenges.

To further strengthen our risk-aware culture, we also integrate positive risk elements into our vision, values, code of conduct, and customer service principles. To guide our risk-taking activities, we have implemented a comprehensive risk appetite framework with a detailed risk appetite statement and clearly defined limits.

Our independent risk function, led by the chief risk officer, collaborates closely with business units and provides them with regular training to foster a risk-aware culture and enhance decision-making processes.

Our goal is to create a sustainable, prosperous business that benefits our customers, shareholders, and the Philippine economy. Our board of directors, Risk Oversight and Compliance Committee, Assets and Liabilities Committee, Credit Committee, Audit Committee, internal audit team, senior management team, and business units all work toward this goal.

Nurturing Talent

Nurturing Talent

Maya’s fast-growing business is made possible by our agile and high-performing talents. Our people are passionate about the work they do and are committed to learning new things, growing their careers, and making a meaningful impact. They take on bold challenges and make even bolder choices that drive our game-changing mission. We partner with our people in shaping the future of work by fostering a collaborative and inclusive work environment.

Fostering sustainability

Our ESG framework sets the foundation for our commitment to sustainability, anchored on the United Nations Sustainable Development Goals (UN SDGs). We’re aligning our actions with the essential requirements of the Bangko Sentral ng Pilipinas and our shareholders as we create our own framework and implement our programs.

Our ESG framework is anchored on three pillars:

Environmental

Across Maya, as we drive digital transactions, we are also promoting paperless transactions. In 2023, we will measure our carbon footprint and commit to environmental goals.

Social

We are empowering communities with transformative tech and investing in our team with progressive people programs. We do this by creating innovations that make money work for Filipinos. Financial literacy is embedded in our user-experience.

Governance

We uphold the highest standards of governance; from the way we conduct our business to ensuring security across our platforms. We aim to spearhead the sustainability dialogue and become a thought leader among stakeholders and regulators alike.