Maya Pay in 4

- Consumer

- Merchant

Keep an eye out for Maya Pay in 4

Pay in 4 will be back with even more effortless ways to shop now and pay later at the brands you love.

What is

Maya Pay in 4?

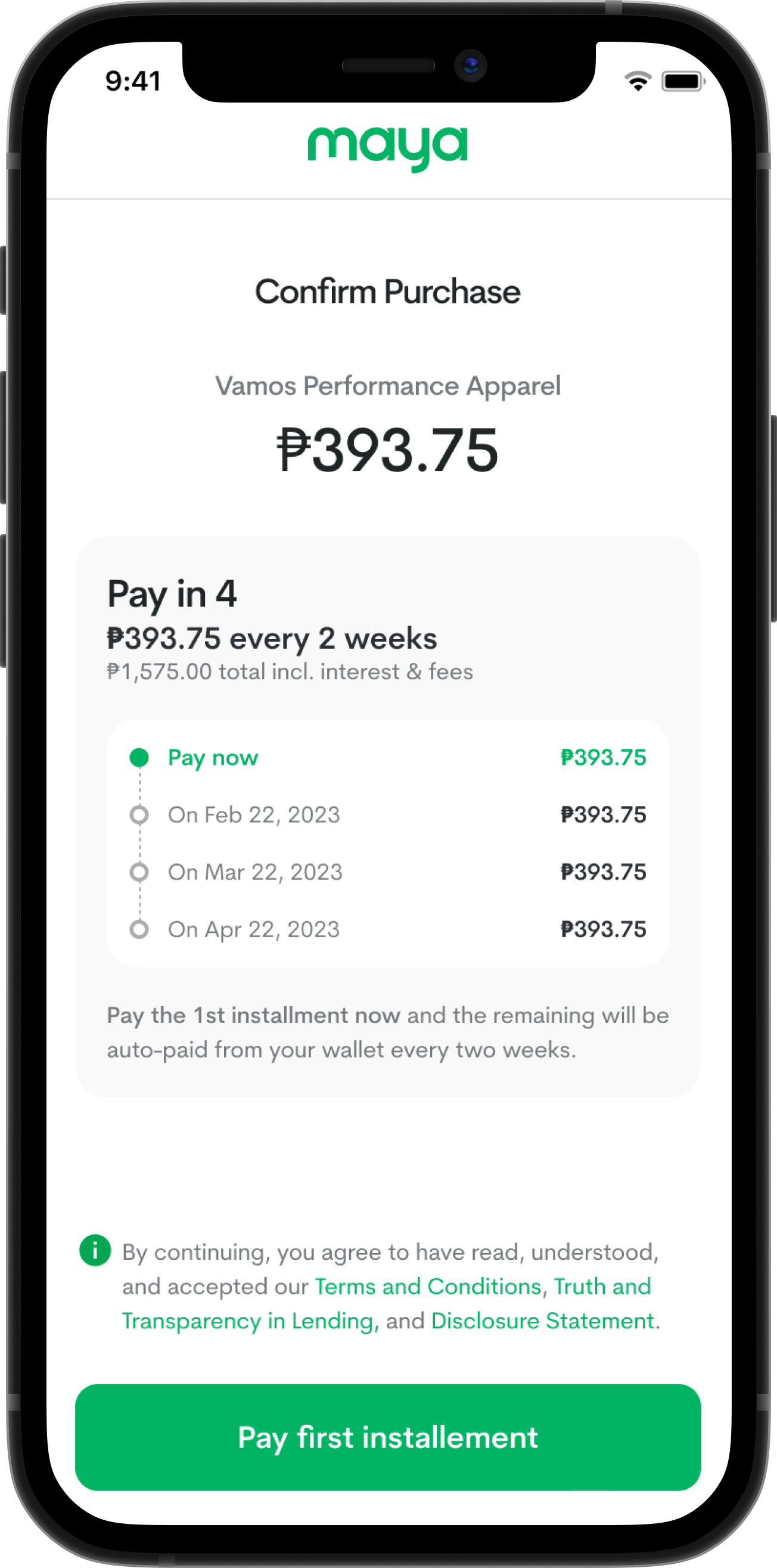

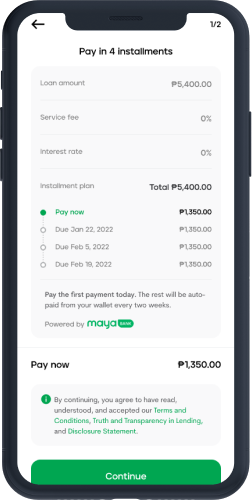

Pay in 4 is Maya’s buy now pay later product designed to give you a way to split up to ₱10,000* worth of purchases into 4 installments due every two weeks with as low as 0% interest even if you don’t have a credit card.

Your total loan amount will be split into 4 installments wherein the first installment is payable upon purchase. This means if you’re buying a ₱2,000 product, you’ll only have to pay ₱500** up front, splitting the balance into three ₱500 installments every two weeks. A one-time service fee may also apply depending on your credit standing.

Explore Maya Pay in 4 as a payment option on your favorite brand’s website or physical store!

*Minimum purchase amount is ₱1,500 while your credit limit varies based on credit standing

**Assuming 0% interest on selected Pay in 4 merchant

Requirement

- Upgraded Maya Account

- KYC1 (Fully verified)

- Good Credit Standing

- Basic information

- Data Privacy Consent

What benefits do you get when you Pay in 4?

As low as 0% interest

Borrow up to ₱10,000 and enjoy as low as 0% interest on selected merchants. The best part? No hidden fees.

Shop at your

favorite stores

Maya Pay in 4 is now available to a wide range of brands online and in-store, coming soon to more of your favorite brands

Seamless experience

Loan application, approval, repayments, and tracking can all be done within the Maya app. Remember, it’s everything and a bank!

PARTNER MERCHANTS

Shop at your

favorite merchants

accepting

Maya Pay in 4

How to use Maya Pay in 4

- Online Checkout

- Scan to Pay

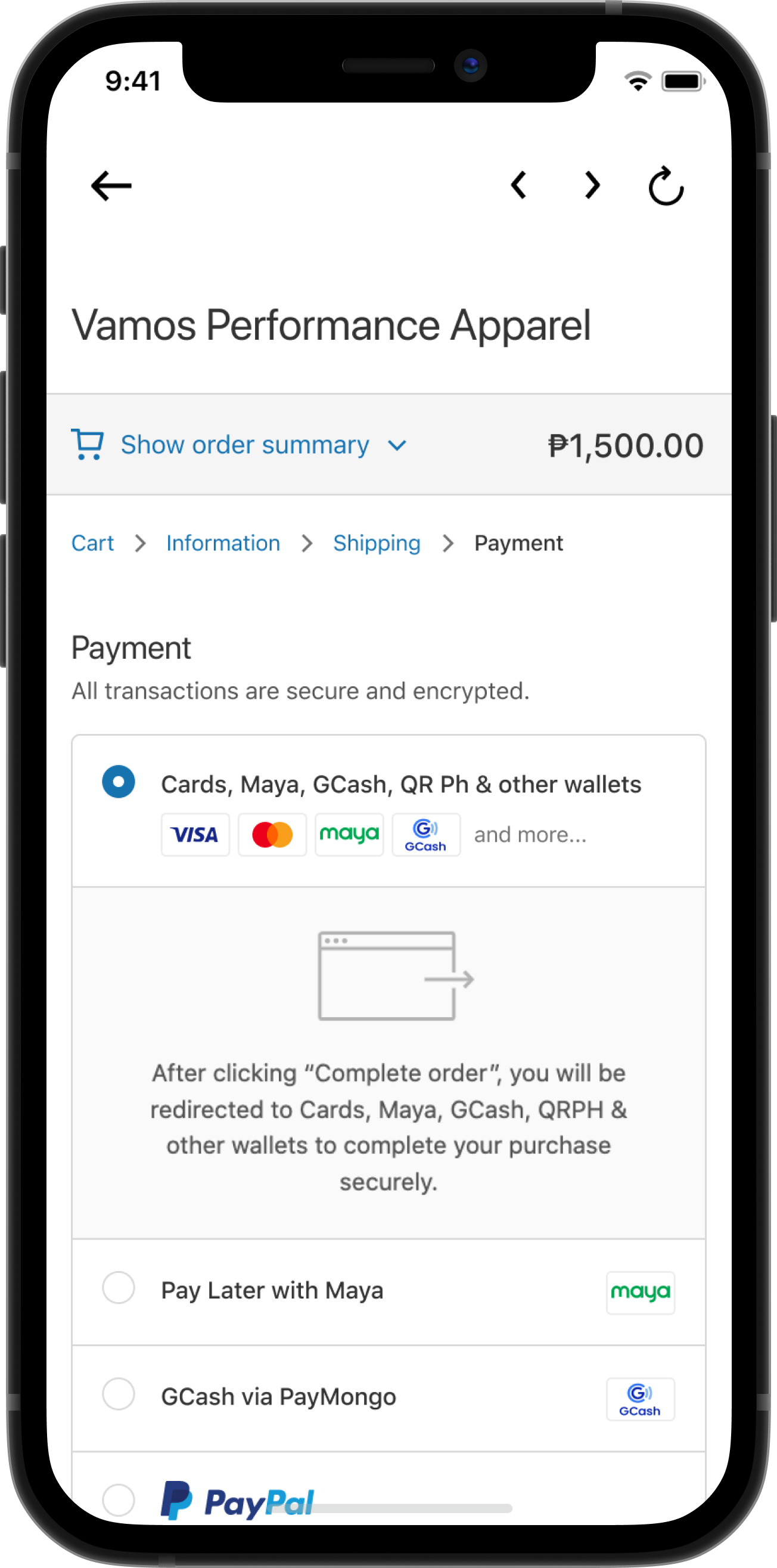

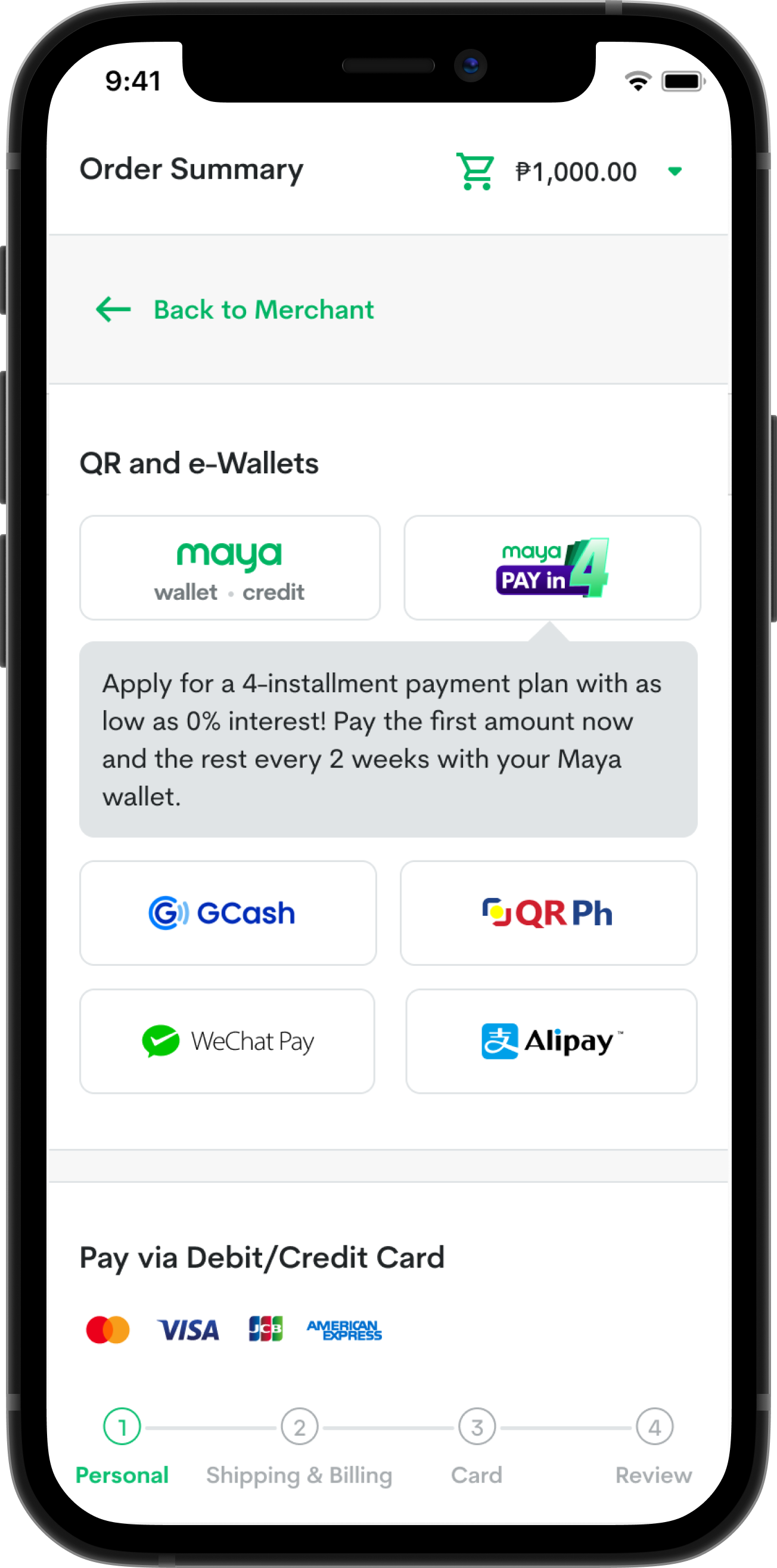

1From the merchant's checkout page, choose 'Credit/Debit cards and e-Wallets'

2Select the Maya Pay in 4 Option

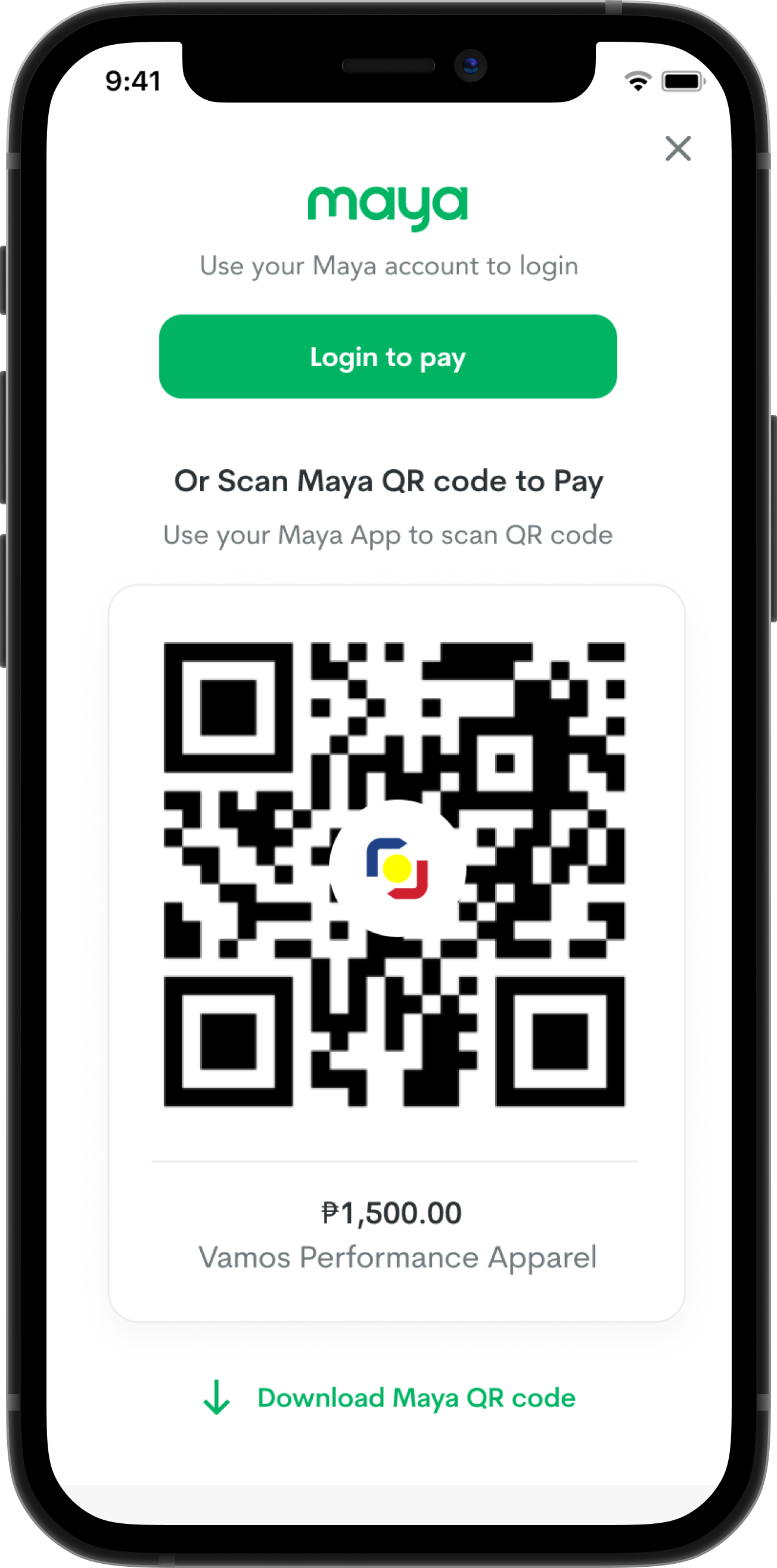

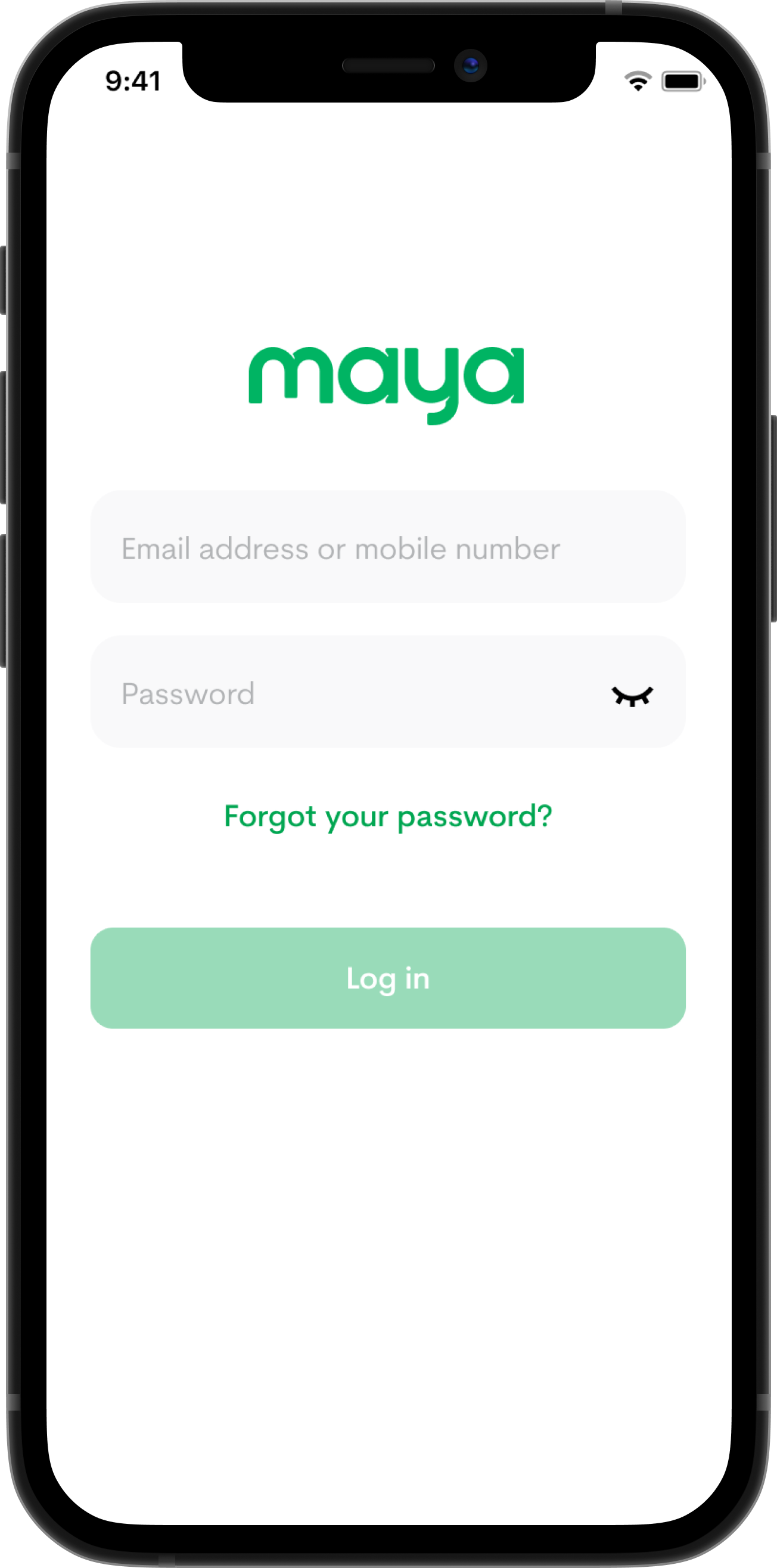

3Login to pay with your Maya number (or scan QR and proceed to step 6)

4 Enter your Maya log in details and tap 'Log in'

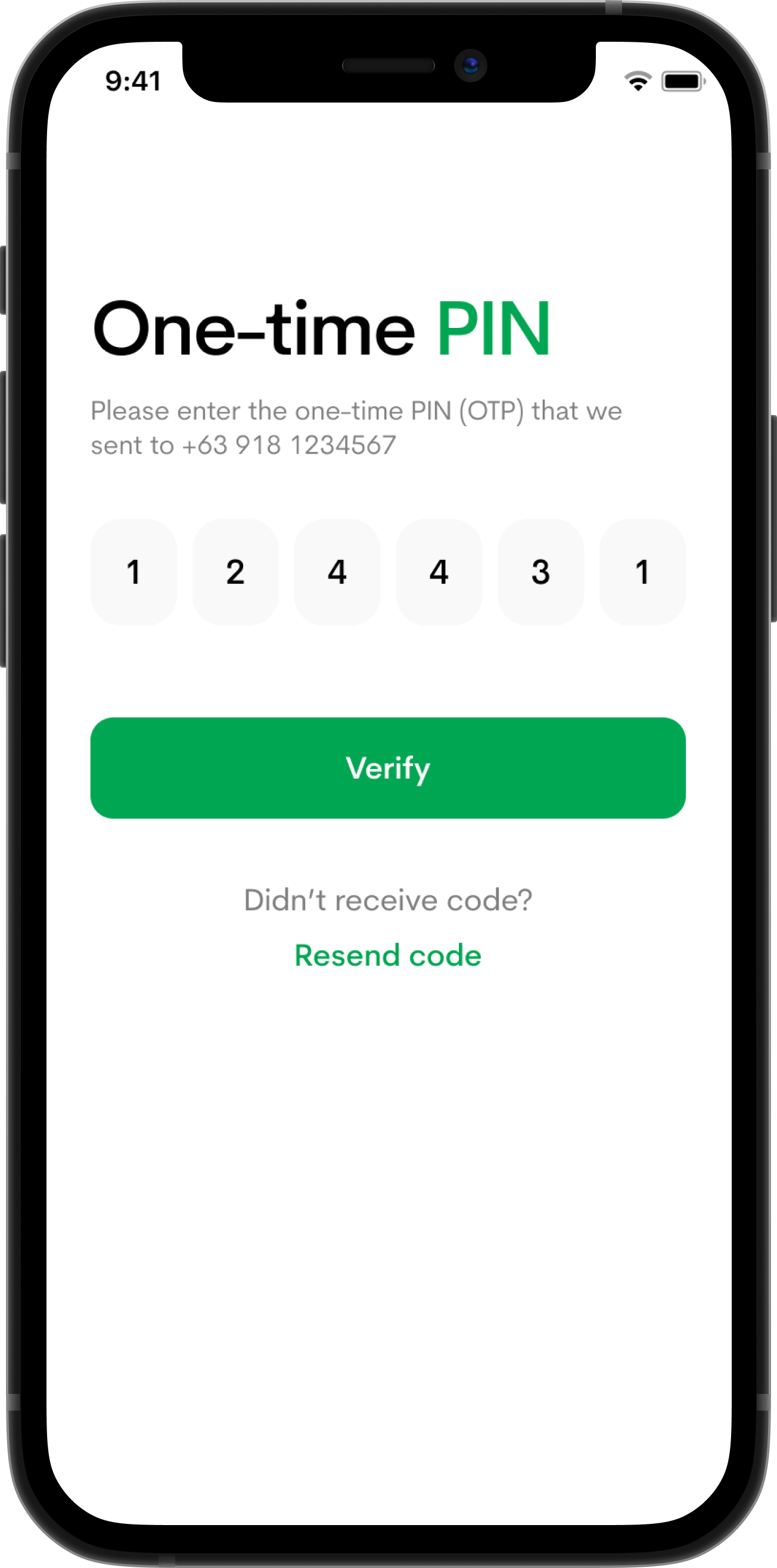

5 Enter the OTP sent to your mobile number

6

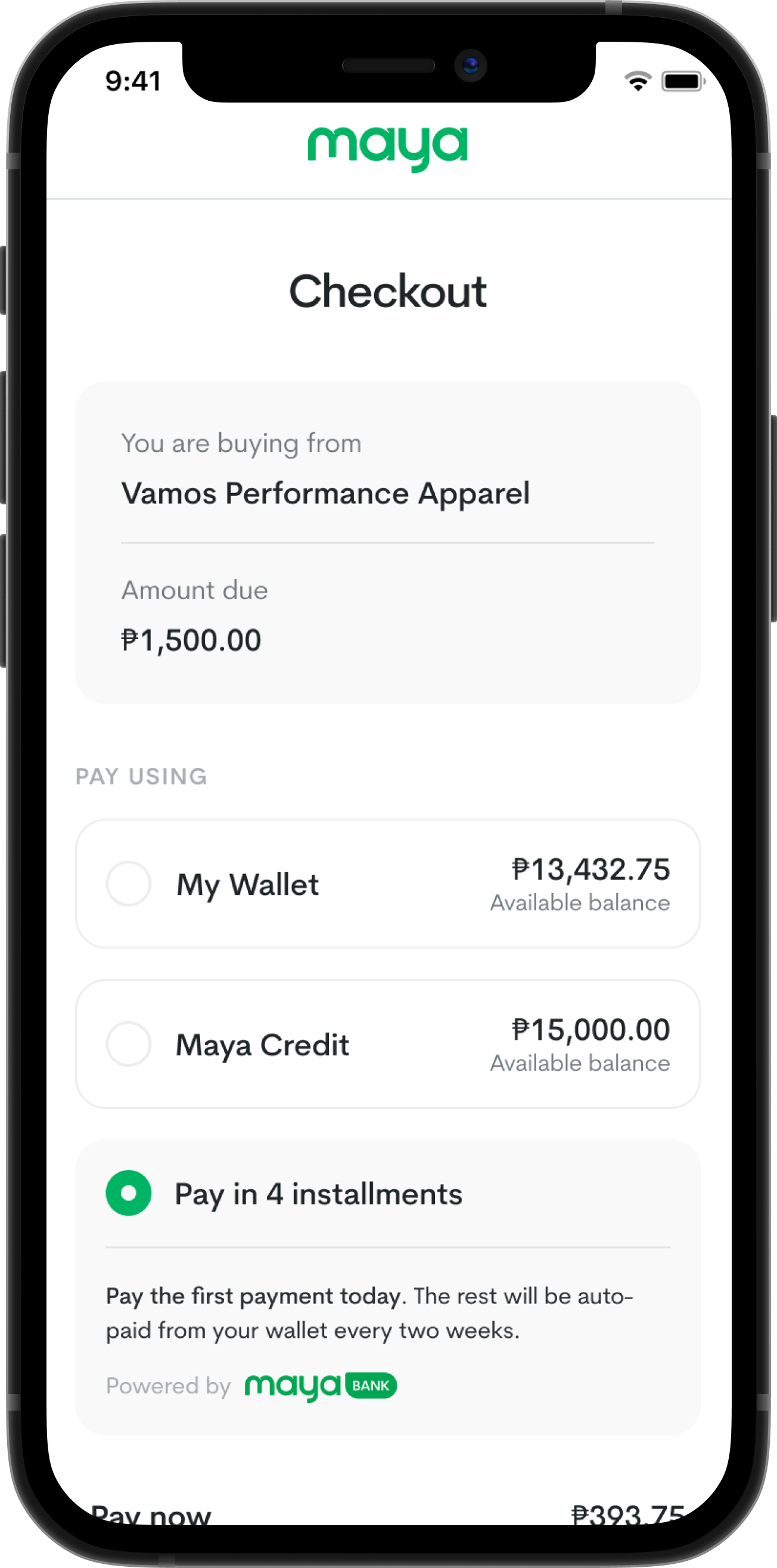

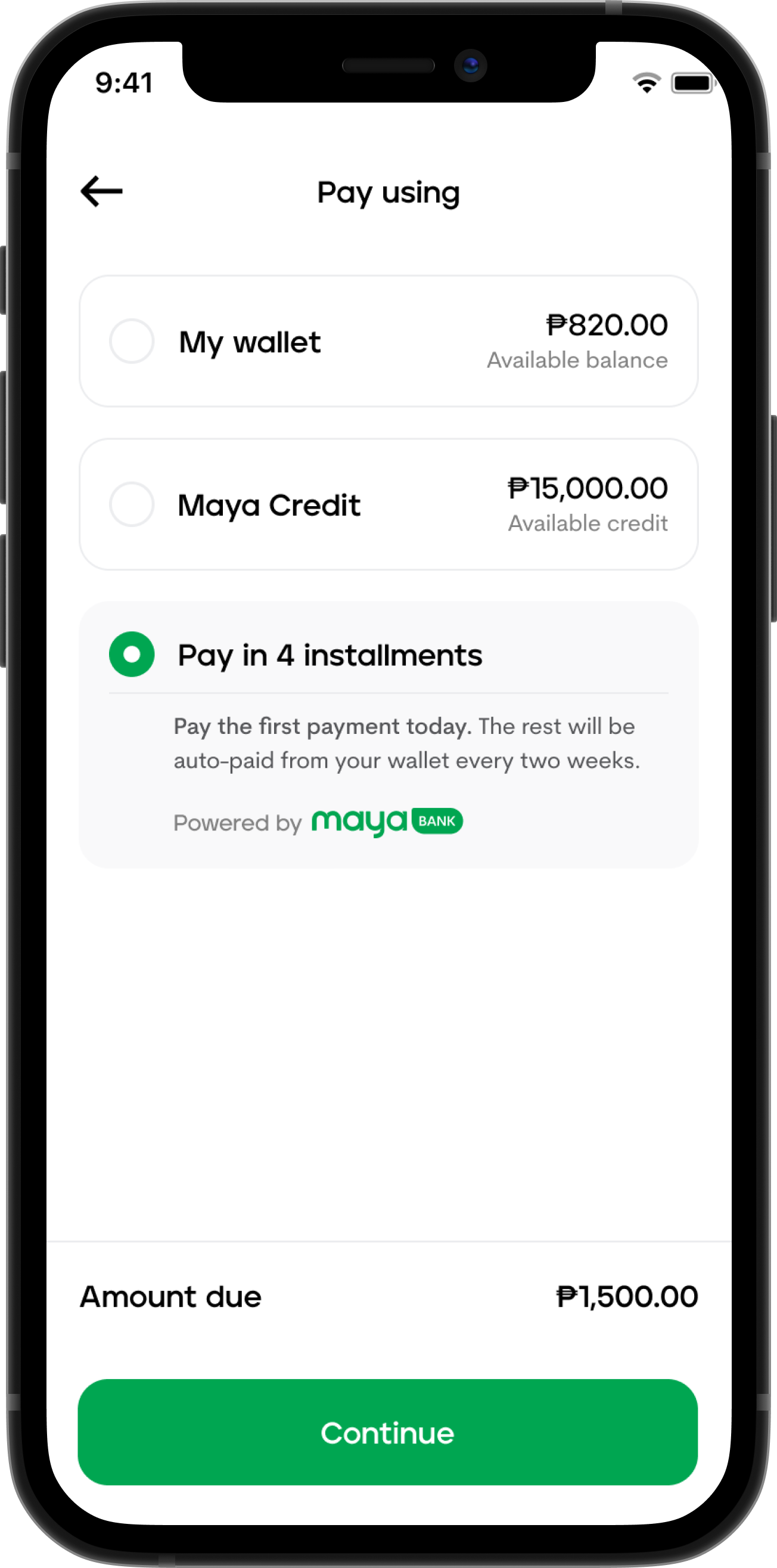

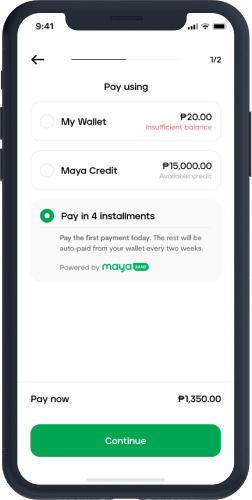

Select 'Pay in 4 installments'

Note: Ensure to have enough Maya Wallet balance for your first installment

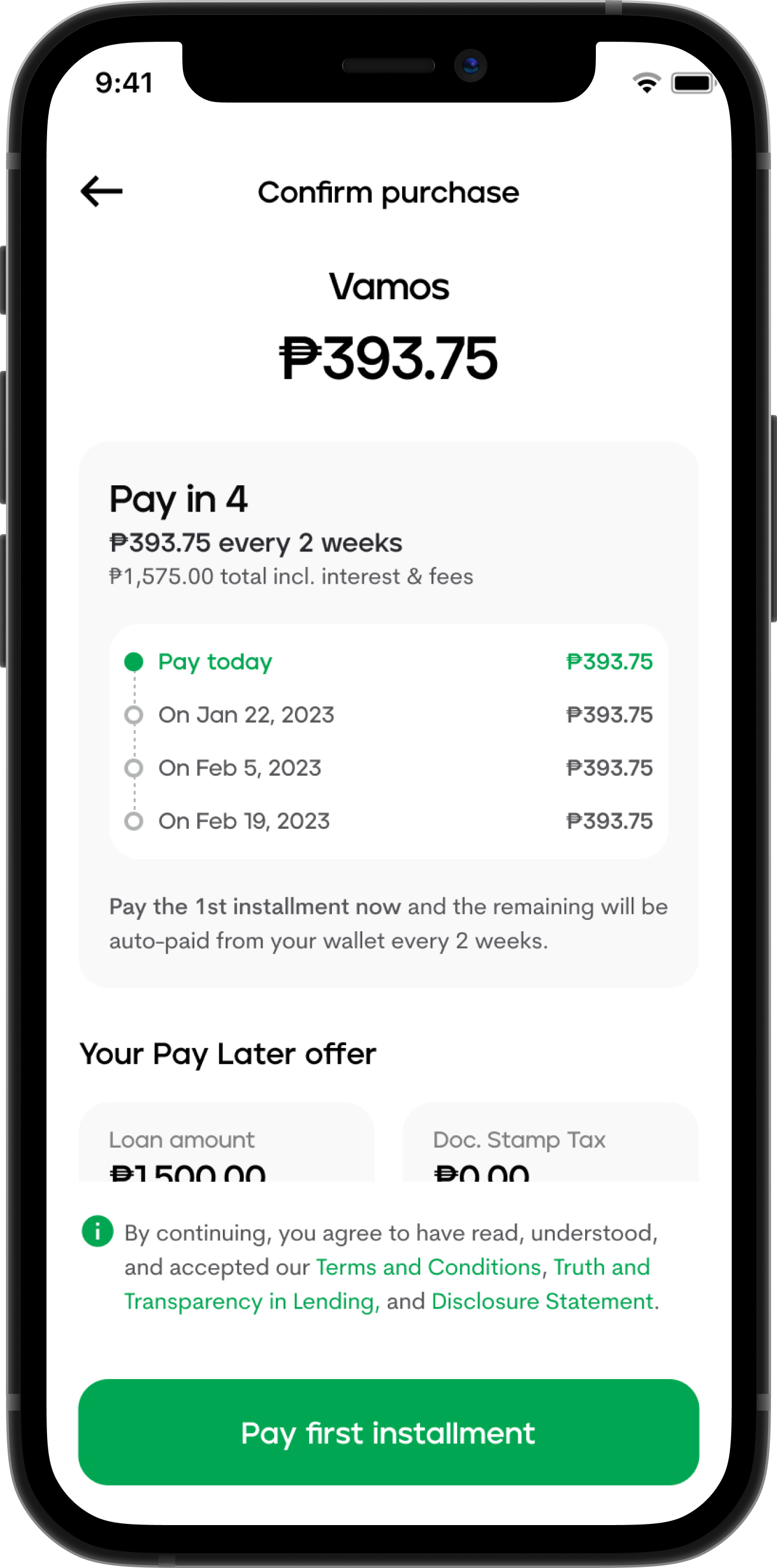

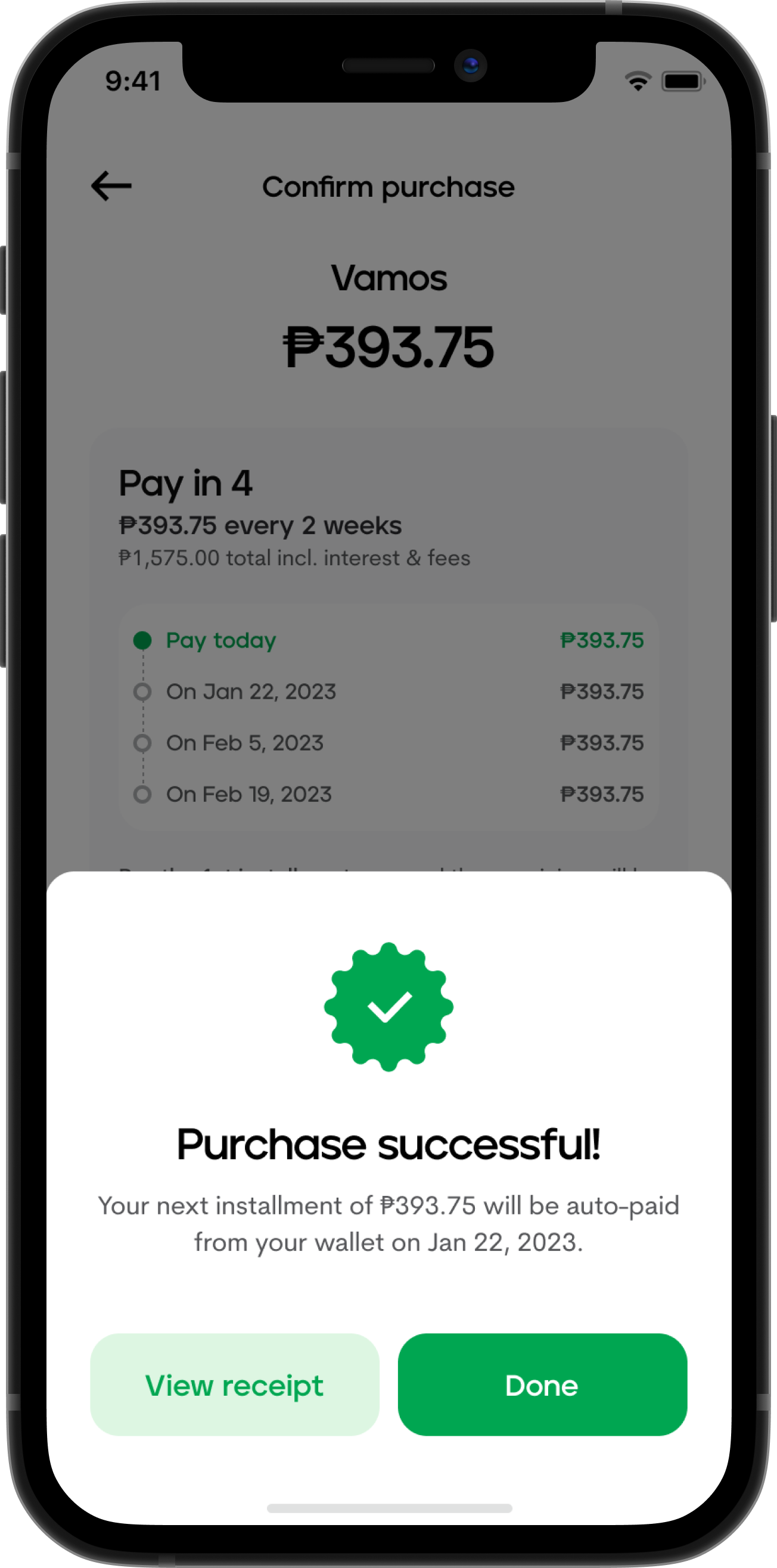

7 Review the transaction and click 'Pay first installment'

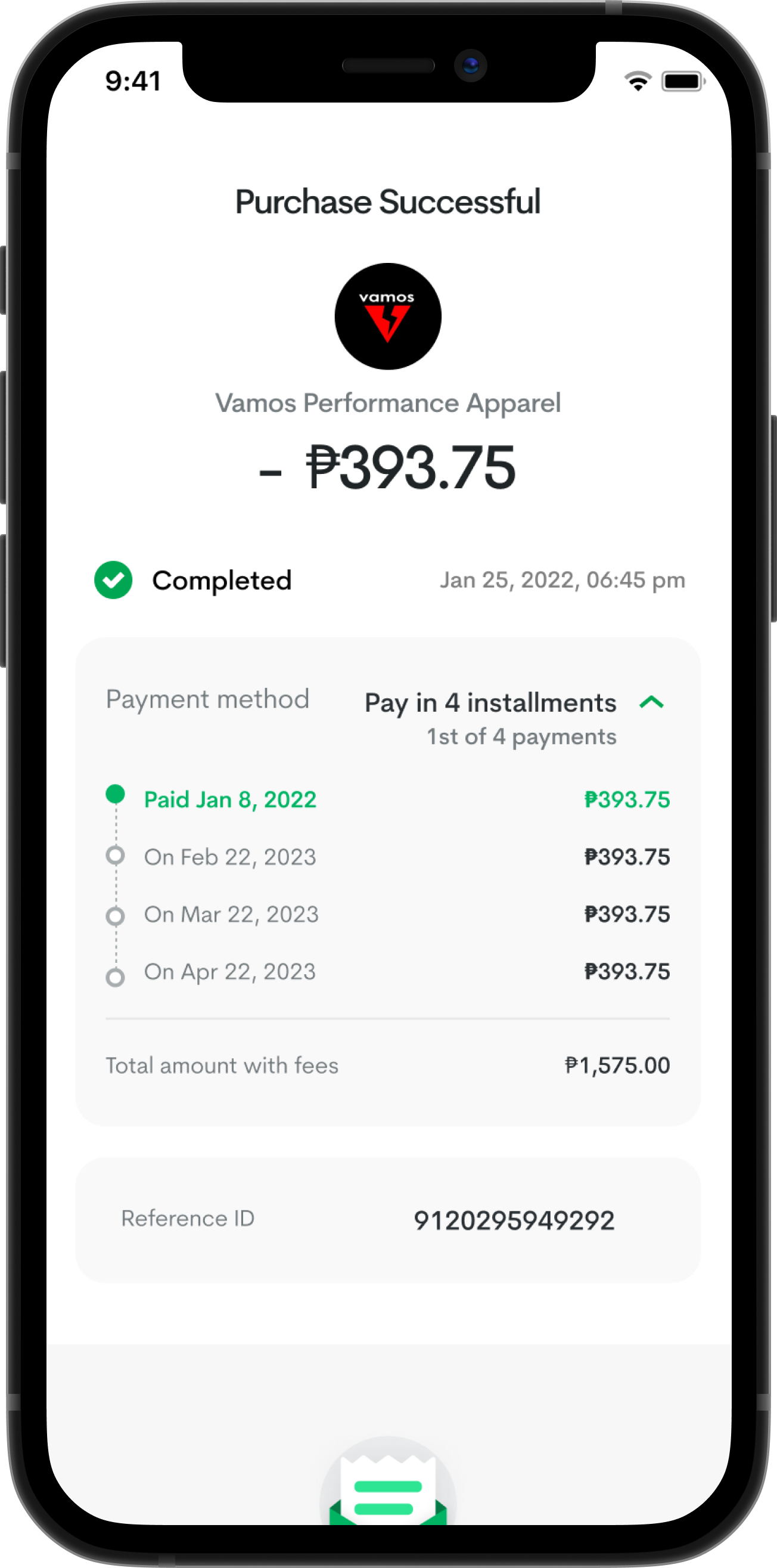

8 Purchase successful!

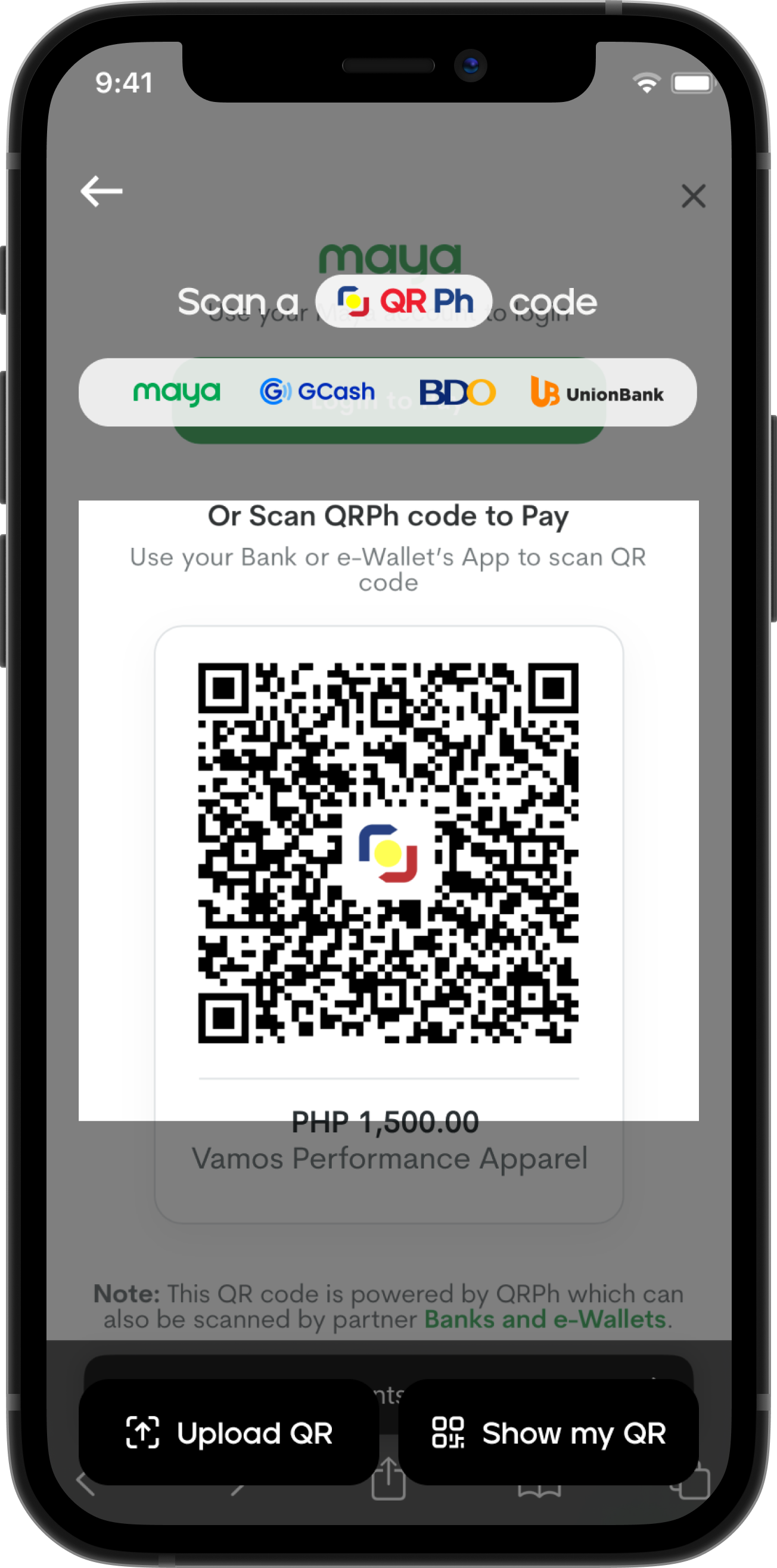

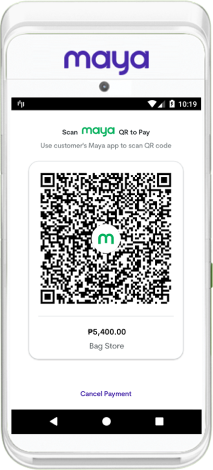

1Scan the merchant's QR using your Maya app

2Select 'Pay in 4 installments'

Note: Ensure to have enough Maya Wallet balance for your first installment

3 Review the transaction and click 'Pay first installment'

4 Purchase successful!

How to Checkout via

Maya Terminal

1 Scan QR on the POS via your Maya app

2 Upon checkout, choose “Pay in 4”

3 Tap “Continue”

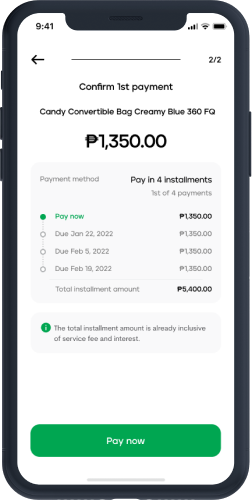

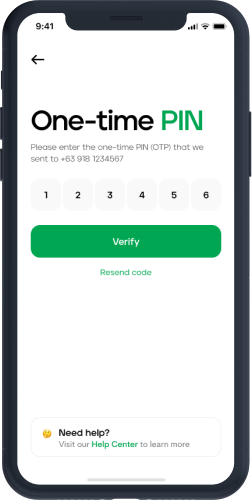

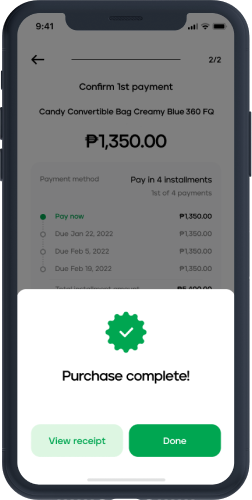

4 Confirm first payment

5 Enter One-time PIN

6 Congratulations! You’ve completed your Pay in 4 purchase

Frequently Asked Questions

You've got questions? We've got answers.

Need more answers?

We'll be taking this time to improve Pay in 4's overall product experience using valuable feedback from both Maya users and merchants looking to offer easy installment options to their customers.

You can expect Pay in 4 to return some time in the future with improved features and a more effortless experience overall.

Yes, Pay in 4 will be paused for all merchants until the feature becomes available again.

Yes, you can keep using Pay in 4 wherever it's accepted until the service ends on January 17, 2024. If the service ends while you still have outstanding Pay in 4 loans to settle, you can continue paying your dues to make sure you don't incur any penalties.

All active loans will still be processed until they have been fully settled. This includes repayments, collections, loan account management, and other loan-related concerns you may have. You can continue to manage your outstanding Pay in 4 loans on the app.

Your Maya Pay in 4 amount dues will still be automatically deducted from your Wallet on your due date until the loan is fully paid off. If you don’t have enough money in your wallet, we’ll use the available amount to partially pay for your loan and use the unpaid balance as the basis for your late payment charges. You can also pay for your loans anytime, whether partially or in full, on your Maya app. All successful payments reflect in real time.

You may pay for your outstanding or past due amount including its late payment charges on your Maya app. All successful payments reflect in real time.

Any refund or dispute request of your Pay in 4 purchase has to be confirmed by the refund policy of the store you purchased from. You may coordinate with the store to get an update regarding your request. Maya will continue to process any ongoing refund or dispute request from the customer and from our merchants. Once the refund or dispute is approved, your Maya Pay in 4 loan repayment details will be adjusted accordingly, including late payment fees incurred. Any excess payments or funds via refund will be credited back to your wallet.

You can reach us at (+632) 8845 7788, domestic toll-free at 1800 1084 57788, or at [email protected]

Offer buy now,

pay later with

Maya Pay in 4

What is

Maya Pay in 4?

Pay in 4 is Maya’s Buy Now Pay Later (BNPL) product that lets your customers pay for your goods and services in a total of 4 installments due every 2 weeks at 0% interest using their Maya Wallet. You may offer Pay in 4 installments as a payment option on both your desktop and mobile website.

What benefits do you get from being a Pay in 4 Merchant

Increase inventory turnover

Keep your business flowing by increasing your inventory turnover and giving your customers great products to choose from

Keep costs to a minimum

Through the Pay in 4 payment scheme, you can minimize high depreciation and warehouse costs to maximize your profit

Improve your business

Get the opportunity to easily increase your customer’s basket size, transaction rate, and conversion rate

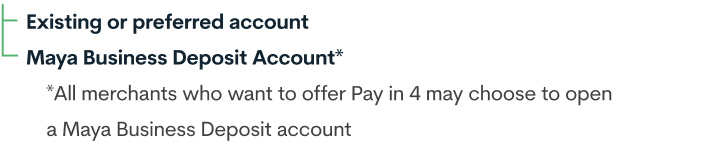

Requirements

Learn all you need to know about

applying to be a Pay in 4 merchant

PARTNER MERCHANTS

Shop at your

favorite merchants

accepting

Maya Pay in 4

Shop at your

favorite merchants

accepting

Maya Pay in 4

Frequently Asked Questions

You've got questions? We've got answers.

Need more answers?

Maya Pay in 4 is a loan product that lets you pay for goods and services in a total of 4 installments due every 2 weeks with no credit card needed using your Maya Wallet. Pay in 4 is a product of Maya Bank, Inc.

With Maya Pay in 4, you can:

• Stretch your money with payments every 2 weeks with no credit card needed

• Shop at your favorite brands online or in-store

• Manage your money and track your payments in the Maya app

Maya Pay in 4 is available as a payment option at participating brands' websites.

You may see the brands that offer Maya Pay in 4 at https://www.mayabank.ph/payin4-partner-merchants/

You can reach us at (+632) 8845 7788, domestic toll-free at 1800 1084 57788, or at [email protected].

Frequently Asked Questions

You've got questions? We've got answers.

Need more answers?

Maya PayLater is a loan service that allows users of the Maya app to shop online or in-store and pay in installments using their Maya Wallet. No credit card needed! Maya PayLater is powered by Maya Bank.

Maya PayLater's first product is Pay in 4, which lets you pay for goods and services in a total of 4 installments due every 2 weeks with no opening fees and as low as 0% interest. Other Maya PayLater products will become available in the future. Maya Pay in 4 is powered by Maya Bank.

Maya PayLater is available as a payment option at participating brands' websites and stores.

You may see the brands that offer Maya PayLater at https://www.mayabank.ph/payin4-partner-merchants/