Setting the New Standard for Digital Financial Services

Launched in 2015 as PayMaya and rebranded as Maya in 2022, Maya has swiftly evolved into the No. 1 fintech ecosystem in the Philippines.

Maya brings together Maya Philippines—the country’s No. 1 payments processor—and Maya Bank—the country’s No. 1 digital bank—under a single brand and platform.

Our goal is simple and bold: to become the primary financial account for Filipinos—both consumers and enterprises—by offering payments, savings, credit, and investing in one seamless, digital experience.

Our Ecosystem: Why It Works

At the heart of Maya is integration:

One platform for everything

Savings, credit, payments, investments, and more—all connected on a single platform

Built for everyone

Our ecosystem spans consumers and businesses, driving network effects and creating value at every interaction

Proprietary tech and AI

Our tech and AI-driven data engine enables real-time decisions, personalized pricing, and dynamic product offers

The result? Each transaction generates data that drives smarter offers, better services, and deeper trust, creating a flywheel effect that strengthens the Maya ecosystem for consumers, businesses, and the economy.

Built for Real Life

Through our integrated ecosystem, our customers now get:

Wallets, QR payments, and cards for everyday spending with Maya Philippines

Savings with up to 15% interest p.a. to grow their money faster

Personal loans, credit lines, and digital credit cards without the hassle

Easy access to crypto, stocks, and mutual funds with Maya Philippines

For businesses—from sari-sari stores to enterprises—we simplify payments and banking, helping them thrive.

Growing with You

As more people use Maya, we’re expanding financial inclusion and improving financial health, giving Filipinos better ways to save, spend, borrow, and invest.

In under three years after launching Maya Bank, we reached profitability. This proves that banking can be both sustainable and inclusive.

Consumer Banking

Maya has increasingly become the preferred financial account for millions of Filipinos.

Deposits grew steadily, driven by Time Deposit Plus and Personal Goals. These products removed barriers, requiring no minimum balance while offering flexible terms and easy goal setting in-app. They encouraged first-time savers to build discipline while earning better rates.

Deposits grew steadily, driven by Time Deposit Plus and Personal Goals. These products removed barriers, requiring no minimum balance while offering flexible terms and easy goal setting in-app. They encouraged first-time savers to build discipline while earning better rates.

Deposits grew steadily, driven by Time Deposit Plus and Personal Goals. These products removed barriers, requiring no minimum balance while offering flexible terms and easy goal setting in-app. They encouraged first-time savers to build discipline while earning better rates.

Deposits grew steadily, driven by Time Deposit Plus and Personal Goals. These products removed barriers, requiring no minimum balance while offering flexible terms and easy goal setting in-app. They encouraged first-time savers to build discipline while earning better rates.

Deposits grew steadily, driven by Time Deposit Plus and Personal Goals. These products removed barriers, requiring no minimum balance while offering flexible terms and easy goal setting in-app. They encouraged first-time savers to build discipline while earning better rates.

Maya Easy Credit

Angelu Zafe

Freelancer

Living alone comes with unexpected expenses, and sometimes, I’m just not financially ready—like when my laptop suddenly broke when I needed it for work. That’s when Maya Easy Credit became a total game-changer for me. I used it to cover my laptop repair because it lets you pay directly at select merchants or transfer your credit limit to your Maya Wallet for easy access when paying bills or sending money. The best part for me was that I got instant approval with no extra documents needed!

Angela Madamesila

Content Creator

As a full-time content creator, I have home and tech upgrades on my wish list that would boost my productivity, like an ergonomic chair, a standing desk, and a MacBook for faster and easier edits. But of course, like any other working millennial, I can’t afford to buy them all at once. That’s why I’m grateful for Maya Personal Loan. It gave me access to the funds I needed and let me pay everything off over 24 months. It let me make all the big purchases I needed in one go without hurting my cash flow or savings. I also loved how fast and easy the application was and how I was able to do it all from home!

Maya Personal Loan

Cari Torres

Freelancer/

Business Owner

Now that I’m navigating life without financial support from my parents, there are moments when I need extra budget for urgent items. When this happens, I turn to Maya Easy Credit because I know it’s safe and secure. It also offers instant approval without requiring any documents and allows me to easily transfer funds to my Maya Wallet so I can cover my household expenses and business expenses without hassle.

Kath and Gene Barcelo

Married couple /

Food Content Creators

As a newly married couple who just got our own place, we realized that hindi rin pala biro mag-furnish ng sariling space. From essential furniture and appliances to adding aesthetic touches, lahat may gastos! Buti na lang, Maya Personal Loan had our back with its loanable amount of up to ₱250K and flexible payment terms of up to 24 months. Nakagaan talaga sa bulsa to have 730 days to pay for everything we bought! Mabilis lang yung application approval. Mas mabilis pa kaysa sa pagdating ng mga online orders namin.

Landers Cashback Everywhere Credit Card

Kent Miro

Macadangdang

Freelancer

My first-ever credit card is the Landers Cashback Everywhere Credit Card! I’ve been saving with Maya, so I was both surprised and happy when my application was approved. Now, I’m enjoying the cashback perks every time I use it.

Kim Tapel

As a regular at Landers, this card just made sense. No annual fees, easy approval, and perks I actually use. This is the ultimate card for next-level savings.

Business Banking

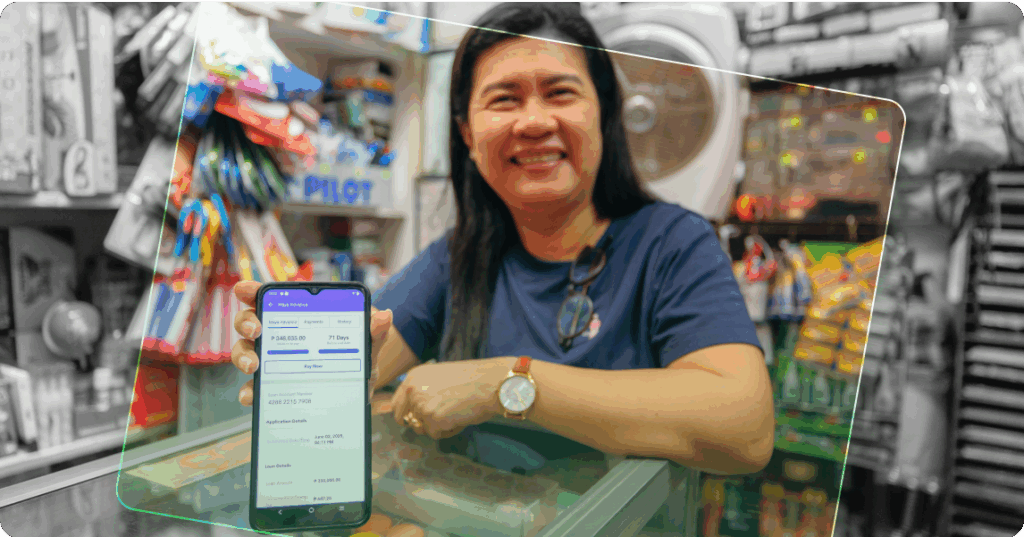

Maya deepened its role as the financial partner for micro, small, and medium (MSME) businesses.

Maya Advance brought working capital loans directly into the Maya Business app, giving micro-merchants and independent sellers instant, collateral-free financing to keep operations running smoothly.

Maya Advance brought working capital loans directly into the Maya Business app, giving micro-merchants and independent sellers instant, collateral-free financing to keep operations running smoothly.

Maya Advance brought working capital loans directly into the Maya Business app, giving micro-merchants and independent sellers instant, collateral-free financing to keep operations running smoothly.

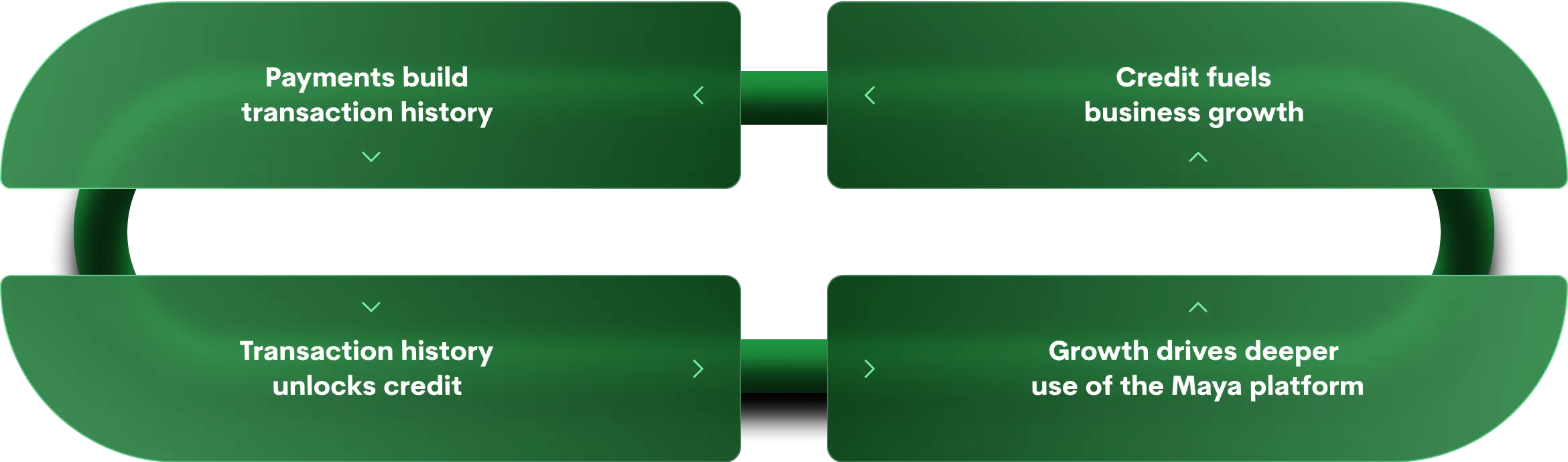

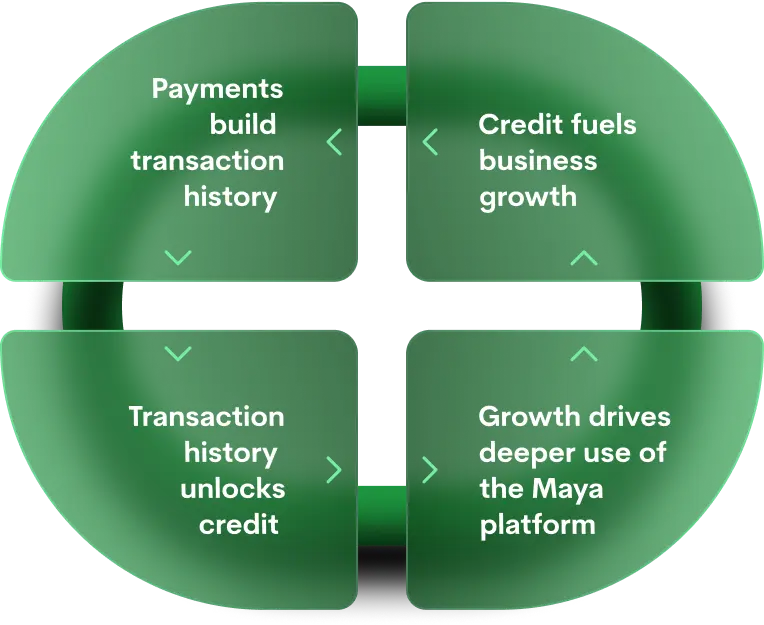

Maya created a strong growth cycle for businesses:

Maya Advance

Jocelyn Solivio

Small Business Owner,

Cadiz Public Market

As a business owner, it’s important for me to always have enough capital for my business. That’s why I use Maya Advance. It allows me to borrow quickly and easily to fund my prepaid load business. I don’t need to go to a bank or wait for a long approval process. With just one tap on the app, I get the funds I need instantly. This has been a huge help in growing my business without the hassle!

Jovelyn Abordo

First-Time Borrower, Cadiz Public Market

Before, I didn’t know where to get additional capital for my small business. But with Maya Advance, I finally had the opportunity to borrow from a legit and reliable provider. As a first-time borrower, the process was incredibly easy. I used my loan to replenish my stocks and keep my business running smoothly.

Powered by Technology, Built for Trust

Maya combines effective engineering practices with emerging technologies to increase business velocity while enhancing safety and security.

Launched a full credit card product in just six months, demonstrating Maya’s agile tech capabilities—a first for digital banks in the Philippines

Leveraged AI-powered credit scoring, using behavioral and transaction data, enabling smarter, fairer lending decisions while expanding inclusion responsibly

Strengthened security with our proprietary anti-fraud technology, in-app security features, and strong internal information security culture and practices

Built on Strong Governance

Maya’s governance culture is anchored in fairness, accountability, integrity, and transparency. Our Corporate Governance Manual sets out clear policies and practices that align with BSP, SEC, and global standards, ensuring responsible and ethical decision making.

Our Board combines deep expertise in banking, fintech, risk, operations, and law to guide Maya’s strategy and protect stakeholders’ interests. Directors undergo regular training on governance, risk, compliance, and market trends to keep oversight sharp and forward-looking

Four board-level committees keep governance focused and strong

The Audit Committee reviews financial reports, oversees internal and external audits, and ensures sound financial controls

The Corporate Governance Committee sets governance standards, leads board evaluations and continuing education, and manages related-party transactions fairly and transparently

The Risk Oversight and Compliance Committee reviews risk frameworks, monitors key risks—from credit to cybersecurity—and ensures compliance with all regulations

The Technology Group Governance Committee guides tech strategy, investments, security, and innovation to keep Maya competitive and secure

Keeping Banking Fair and Safe

Maya protects customers and the financial system every day.

Reliable consumer protection

We build products with clear terms, fair pricing, and transparent disclosures, empowering customers to make informed choices. We also resolve complaints quickly through a dedicated process aligned with BSP standards.

Strong compliance culture

The Compliance Management, led by the Chief Compliance Officer, operates independently to ensure that all policies, processes, and operations adhere to BSP regulations, AMLA requirements, and international standards. Reporting directly to the Board, Compliance Management provides timely and comprehensive updates to ensure accountability, regulatory alignment, and robust governance.

Fraud Controls

Anti-Money Laundering, Terrorism Financing, and Proliferation Financing Controls combine strong customer due diligence, AI-driven and rules-based transaction monitoring, regular staff training, and independent compliance testing to detect and prevent financial crime

Audits and Checks that Build Trust

Independent audits and risk reviews keep Maya resilient.

Internal Audit operates independently and reports directly to the Audit Committee. It reviews financial controls, operations, cybersecurity, fraud risks, and regulatory compliance to strengthen systems and processes.

External audits validate financial reports and compliance with accounting standards, providing stakeholders with confidence in Maya’s integrity.

Built to Manage

Risks Well

Maya manages risks with one goal: to keep banking safe, resilient, and trusted by millions.

Our approach combines strong frameworks, clear limits, and proactive oversight—all aligned with regulatory standards to support growth and protect customers.

Four key committees oversee Maya’s risks:

The Risk Oversight and Compliance Committee (ROCCOM) is a board-level committee that sets the direction for risk management programs, ensuring risks are identified, assessed, and managed effectively

The Asset and Liquidity Committee (ALCO) is a management-level committee that manages balance sheet risks, ensuring strong liquidity, stable capital, and sound market risk positions

The Credit Committee (CRECOM) is a management-level committee that guides credit strategy and policies, oversees customer eligibility and loan portfolio quality, and ensures compliance with regulatory credit requirements

The Business Continuity Management Committee (BCMC) is a management-level committee that ensures Maya remains resilient, with plans in place to respond to crises and operational disruptions without interrupting customer services

Three Lines of Defense

Maya’s risk culture is built on accountability at all levels.

First line

Business units own and manage day-to-day risks within defined limits and policies

Second line

Risk and Compliance Management teams oversee risk-taking activities, develop methodologies, set internal limits, and ensure compliance with regulatory and internal standards

Third line

Internal Audit provides independent assurance, reviewing how effectively and timely risks are managed and controls are implemented

Guided by Clear Risk Appetite

Maya defines its risk appetite to balance growth, inclusion, and safety. We maintain:

A moderate appetite for risks that support responsible lending and business growth

A low appetite for risks that could harm financial stability, customer trust, or regulatory compliance

We also set clear limits for each type of risk—from credit and market to operational, IT, and strategic—ensuring our decisions stay within safe boundaries as Maya grows.

Sustainability: Built into the Way We Work

At Maya, sustainability isn’t a separate program. It’s part of every product, policy, and decision.

We built our sustainability strategy on an ESG framework with three pillars:

Environmental

Minimizing our footprint with digital-first, cloud-native operations

Social

Promoting inclusion, financial health, and MSME growth

Governance

Embedding strong controls, fairness, transparency, and data ethics

This strategy aligns with the UN Sustainable Development Goals and BSP’s sustainability circulars, integrating ESG into our products, operations, risk management, and governance.

At the heart of this framework are four core values that shape everything Maya does.

Respect for Communities

Financial inclusion drives economic growth—which is why we build our products and services to serve the unbanked and unhappily banked:

Inclusive savings with no maintaining balance and flexible goals encourage first-time savers

Fair credit access through AI-powered credit scoring— enabling responsible lending among those overlooked by traditional banks

MSME financing like Maya Advance and Flexi Loan fuels business growth

MSME financing like Maya Advance and Flexi Loan fuels business growth

This approach expands financial health and strengthens communities.

Respect for Transparency

Trust is built on transparency and strong governance, which is why we promote:

Privacy and data protection, with 100% of employees trained, privacy impact assessments in place for all products, and zero data breaches in compliance with the Data Privacy Act

Fraud prevention and scam protection using AI-powered monitoring and multi-agency networks (e.g., PROTECTA FINTECH) to keep banking secure

Business ethics and customer protection upheld by clear governance policies, product transparency, and continuous compliance training

Respect for the Environment

Digital-first banking keeps Maya’s footprint small—and helps it keep getting smaller. Since 2022, our Scope 1 and 2 operational emissions dropped by 27.9%, thanks to energy efficiencies, reduced fuel use, and cloud-native systems.