The challenge

While banks remain a symbol of financial security and upward mobility in the Philippines, traditional banking is often inaccessible and inconvenient. This leaves millions of Filipinos:

Unbanked

About 79% of adults under socioeconomic class D and 87% of adults under class E are unbanked or without a financial account.1

Underbanked

Out of 18 million adults with a bank account, only 9 million keep savings with their bank, and only 1.4 million have availed of bank loans.2

Unhappily Banked

Filipinos are dissatisfied with traditional banking and its virtually non-existent savings interest earnings and poor mobile app service, as shown by the underwhelming app ratings of the big banks.3

1 2021 Financial Inclusion Survey, Bangko Sentral ng Pilipinas (BSP)

2 Ibid

3 Average rating on Apple Store for the top five largest banks is 1.9 out of perfect 5 as of April 3, 2024.

Our solution

Maya stepped up, merging the security of banking with the convenience of fintech to offer delightful banking that’s accessible to all.

We made saving more rewarding by empowering our customers to earn up to 14% interest rate per annum

We scaled unsecured credit disbursement to borrowers using alternative data for credit scoring

We launched credit products for SMEs and sari-sari stores while leveraging our ecosystem to gain a unique insight into these businesses

As a result, Maya has become the fastest and easiest way to get everyone banked—and we’re only getting started.

Our impact

In just a little over a year, Maya has shown how digital banking can supercharge financial inclusion.

Empowering future generations

With 31% of our depositors and 20% of our borrowers being Gen Zs, and Millennials making up 53% of our depositors and 66% of our borrowers, we are effectively integrating the country’s future wealth creators into the financial system.

Breaking barriers

With Maya Bank being the first source of credit for 59% of our borrowers, we have demonstrated how digital banking can be the simplest route toward financial access for the unbanked and underbanked.

And our strategy has already started to pay off.

Record credit growth

By leveraging AI and tech to transform customer transaction data into powerful lending decisions, 2023 loan disbursements jumped to ₱22B in 2023 from just ₱3B a year earlier.

Unmatched customer acquisition

Our depositor base doubled, reaching 3 million by the end of 2023 and causing our deposits to surge to approximately ₱25B.

Maya is now the undisputed leader in digital banking, amassing multiple awards and recognitions here and abroad

- 🏦 Banking

- 💼 Work Environment

- ✨ Marketing

- World's Best Banks List (2023)

- Fintech 250 List (2022)

- Best Consumer Digital Bank in the Philippines

- Best Mobile App in the Philippines

- Best Digital Deposit Service

- Best Merchant Service

- Best Digital Brand Campaign

- Best B2C/B2B Banking Initiative

- Most Innovative Merchant Service

- Silver, Fintech Category

- Bronze, Branded Content Categoryt

- The Big Bang Category

- The Changemaker Category

- The Collaborator Category

- The Firestarter Category

- The Long and Short Category

- The Big Category (Project Hope)

- The Collaborator (Project Hope)

- Art Direction

- Best Cinematography

- Best Editing

- Film Animation

- Film Direction

- Film Production & Design

- Film Visual Effects

- Audio Visual Branded Content Talent

- Touchpoints & Technology

- Business to Business Communication Category (1-2-3 Grow Bundle Campaign)

- Marketing and Brand Communication Category (My Money, My Bank, My Way Campaign)

- Influencer Marketing Category

- Best Use of Social Media Categor

- Marketing and Brand Communication Category (PayDay Save Campaign)

- Audio/Visual Category (Free ₿itcoin Campaign)

- Audio/Visual Category (PayMaya is Now Maya Campaign),

- Event Category (PayMaya is Now Maya Campaign)

- Event Category (Make Big Moves with Maya Business)

- Website Category (Maya Website Refresh)

- Audio/Visual Category (Verified Seller Program)

And we’re also the #1 fintech ecosystem in the Philippines

Financial & Operational Highlights

Financial & Operational Highlights

Operational Highlights

Powered by our fintech ecosystem, we have made banking simple, innovative, and inclusive, cementing our position as the fastest and safest way to get everyone banked.

In 2022, we revolutionized the game. For the first time, consumers and businesses could enjoy digital payments and digital banking through a single platform. A year later, Maya pushed even further, accelerating game-changing innovations from high engagement banking to lending powered by artificial intelligence (AI) and machine learning (ML).

Empowering future generations

With Gen Zs constituting 31% of our depositors and 20% of our borrowers, and Millennials making up 53% and 66% respectively, we're integrating the future's wealth creators into the financial system.

Breaking barriers

Maya research shows that 59% of our borrowers have Maya as their sole source of credit, highlighting digital banking as the simplest route toward financial access for the unbanked and underbanked.

Consumer

Banking Highlights

Consumer

Banking Highlights

Maya’s success lies in making banking intuitive. By integrating banking into the daily lives of our customers, we’re helping them build their financial standing and enhance their credit profile. Beyond financial inclusion, we are also promoting financial well-being and independence.

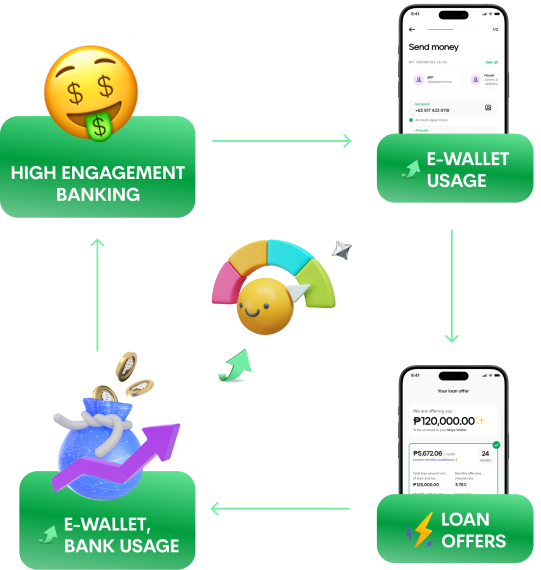

Our Spend > Save > Borrow > Grow strategy is drawing in a growing base of highly engaged customers into our ecosystem. Our goal is to encourage each customer to increase their smart spending, such as bill payments and card usage, to earn higher savings interest and improve their credit score.

These improved credit scores, in turn, unlock Maya’s loan offerings for our customers, giving them access to additional resources they can use to further enhance their wise spending. This cycle ultimately drives new and repeated loan use as well as repayment efficiency.

In addition, our prudent credit management practices allow us to further boost lending participation and give us a unique edge in fostering financial inclusivity and growth. Because of our extensive ecosystem, we are also able to offer our customers wealth-building products they can use to grow their money and build a better financial footprint.

Discover Maya’s suite of game-changing deposit and credit products

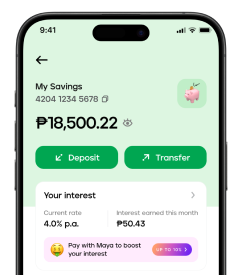

Maya Savings makes saving easier and more rewarding for our customers by allowing them to open an account with any amount and just one ID via the app

Explore Maya Savings

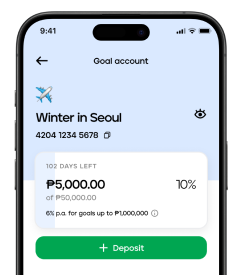

Personal Goals gives our customers the tools they need to easily budget their money for the things that truly matter to them—all while earning 4% interest rate p.a., credited monthly.

Explore Personal Goals

Time Deposit Plus empowers our customers to grow their money more quickly by allowing them to start with any amount, open up to 5 accounts worth ₱1M each, and earn up to 6% interest rate p.a. on each one.

Explore Time Deposit Plus

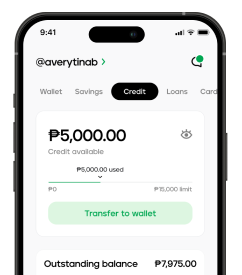

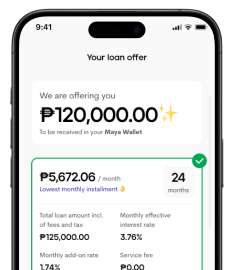

Maya Easy Credit

gives eligible customers instant access to up to ₱30,000 for their essential and emergency expenses.

Explore Easy Credit

Maya Personal Loan

helps customers with good credit standing make significant life moves, such as upgrading their homes, paying tuition, or buying a vehicle, by giving them instant access to up to ₱250,000.

Explore Personal LoanBusiness

Banking Highlights

Business

Banking Highlights

Powered by Maya Bank for banking services and Maya Philippines for digital payments, Maya Business saw an opportunity to offer simplicity in a world of complexity, seamlessly integrating a comprehensive suite of financial services through a single digital platform.

Maya Business: All-in-one business growth partner

Business Deposits

Designed to simplify money management for Maya Business clients of any size with a single account, Maya Business Deposit is a fully digital deposit product powered by Maya Bank

Maya Advance

A loan product available in the Maya Business app, Maya Advance provides prequalified Maya Center agents with quick and accessible funding they can use to grow their business and manage their finances better

Flexi Loan

Offering up to ₱2M in unsecured loans, Flexi Loan provides MSMEs with flexible and accessible financing options

Delightful Banking Built on a Solid Tech Foundation

Our approach to creating game-changing financial solutions is not only guided by our mission to accelerate financial inclusion in the country, but powered by a robust technological foundation.

Cloud-based

For unmatched go-to-

market speeds

Driven by data and AI

For smarter business decisions,

policies, and processes

Secure and private

For worry-free banking

Highly scalable

For superior adaptability to

ever-changing market

demands

Available 24x7

For maximum convenience

and reliability

Testimonials

Cultivating Corporate Governance

Cultivating Corporate Governance

Our Promise

Maya Bank is committed to the highest standards of governance in line with BSP and SEC guidelines. Our shareholders, Board of Directors, and Senior Management recognize the crucial role of good governance in strategic decisions. We cultivate awareness of its importance to meet our economic, ethical, legal, environmental, and social obligations. To support adherence, we have a Corporate Governance Manual (CGM) that outlines our principles, values, and compliance with laws and internal policies. Regularly updated, the CGM guides us in improving financial health, accelerating financial inclusion, fostering competitiveness, delivering top-notch customer support, and adhering to applicable laws and regulations.

Governance Culture

We are committed to conducting our business according to the highest ethical standards.

Fairness

We value justice and fair play in all our dealings, always striving for mutual benefit.

Accountability

Everyone is accountable for their decisions, actions, and behavior, serving our stakeholders to the best of their ability.

Integrity

Our team upholds the principles of legal and ethical conduct, guided by the adage "honesty is the best policy".

Transparency

We value truth and openness, always providing accurate information in a timely manner and being open to scrutiny.

We ensure strong leadership in governance and compliance

Board of Directors

The Board of Directors at Maya Bank ensures prudent management, integrity, and alignment with corporate objectives. They guide business strategies, oversee major projects, and focus on long-term success. The 12-member Board, mostly non-executive and independent directors, meets quarterly with additional meetings as needed. New appointees complete a Corporate Governance seminar. Candidates are sourced through professional networks and referrals, vetted by the Corporate Governance Committee, and elected by shareholders.

Committees

Maya Bank's Board-level Committees ensure governance, compliance, audit, strategy, risk oversight, and technology requirements, meeting quarterly and adhering to BSP guidelines. The Audit Committee oversees accounting integrity and audits. The Corporate Governance Committee handles nominations, education, performance evaluations, and related party transactions. The Risk Oversight and Compliance Committee develops and oversees risk management and compliance. The Technology Group Governance Committee, including IT leaders, oversees the bank's IT, security, and privacy functions, keeping the Board informed on significant technology matters.

Related Party Transactions

Maya Bank ensures all related-party transactions are fair, transparent, and conducted at arm's length. The CG Committee evaluates these transactions based on the relationship, transaction details, benefits, alternative sources, and comparability with unrelated parties. The Bank's conflict of interest policy requires disclosure of any financial interests in transactions. In 2023, no Material Related Party Transactions were reported.

Retirement and Succession

Maya Bank actively looks for future leaders through talent bench reviews and offers them opportunities to step into leadership roles. There is a concrete succession plan in place to ensure continuous and relevant leadership, especially during sudden changes or retirement. The normal retirement age for employees is sixty (60), but retiring at a later age is also considered based on individual circumstances.

Code of Discipline

At Maya Bank, we are serious about maintaining a positive professional work environment. To help everyone uphold the highest standards of discipline and professionalism, we make our Board-approved Code of Discipline available to all employees on our internal website.

We are committed to compliance and consumer protection

Compliance Program

Maya Bank promotes a strong compliance culture starting from the top leadership. The Board of Directors, President, and Senior Management set the example and require all team members to understand and adhere to relevant laws and regulations. The Compliance Office, led by the Chief Compliance Officer, ensures organizational adherence to both regulatory and internal policies. Operating independently, it reports issues directly to the Board of Directors through the Risk Oversight and Compliance Committee.

Anti-Money Laundering, Terrorist Financing, and Proliferation Financing

Maya Bank is committed to conducting business ethically and responsibly through robust anti-money laundering, counter-terrorist financing, and counter-proliferation financing programs. We continuously update our policies, use advanced technology to detect suspicious activities, and train our staff to identify and report suspicious transactions. We collaborate with government agencies, law enforcement, and other banks to enhance our efforts against financial crimes while prioritizing customer and shareholder privacy.

Consumer Protection Policy

We are committed to upholding the highest standards of business conduct and consumer protection through policies and procedures based on relevant regulations, ensuring our Consumer Protection Framework, modeled on BSP regulations, provides the best financial customer experience, measured by customer satisfaction, reliability, and trust.

Internal Audit

Maya Bank’s independent Internal Audit team ensures our operations are efficient and effective by identifying and managing risks, maintaining accurate information, and ensuring compliance with policies and legal requirements. They oversee resource management, goal achievement, and process quality, addressing any legal or regulatory issues promptly. With unrestricted access and direct communication with the Audit Committee, they enforce actions based on significant findings. Reporting to the Board via the Audit Committee, they maintain independence from daily operations. Meanwhile, the Audit Committee supports the Board by overseeing internal audits and ensuring a robust control framework covering reporting, compliance, efficiency, and asset protection, addressing deficiencies promptly.

Managing Risk

Managing Risk

Risk Governance and Structure

At Maya Bank, we have established an internal Risk Management Framework with set risk limits to ensure the Bank remains compliant with regulatory requirements. To maintain strict adherence, these limits are closely monitored through a red, amber, and green rating system.

Additionally, Maya Bank has instituted a clear structure of responsibility and accountability among risk stakeholders. This structure guarantees oversight, compliance, and actions are effectively aligned with our commitment to efficiently managing risks.

Risk Management

Maya Bank’s Risk Management Framework includes internal risk limits to ensure regulatory compliance, monitored using a red, amber, and green rating approach. Several committees, such as the Risk Oversight and Compliance Committee (ROCCom), the Asset and Liquidity Committee (ALCO), and the Credit Committee (CreCom), oversee and manage different aspects of risk, developing and implementing risk policies, and managing the bank’s balance sheet.

These committees also oversee the bank’s credit strategy, coordinating with the Board of Directors to review, approve, and execute strategies and decisions in line with regulatory requirements. Internal risk limits are monitored for compliance using an RAG rating approach for escalation.

Three Lines of Defenses

The Bank safeguards its operations with three lines of defense. The first line involves business units managing risk exposures and collaborating with Risk Management and Compliance to identify and report potential risks. The second line involves Risk Management and Compliance overseeing and ensuring the identification, monitoring, and reporting of risks, adherence to limits, and compliance with internal policies and BSP regulations in the Bank’s Asset & Liability Management (ALM) and capital management activities. The third line involves Compliance, which ensures adherence to policies and regulations through annual reviews. At the same time, Internal Audit evaluates and improves governance, risk management, and control processes.

Risk Appetite Statement

Maya Bank acknowledges the need to ensure that risks are within the appetite of the organization to maintain our integrity and the trust of the customers, investors, and stakeholders. Thus, Risk Appetite Statements are crafted and monitored periodically as a control.

Liquidity Risk

We aim to maintain a strong liquidity position to be able to meet our financial obligations as they come due. Our goal is to support the liquidity requirements of the business, whilst securing these funds in a timely manner. We actively monitor and manage our liquidity through regular stress testing, forecasting, and contingency planning, and commit to maintaining a sufficient level of cash and high-quality liquid assets to meet our immediate and potential future needs.

Reputational Risk

At Maya, our commitment to ethical behavior, responsible conduct, and integrity underpins our reputation. We aim to continuously establish robust controls, uphold transparency in our operations, and promote a strong organizational culture based on ethics. This means that we strike a balance between the level of reputational risk that we are willing to accept in pursuit of our business goals while preserving the trust and confidence of our customers, shareholders, and the wider community.

Model Risk

We recognize that inaccurate or unreliable models could cause significant errors in decision-making and result in material losses. That’s why we actively monitor and manage model risk by implementing robust model validation and monitoring processes. We ensure that all models used in our organization are regularly reviewed, validated, and updated whenever necessary as prescribed in the Model Risk Management Framework.

Outsourcing Risk

At Maya, we recognize the strategic importance of outsourcing to enhance efficiency, reduce costs, and access specialized expertise. While we embrace the benefits of outsourcing, we also acknowledge the inherent risks involved. Our partners maintain high levels of operational excellence and compliance with agreed-upon service levels.

Compliance Risk

We are committed to complying with all the relevant laws and regulations. We recognize that our operations have inherent risks, but we are committed to managing those risks effectively, ensuring our operations remain at the forefront of innovation and accountability.

Market Risk

Our primary aim is to ensure sustainability of operations centered on supporting our core banking business lines. We will evaluate market risk opportunistically, if or when a strong risk reward proposition presents itself.

Operational Risk

People: To achieve our business growth and objectives, it is imperative that we attract and retain digitally-oriented human capital and therefore we will exhaust all possible means to bring in and retain the best of our talents.

Internal Fraud: We will have zero tolerance for internal fraud and will be subject to disciplinary measures and legal action of employees who are proven to have committed fraud.

Loss Exposure: We are committed to taking all reasonable steps to mitigate and control operational risks.

Credit Risk

Lending to consumers and MSMEs is pivotal to the Bank’s strategy to solve for access to financial services. We are committed to providing financial services that meet the needs of the customers while maintaining a strong credit risk profile. The credit risk management approach is proactive and underpinned by a strong credit analysis process, robust risk rating & credit scoring models and loan monitoring practices. The framework is based on sound credit risk policies and practices which are regularly reviewed and updated to ensure they remain effective and aligned with the risk appetite. It is important for the Bank to actively manage and monitor credit risk exposure by implementing robust underwriting standards and credit risk management processes. The Bank leverages on both traditional and alternative data for credit risk identification and establishment of periodic portfolio quality reviews to ensure that the credit risk profile of the loan portfolio is aligned to risk appetite.

Strategic Risk

Maya Bank will continue to pursue a strategy of revolutionizing digital financial services in the Philippines. We will also assess regional growth opportunities and invest in synergistic businesses.

Information Technology (IT) Risk

For IT Risk, we have a low appetite for losing continuity of our business operations stemming from unreliable systems. It aims to adopt innovative technological solutions to meet user demands in a rapidly changing environment. In the same manner, we will manage our information technology infrastructure to ensure system availability, capacity to meet business requirements, and powerful defenses against both natural and man-made threats, including cyber-attacks.

As for Information Security Risk, we will constantly protect and strengthen our systems and processes against vulnerabilities and gain the trust and confidence of our customers by offering safe and secure financial products.

Legal Risk

We will conduct our business within the confines of all laws and regulations. All directors, officers, employees, third-party services providers, and counterparties are mandated to maintain the highest ethical standards and shall be administratively or criminally accountable for transgressions of the Company’s standards and/or laws or regulations.

Concentration Risk

Our strategy is to tap both the unbanked and the unhappily banked. We proactively manage and monitor concentration risk by diversifying and revolutionizing our product offers, varying industries and geographic locations.

Nurturing Talent

Nurturing Talent

Talent Management as Catalyst for Growth

In the dynamic landscape of Maya, our performance management program is built on the Objectives and Key Results (OKRs) Framework, fostering a continuous cycle of growth and development. This revolutionary program emphasizes Alignment, Engagement, Collaboration, and Adaptability, ensuring teams and individuals align with organizational goals, enhancing performance by highlighting task significance, promoting teamwork to achieve objectives, and regularly reviewing OKRs for relevance. The focus is on ongoing conversations about feedback and development.

Fair and Competitive Compensation

Our compensation program is based on three main principles: pay for position, pay for person, and pay for performance. It aims to provide fair and competitive compensation to empower employees and encourage them to do their best work. Fair compensation, empowerment, and meaningful work are emphasized to drive employee success and contribute to the overall success of the company.

Growing Continuously

At Maya Bank, we prioritize continuous growth through diverse learning opportunities. Our team engages in self-led learning via platforms like LinkedIn Learning and O'Reilly, accessing courses and resources tailored to business, technology, and leadership. We offer adaptive learning paths based on business needs and support experiential learning activities such as onboarding facilitation, mentorship, and content development to enhance our employees' skills and knowledge.

Cultivating Thriving Teams through Active Listening and Connectedness

At Maya Bank, our Employee Engagement and Communications Programs integrate work and life seamlessly and continually evolve our culture. We listen to employees through our engagement platform, tailor programs to meet their needs, and empower managers to lead meaningful team discussions. We involve all teams in creating a connected environment through events, activities, our internal Maya Hub, and peer well-being groups, resulting in a positive trend in our employee engagement score on the global Glint benchmark in 2023.

Prioritizing Safety and Well-being

At Maya, we prioritize the safety and well-being of our employees through a holistic approach. Our initiatives include a 24/7 Employee Assistance Program, bi-monthly Wellbeing Talks, Employee Growth Program supporting Peer Well-being Groups, and the SAFEwork Program for employee safety during the pandemic.

Thriving at Maya:

Empowerment at Work and in Life

Fostering Sustainability

Fostering Sustainability

Maya ESG Framework

Maya aimed to expand financial inclusion by enabling Filipinos to start sending and accepting cashless payments, allowing them to own a basic financial inclusion. Our effort paid off as the number of Filipinos with financial accounts increased. We are now on to the next phase of financial inclusion, empowering Filipinos to utilize their financial accounts to improve their financial health and wellbeing. This is the core of Maya’s ESG commitment. We want our customers to use our platform to manage and master their money confidently.

ESG Pillars

Our ESG Framework is anchored on three pillars: Environmental, Social, and Governance, supporting the UN Sustainable Development Goals and aligning with the Bangko Sentral ng Pilipinas and shareholder policies. We are committed to minimizing our environmental footprint, empowering communities and employees through innovation, and becoming thought leaders among stakeholders and regulators. With ERM’s assistance, we conducted a materiality assessment highlighting our ESG Principles: Respect for People, Communities, Transparency, and the Environment. We prioritize customer financial safety, employee satisfaction, regulatory compliance, information security, and transparent communication of our environmental and community impact.

ESG Goals

Based on our materiality assessment, we have laid down our priority goals for each sustainability pillar relevant to our business and shareholders.

Minimizing Maya’s Environmental Footprint

Our goal is to achieve net zero by 2050, in line with the Paris 2015 Agreement. Our baseline GHG emissions study revealed a low carbon footprint per employee, indicating Maya is not a major source of emissions.