Home › Credit card

Credit Card Philippines

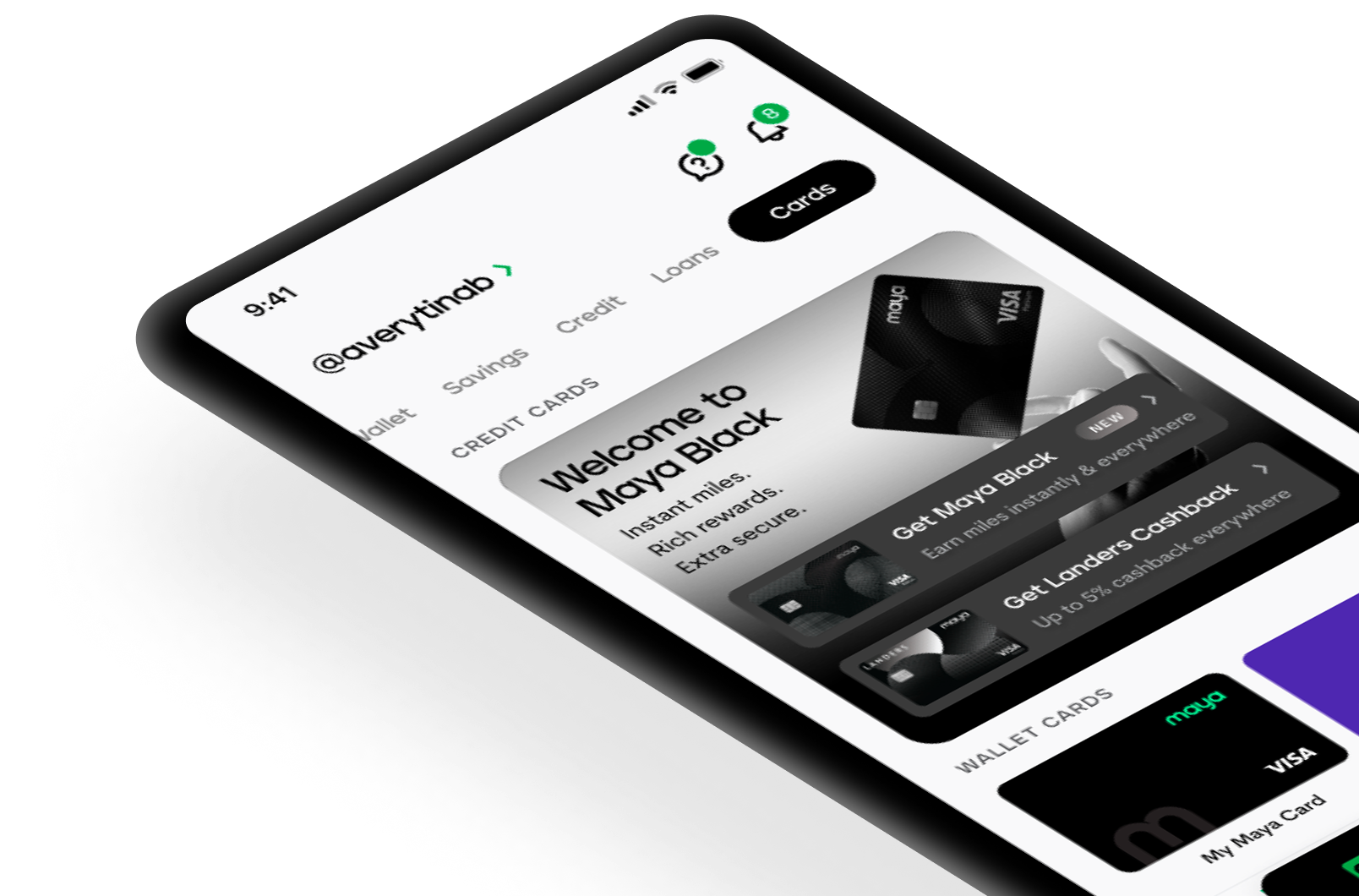

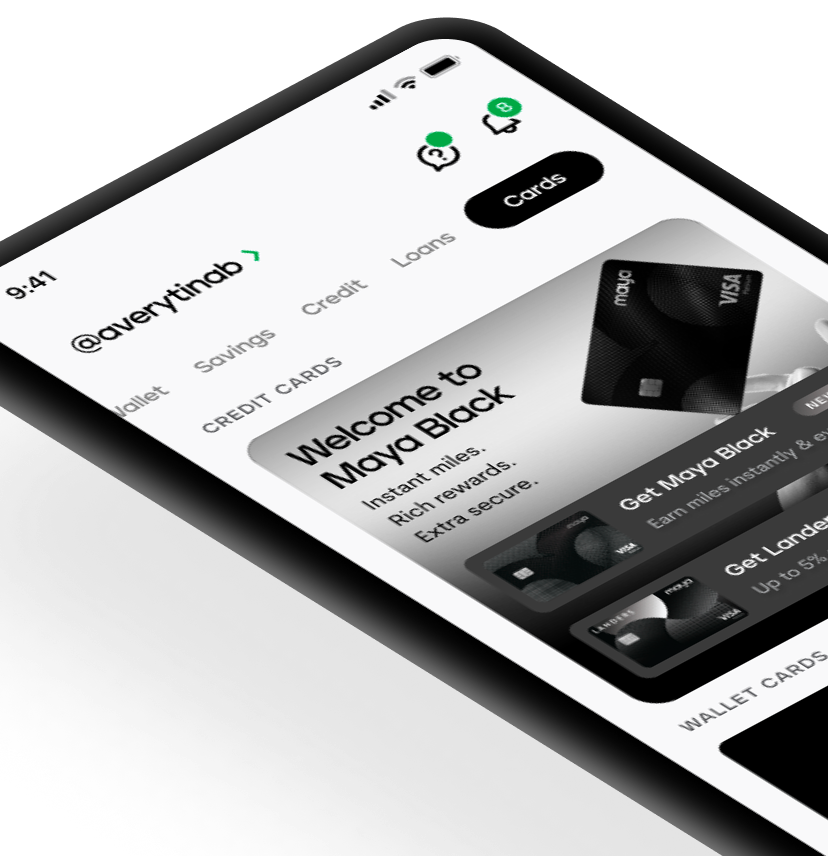

The only cards you’ll ever need

Discover a new world of credit cards from the #1 Digital Bank App in the Philippines

in monthly active users

T&Cs apply. Credit card approval and offer are subject to credit evaluation. Users with access may apply directly on the Maya app. Some features will become available in a future update. Maya Philippines, Inc. and Maya Bank, Inc. are regulated by the Bangko Sentral ng Pilipinas. www.bsp.gov.ph. For 24/7 assistance, visit the Help Center on the Maya app.

Level up your credit card game

Instant rewards with every spend

Earn instant cashback points or Maya Miles and enjoy the perks right away.

No need for monthly statements or phone calls

Get approved in seconds

Apply right on the app and start using your card details as soon as you’re approved—no extra documents

needed

Application is subject to credit evaluation

One app to do

them all

Track your transactions in real time, pay your dues, check your statements, and manage your cards—all with just a few taps on the Maya app

Next-level security

Freeze and unfreeze your card, set local and overseas spending limits, or allow online payments—all without having to call your bank

Bank with the best

Get banked with the #1 Digital Bank App in the Philippines

in monthly active users

More exciting updates are coming your way

Stay tuned for more updates,

new features, and exciting deals

Instant rewards

with every spend

Earn instant cashback points or Maya Miles and enjoy the perks right away. No need for monthly statements or phone calls

Get approved in seconds

Apply right on the app and start using your card details as soon as you’re approved—no extra documents needed

Application is subject to credit evaluation

One app to do

them all

Track your transactions in real time, pay your dues, check your statements, and manage your cards—all with just a few taps on the Maya app

Next-level security

Freeze and unfreeze your card, set local and overseas spending limits, or allow online payments—all without having to call your bank

Bank with the best

Get banked with the #1 Digital Bank App in the Philippines

in monthly active users

More exciting updates are coming your way

Stay tuned for more updates, new features, and exciting deals

Which is the right card for you

Earn up to 5% cashback with a credit card that doubles as your Landers membership card

Enjoy instant miles, rich rewards, and an extra secure credit card experience

Best used for

Earning cashback points that you can use at Landers to pay for your grocery bill

Earning Maya Miles to help you get closer to your next trip, shopping spree, or dinner out

Where can I use it?

Anywhere in the world that accepts Visa

Anywhere in the world that accepts Visa

Rewards and Perks

- Up to 5% cashback at Landers

- 2% cashback on dining

- 1% cashback everywhere else

- Access to any Landers Superstore nationwide

- Access to Visa Platinum Concierge

- Earn Maya Miles instantly and everywhere at 1 Maya Mile per ₱40 spend

- Enjoy quarterly airport lounge passes powered by DragonPass

- Earn up to 10x more Maya Miles at Maya Black Preferred merchants

- Use your miles to pay, get airline miles, and earn other rewards from the in-app catalog

- Unlock more exclusive travel perks such as travel insurance, free eSIMs, and more

Requirements

21 to 65 years old

Filipino resident

Upgraded Maya account

- Landers membership

Application is subject to credit evaluation

- 21 to 65 years old

- Filipino resident

- Upgraded Maya account

Application is subject to credit evaluation

Annual Fees

Waived

No annual fee for life as long as you transact at least 1x a month with your card

Get access to exclusive promos with your Maya credit card

PARTNER MERCHANTS

Discover a new world of rewards

Gain access to Visa-exclusive perks with your Landers Cashback Everywhere or Maya Black credit card