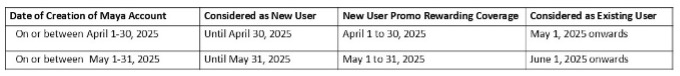

Boost your Maya Savings interest all the way up to 15% p.a

Savings made sexy

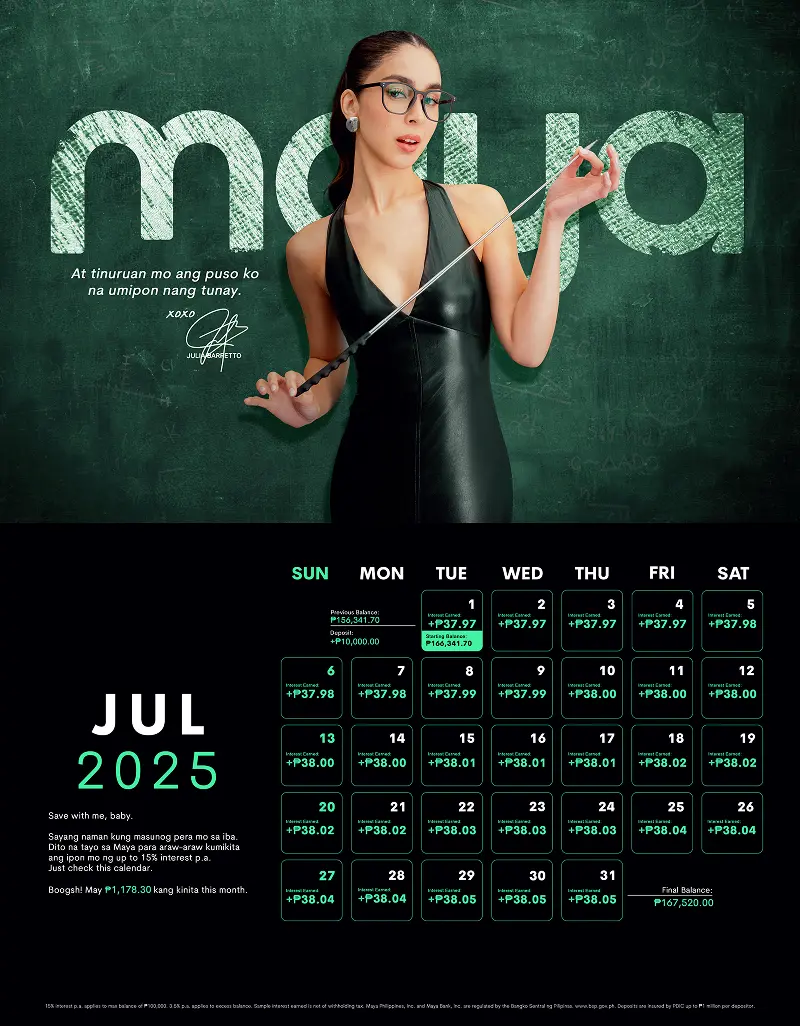

Julia is the world’s first-ever Savings Calendar Girl – and she’s crazy about growing your money with Maya all year.

Download the savings calendar below to see how much you can earn every day of the month with Maya Savings. ‘Wag na sunog-pera sa inflation, baby. 😘

Want to meet Julia and win a signed savings calendar? Get your chance with every ₱1,000 you deposit to Maya Savings.

Why

thousands or more?

Why

Join Julia and boost your Maya Savings interest all the way up to 15% p.a.

Inflation?

Not on Julia's watch.

How to boogsh boost

your interest

- Existing Maya User

- New Maya User

3.5% p.a.

Open Maya Savings

5% p.a.

Reach a total of P250 on bills, load, stocks, funds, or payments via QR Ph, card, or online checkout

6% p.a.

Reach a total of P1,000 on stocks, funds, or payments via QR Ph, card, or online checkout

8% p.a.

Reach a total of P3,000 on payments using Maya Easy Credit via QR or Maya Shop

10% p.a.

Reach a total of P25,000 on stocks, funds, or payments via QR Ph, card, or online checkout

12% p.a.

Reach a total of P35,000 on stocks, funds, or payments via QR Ph, card, or online checkout

13% p.a.

Reach a total of P15,000 on payments using your Landers Credit Card

*For select users only*

14% p.a.

Reach a total of P30,000 on payments using your Landers Credit Card or Maya Black Credit Card

15% p.a.

Reach a total of P40,000 on payments using your Landers Credit Card or Maya Black Credit Card

How to boogsh boost

your interest

3.5% p.a.

Open Maya Savings and deposit any amount

5% p.a.

Reach a total of P250 on bills, load, stocks, funds, or payments via QR Ph, card, or online checkout

6% p.a.

Reach a total of P1,000 on stocks, funds, or payments via QR Ph, card, or online checkout

8% p.a.

Reach a total of P3,000 on payments using Maya Easy Credit via QR or Maya Shop

10% p.a.

Reach a total of P25,000 on stocks, funds, or payments via QR Ph, card, or online checkout

12% p.a.

Reach a total of P35,000 on stocks, funds, or payments via QR Ph, card, or online checkout

13% p.a.

Reach a total of P3,000 on Grab payments using Maya

14% p.a.

Reach a total of P30,000 on payments using your Landers Credit Card

15% p.a.

Reach a total of P40,000 on payments using your Landers Credit Card

I'm game to save 1

I’ll keep the money in my account for

I can pay for bills and buy airtime load worth/total

I can pay via Maya Card, QR, or checkout worth/total

I can pay using Maya Easy Credit worth/total

I can pay on Grab using my linked Maya account worth/total

I can pay using my Landers Credit Card worth/total

Your boosted interest2 is

15% p.a.

That’s

₱ 5

1 Savings balance in excess of ₱100,000 earns 3.5% p.a.

2 Highest possible daily interest (gross) you can earn for [x] days, computed as [saved amount] x 1/365 x [boosted interest rate]

Check out the full interest rate chart to find out more

Partner Merchants

So many ways to earn, not burn

Use Maya at any these merchants to earn up to 15% interest p.a on Maya Savings

Log in to your Maya app, tap ‘Savings’ at the top of the screen, and select ‘Start saving now.’ Follow the rest of the instructions to set up your Maya Savings account!

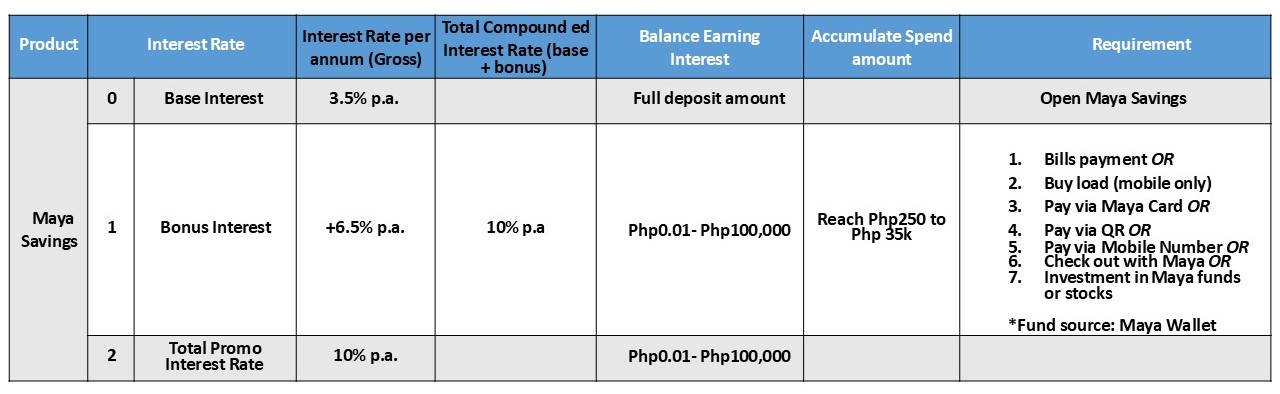

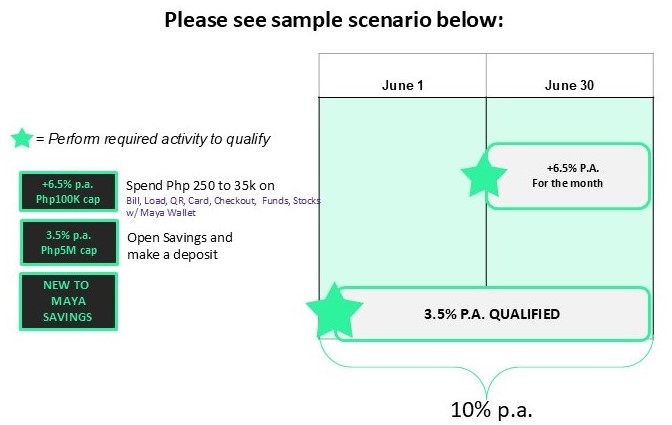

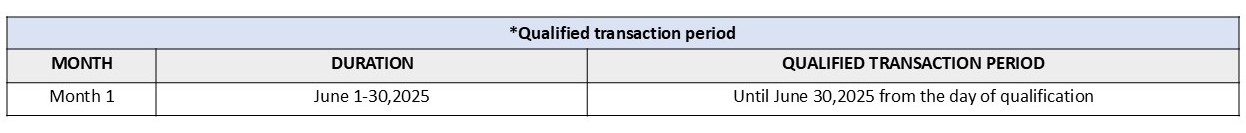

Your Maya Savings account earns a base interest rate of 3.5% p.a.* credited daily.

Want it boosted up to 15% p.a.**? Keep using Maya for your everyday payments!

For more details, learn more about it at mayabank.ph/highinterestsavings.

Interest rates may change but will only take effect after the public has been notified. Accounts with no deposit or withdrawal for the past 2 years will earn no interest.

For the latest interest rates, refer to: https://support.mayabank.ph/s/article/How-much-interest-will-my-money-earn-in-Maya-Savings

*Base interest rate applies to deposit balance of up to P5,000,000

**Bonus interest applies to deposit balance of up to P100,000

Your Maya Savings account earns interest daily. Your interest is based on your balance at the end of the day and is credited to your account on the next day minus applicable taxes.

Your Personal Goal accounts, meanwhile, earn interest monthly. Your interest is credited to your accounts on the first calendar day of the following month minus applicable taxes.

Absolutely. We own a digital banking license from the Bangko Sentral ng Pilipinas, meaning our customers are protected by very strict standards and guidelines. In addition, deposits are insured by the Philippine Deposit Insurance Corporation (PDIC) up to P500,000 per depositor. You can rest easy knowing your money is safe with Maya.

If you already have an upgraded Maya account, we should have all the information we need for you to start saving. Otherwise, you’ll need to upgrade first and provide the following:

- Full name (including your middle name) and/or PhilSys number (if available)

- Date and place of birth

- Address

- Contact number and email address

- Citizenship or nationality

- Source of funds and nature of work

- Signature or biometric data

- 1 primary ID or 2 secondary IDs (go to maya.ph/upgrade for a full list of accepted IDs)

Your information will be shared with Maya Bank, Inc. with your consent.

You’ll need to upgrade your account first, which will also unlock the rest of Maya’s features. Upgrading is totally free and shouldn’t take long. For instructions, visit maya.ph/upgrade.

No. You can deposit as little or as much as you want!

Earned interest is computed daily using the applicable interest rate/s and your end-of-day balance based on (Actual number of days considered in the computation)/(365).

Daily interest earned is computed based on the following formula:

End-of-day balance x (interest rate) x (1/365)

Total interest earned for the month is the sum of the daily interest earned for each day in the month.

Interest rates may change but will only take effect after the public has been notified. Accounts with no deposit or withdrawal for the past 2 years will earn no interest. For the latest interest rates, see Annex A of the Terms and Conditions at mayabank.ph/terms-conditions.

Yes. Your Maya Savings account number is 12 digits long and may only be used for bank-related transactions, like transfers. You can find it under My Savings (or under the name of your Personal Goal/s, if you have any).

Your Maya number, on the other hand, is the 11-digit mobile number you used to create your Maya account.

You can deposit using money from your Maya Wallet or from a non-Maya bank account:

From your Maya Wallet

- On your Savings dashboard, tap ‘Deposit.’

- Choose ‘My Wallet.’

- Choose ‘My Savings’ (or any of your Personal Goals, if you have any)

- Enter the amount to be deposited.

- Press ‘Deposit’ to complete the transaction.

From a non-Maya bank app

- Open your other bank app and initiate a transfer.

- Select ‘Maya Bank, Inc.’ as the destination.

- Enter your account details, including your 12-digit Maya Savings account number.

- Enter the amount to be transferred.

- Choose PESONet or InstaPay and complete the transaction.

Note: PESONet transactions made before 4 PM will be posted within the same business day. PESONet transactions made after 4 PM or on a holiday or weekend will be processed on the next available business day.

You can transfer to your Wallet instantly and for free. Here’s how:

- On your Savings dashboard, tap ‘Transfer.’

- Choose ‘My Wallet.’

- Enter the amount to be transferred.

- Tap ‘Transfer’ to complete the transaction.

.jpg)

.jpg)